Session 9 the Budget

advertisement

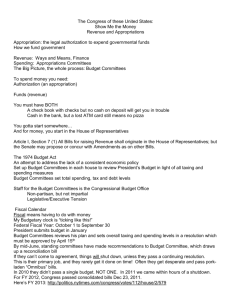

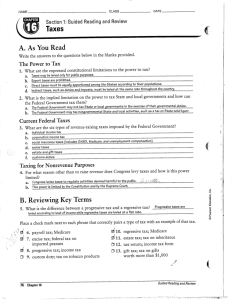

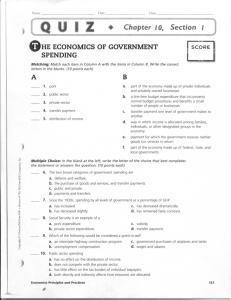

AP Gov. Exam Review Congress, the President and the Budget Session 9 The Budget-making Process Four Major Themes: 1. The national deficit is money the government does not have to pay its bills. This can change from fiscal year to fiscal year. When the government spends more than it takes in in federal revenues. The opposite being a federal surplus 2. Entitlement spending takes up the largest portion of the federal budget. These programs are also considered “uncontrollable spending” and are required by federal law. The national debt is all outstanding receipts the government owes. 3. The federal budget-making process is an extremely political process with many actors and uncertain outcomes. Main ActorsCongressPresidentInterest GroupsAgency headsCBOOMBGAO- 4. Since the end of World War II, the role of the federal government in people’s lives has increased tremendously. These programs like Social Security, Medicare and Medicaid are extremely popular and the American public has shown a reluctance to reduce benefits. Paradox= programs are popular and need tax revenue to fund them. Program demands are increasing and demand more tax revenue. Tax increases are very unpopular with Americans. Rise of the welfare and national security state. AP Gov. Exam Review Term, idea, concept etc. National deficit vs. National debt Congress, the President and the Budget Definition or examples Here’s why it’s important: An excess of federal expenditures (spending) over federal revenues (what we bring in in taxes) Federal government has to borrow money to pay its bills. Debt is all the money borrowed over the years that is yet to be paid Tax expenditures ***Entitlement programs*** Session 9 Budget Deficit: a situation in which the government spends more money than it takes in from taxes and fees. (G>T). Typically we use deficit financing by selling govt securities to the public. Revenue losses that result from special exemptions, exclusions or deductions on federal tax law Exemptions and reductions are very popular but cost the federal government billions in lost revenue Policies for which Congress has obligated itself to pay X level of benefits to Y number of recipients. Social Security, Medicare and Medicaid Very popular. Pay as you go. KEY=baby boom generation is a major strain on entitlement programs. More people benefiting from the current system than those paying in. AP Gov. Exam Review Congress, the President and the Budget Session 9 Term, idea, concept etc. Definition or examples Here’s why it’s important: ***Uncontrollable spending*** Expenditures that are determined not by a fixed amount of appropriated funds by Congress but by how many eligible beneficiaries there are for a program or by previous obligations Entitlement spending makes up the bulk of uncontrollable spending. These programs are not subject to annual authorizations. Also nondiscretionary spending= obligations we can’t do anything about. Federal funds that must be reauthorized from year to year. These can be changed. Entitlements are taking more and more away from discretionary spending i.e. education, environment & transportation Last year’s budget is the best predictor of this year’s budget plus a little more Agencies are encouraged to spend ALL of their allocated budget. If they don’t, that money will be taken away for the next fiscal year. Congress will see those funds as not used and un-needed. Discretionary spending Incrementalism