Central Banking in the Philippines

advertisement

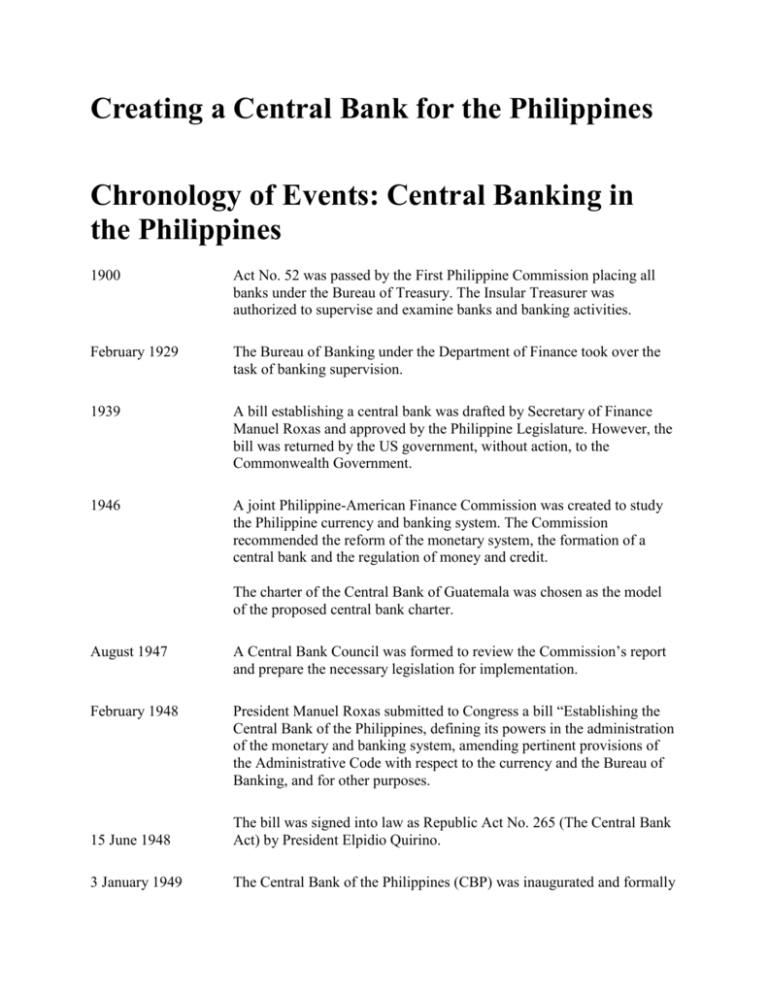

Creating a Central Bank for the Philippines Chronology of Events: Central Banking in the Philippines 1900 Act No. 52 was passed by the First Philippine Commission placing all banks under the Bureau of Treasury. The Insular Treasurer was authorized to supervise and examine banks and banking activities. February 1929 The Bureau of Banking under the Department of Finance took over the task of banking supervision. 1939 A bill establishing a central bank was drafted by Secretary of Finance Manuel Roxas and approved by the Philippine Legislature. However, the bill was returned by the US government, without action, to the Commonwealth Government. 1946 A joint Philippine-American Finance Commission was created to study the Philippine currency and banking system. The Commission recommended the reform of the monetary system, the formation of a central bank and the regulation of money and credit. The charter of the Central Bank of Guatemala was chosen as the model of the proposed central bank charter. August 1947 A Central Bank Council was formed to review the Commission’s report and prepare the necessary legislation for implementation. February 1948 President Manuel Roxas submitted to Congress a bill “Establishing the Central Bank of the Philippines, defining its powers in the administration of the monetary and banking system, amending pertinent provisions of the Administrative Code with respect to the currency and the Bureau of Banking, and for other purposes. 15 June 1948 The bill was signed into law as Republic Act No. 265 (The Central Bank Act) by President Elpidio Quirino. 3 January 1949 The Central Bank of the Philippines (CBP) was inaugurated and formally opened with Hon. Miguel Cuaderno, Sr. as the first governor. The broad policy objectives contained in RA No. 265 guided the CBP in the implementation of its duties and responsibilities, particularly in relation to the promotion of economic development in addition to the maintenance of internal and external monetary stability. November 1972 RA No. 265 was amended by Presidential Decree No. 72 to make the CBP more responsive to changing economic conditions. PD No. 72 emphasized the maintenance of domestic and international monetary stability as the primary objective of the CBP. Moreover, the CBP’s authority was expanded to include not only the supervision of the banking system but also the regulation of the entire financial system. January 1981 1986 3 July 1993 Further amendments were made with the issuance of PD No. 1771 to improve and strengthen the financial system, among which was the increase in the capitalization of the CBP from P10 million to P10 billion. Executive Order No. 16 amended the Monetary Board membership to promote greater harmony and coordination of government monetary and fiscal policies. The Bangko Sentral ng Pilipinas (BSP) was established to replace the CBP as the country’s central monetary authority. The BSP Vision and Mission Vision The BSP aims to be a world-class monetary authority and a catalyst for a globally competitive economy and financial system that delivers a high quality of life for all Filipinos. Mission BSP is committed to promote and maintain price stability and provide proactive leadership in bringing about a strong financial system conducive to a balanced and sustainable growth of the economy. Towards this end, it shall conduct sound monetary policy and effective supervision over financial institutions under its jurisdiction. Overview of Functions and Operations Objectives The BSP’s primary objective is to maintain price stability conducive to a balanced and sustainable economic growth. The BSP also aims to promote and preserve monetary stability and the convertibility of the national currency. Responsibilities The BSP provides policy directions in the areas of money, banking and credit. It supervises operations of banks and exercises regulatory powers over non-bank financial institutions with quasi-banking functions. Under the New Central Bank Act, the BSP performs the following functions, all of which relate to its status as the Republic’s central monetary authority. Liquidity Management. The BSP formulates and implements monetary policy aimed at influencing money supply consistent with its primary objective to maintain price stability. Currency issue. The BSP has the exclusive power to issue the national currency. All notes and coins issued by the BSP are fully guaranteed by the Government and are considered legal tender for all private and public debts. Lender of last resort. The BSP extends discounts, loans and advances to banking institutions for liquidity purposes. Financial Supervision. The BSP supervises banks and exercises regulatory powers over non-bank institutions performing quasibanking functions. Management of foreign currency reserves. The BSP seeks to maintain sufficient international reserves to meet any foreseeable net demands for foreign currencies in order to preserve the international stability and convertibility of the Philippine peso. Determination of exchange rate policy. The BSP determines the exchange rate policy of the Philippines. Currently, the BSP adheres to a market-oriented foreign exchange rate policy such that the role of Bangko Sentral is principally to ensure orderly conditions in the market. Other activities. The BSP functions as the banker, financial advisor and official depository of the Government, its political subdivisions and instrumentalities and government-owned and controlled corporations. The BSP's Organizational Structure as of June 2009 Executive Management Services Functional Sectors o Monetary Stability Sector o Supervision and Examination Sector o Resource Management Sector Security Plant Complex The Monetary Board The powers and function of Bangko Sentral are exercised by its Monetary Board, which has seven members appointed by the President of The Philippines. Under the New Central Bank Act, one of the government sector members of the Monetary Board must also be a member of the Cabinet designated by the President. The New Central Bank Act establishes certain qualifications for the members of the Monetary Board and also prohibits members from holding certain positions with other governmental agencies and private institutions that may give rise to conflicts of interest. With the exception of the members of the Cabinet, the Governor and the other members of the Monetary Board serve terms of six years and may only be removed for cause. The Monetary Board meets at least once a week. The Board may be called to a meeting by the Governor of the Bangko Sentral or by two (2) other members of the Board. Usually, the Board meets every Thursday but on some occasions, it convenes to discuss urgent issues. The major functions of the Monetary Board include the power to: 1. Issue rules and regulations it considers necessary for the effective discharge of the responsibilities and exercise of the powers vested in it; 2. Direct the management, operations, and administration of Bangko Sentral, organize its personnel and issue such rules and regulations as it may deem necessary or desirable for this purpose; 3. Establish a human resource management system which governs the selection, hiring, appointment, transfer, promotion, or dismissal of all personnel; 4. Adopt an annual budget for and authorize such expenditures by Bangko Sentral as are in the interest of the effective administration and operations of Bangko Sentral in accordance with applicable laws and regulations; and 5. Indemnify its members and other officials of Bangko Sentral, including personnel of the departments performing supervision and examination functions, against all costs and expenses reasonably incurred by such persons in connection with any civil or criminal action, suit or proceeding, to which any of them may be made a party by reason of the performance of his functions or duties, unless such members or other officials is found to be liable for negligence or misconduct. The BSP Monetary Board Chairman Amando M. Tetangco, Jr. Members Cesar V. Purisima Juanita D. Amatong Nelly Favis-Villafuerte Alfredo C. Antonio Ignacio R. Bunye Peter B. Favila The Governor The Governor is the chief executive officer of BSP and is required to direct and supervise the operations and internal administration of BSP. Specifically, the Governor: prepares the agenda for the meetings of the Monetary Board and submits policy recommendations for consideration of the Board; executes and administers policies and measures approved by the Monetary Board; appoints and fixes the remunerations and other emoluments of personnel, as well as imposes disciplinary measures upon personnel of the Bangko Sentral; renders opinions, decisions, or rulings, which shall be final and executory until reversed or modified by the Monetary Board, on matters regarding application or enforcement of laws pertaining to institutions supervised by the BSP and laws pertaining to quasibanks, as well as regulations, policies or instructions issued by the Monetary Board, and the implementation thereof; and exercises such other powers as may be vested in him by the Monetary Board. The Governor is the principal representative of the Monetary Board and of the BSP. As such, the Governor is empowered to: represent the Monetary Board and the BSP in all dealings with other offices, agencies and instrumentalities of the Government and all other persons or entities, public or private, whether domestic, foreign or international; and sign contracts entered into by the BSP, notes and securities issued by the BSP, all reports, balance sheets, profit and loss statements, correspondence and other documents of the BSP. Governor Amando M. Tetangco, Jr. Past Governors Profile of the Governor Amando M. Tetangco, Jr. assumed office as Governor of the Bangko Sentral ng Pilipinas in July 2005. He is a career central banker, occupying different positions in the organization in a span of over three decades. Immediately prior to his appointment as BSP Governor, he was Deputy Governor in-charge of the Banking Services Sector, Economic Research and Treasury. As BSP Governor, he is also the Chairman of the Monetary Board, Anti-Money Laundering Council (AMLC) and Philippine International Convention Center (PICC); ViceChairman of the Agriculture Credit Policy Council (ACPC); Member of the Capital Market Development Council (CMDC), Export Development Council (EDC), PhilExport Board of Trustees (PHILEXPORT), Philippine ExportImport Credit Agency (PHILEXIM); and Director of Philippine Deposit Insurance Corporation (PDIC), National Development Council (NDC) and National Home Mortgage Finance Corporation (NHMFC). He also represents the country in various international and regional organizations, including the Executive Meeting of East Asia and Pacific (EMEAP) Central Banks; ASEAN and ASEAN+3; South East Asia Central Banks (SEACEN); South East Asia, New Zealand and Australia (SEANZA); Center for Latin American Monetary Studies (CEMLA); and Asia-Pacific Economic Cooperation (APEC). He is the Governor for the Philippines in the International Monetary Fund (IMF) and the Alternate Governor in the World Bank (WB) and in the Asian Development Bank (ADB). Before joining the Central Bank of the Philippines in 1974, Mr. Tetangco was connected with the Management Services Division of accounting firm SGV & Co. Mr. Tetangco took up AB Economics at the Ateneo de Manila University where he graduated cum laude. He took up graduate courses in business administration in the same institution. As a central bank scholar, Mr. Tetangco took up his MA in Public Policy and Administration (concentration in Development Economics) at the University of Wisconsin in Madison, USA. Earlier, he finished his elementary and high school education at Don Bosco Academy in Pampanga. Mr. Tetangco is married to Elvira Ma. Plana. They have three children: a son and two daughters. Central Bank Governors Name Tenure 3 January 1949 Miguel Cuaderno, 31 December Sr. 1960 6 January 1961 Andres V. Castillo 31 December 1967 1 January 1968 Alfonso Calalang 9 January 1970 10 January 1970 Gregorio S. - 15 January Licaros 1981 16 January 1981 Jaime C. Laya - 18 January 1984 19 January 1984 Jose B. - 19 February Fernandez, Jr. 1990 20 February 1990 Jose L. Cuisa, Jr. - 2 Juy 1993 Bangko Sentral Governors Name Gabriel C. Singson Tenure 6 July 1993 - 5 July 1999 Rafael B. Buenaventura Amando M. Tetangco, Jr. 6 July 1999 - 3 July 2005 4 July 2005Present