Monetary Policy and Central Banking

advertisement

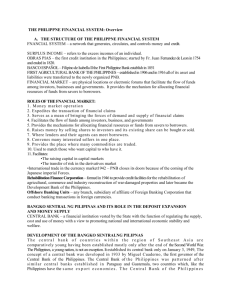

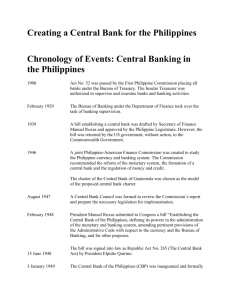

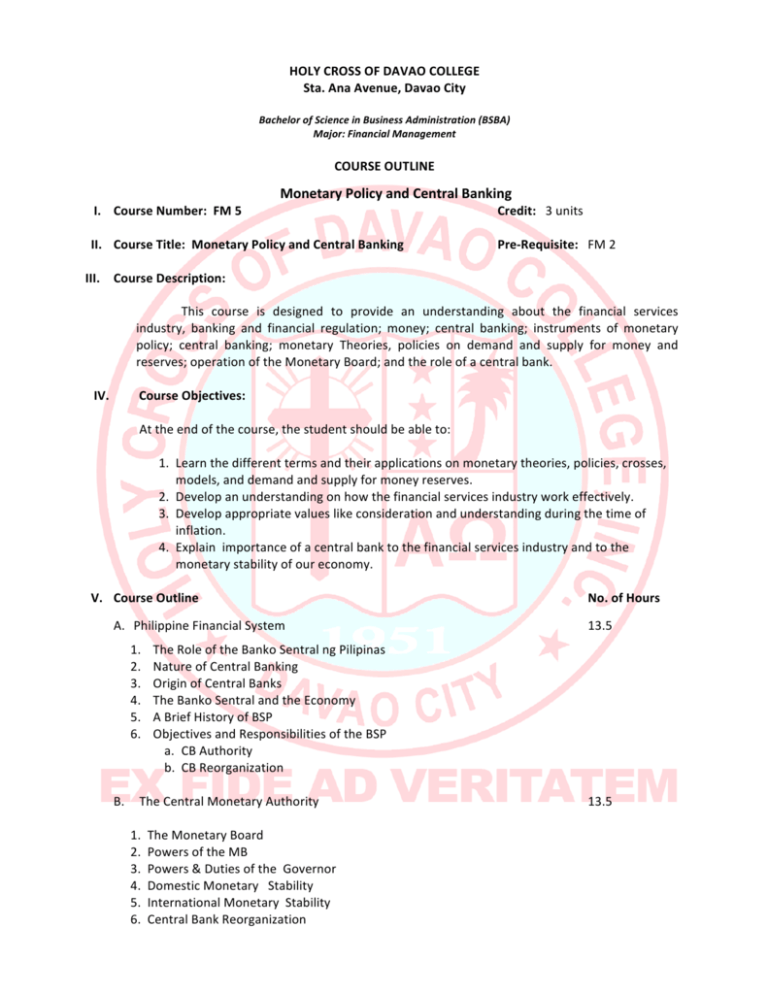

HOLY CROSS OF DAVAO COLLEGE Sta. Ana Avenue, Davao City Bachelor of Science in Business Administration (BSBA) Major: Financial Management COURSE OUTLINE Monetary Policy and Central Banking I. Course Number: FM 5 Credit: 3 units II. Course Title: Monetary Policy and Central Banking Pre-­‐Requisite: FM 2 III. Course Description: This course is designed to provide an understanding about the financial services industry, banking and financial regulation; money; central banking; instruments of monetary policy; central banking; monetary Theories, policies on demand and supply for money and reserves; operation of the Monetary Board; and the role of a central bank. IV. Course Objectives: At the end of the course, the student should be able to: 1. Learn the different terms and their applications on monetary theories, policies, crosses, models, and demand and supply for money reserves. 2. Develop an understanding on how the financial services industry work effectively. 3. Develop appropriate values like consideration and understanding during the time of inflation. 4. Explain importance of a central bank to the financial services industry and to the monetary stability of our economy. V. Course Outline No. of Hours A. Philippine Financial System The Role of the Banko Sentral ng Pilipinas Nature of Central Banking Origin of Central Banks The Banko Sentral and the Economy A Brief History of BSP Objectives and Responsibilities of the BSP a. CB Authority b. CB Reorganization B. The Central Monetary Authority 13.5 13.5 1. 2. 3. 4. 5. 6. 1. 2. 3. 4. 5. 6. The Monetary Board Powers of the MB Powers & Duties of the Governor Domestic Monetary Stability International Monetary Stability Central Bank Reorganization C. Functions and Operations of the Banko Sentral 1. 2. 3. 4. 5. 6. 7. 13.5 No. of Hours 13.5 Characteristics of BSP Functions of BSP Monetary Tools Activities of the CB The BSP and Industrial Development The CBP Coordinates With International Institutions Credit Operations 8. Supervision of Financial Institutions 1. Supervision and Regulation 2. Types of Examination 3. Monetary Theory 4. Inflation 5. Types of Inflation 6. Unemployment 7. Theories of Employment 8. Types of Employment 9. Monetary Policies 10. Objectives of Monetary Policies 11. Responsibilities of Fiscal Policies VI. References A. Bibliography Buenaventura, Rafael B. (2003) Perspective from Banko Sentral ng Pilipinas Bunye, Ignacio R.(2011) Central Banking for every Juan and Maria, Tormis Books, Alabang, Muntinlupa City Pagoso, Cristobal M. (2010), Money, Credit and Banking, Rex Bookstore Inc. Quezon City Websites: http://www.bsp.gov.ph/about/governance_amt.asp http://www.bsp.gov.ph http://www.country-­‐data.com/frd/cs/philippines/phappen.html VI. Course Requirements: A. 4 Major Exams B. Class Standing (Quizzes, Seat work, Assignment/Research work, group presentation) C. Written Analysis of Case Study (WACS) VII. Grading System Midterm Grade Final Grade Prelim Examination 25% Semi-­‐final Examination 25% Midterm Examination 25% Final Examination 25% Class Standing 50% Class Standing 50% Total 100% Total 100% Midterm Grade + Final Grade Final Grade = 2