Budget Intro Activity

advertisement

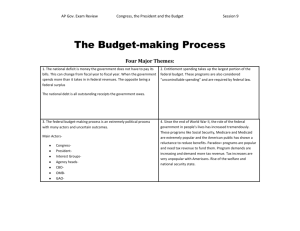

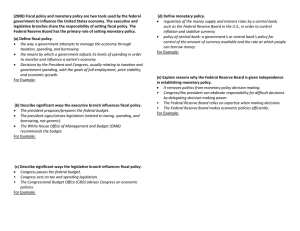

Name ________________ AP Government Public Policy Economic Policy & The Budget Process of the Federal Government Directions: Using the document “Understanding the Federal Budget” and your book, look up the definitions of the following terms and answer the following questions. Terms: Deficit – Surplus- Balanced budget National debt – Gross domestic product (GDP)- Monetarism– Keynesiansim– The Federal Reserve Board (The Fed) – Monetary policy Fiscal policy – BudgetFiscal year – Budget resolution – Entitlements – Income tax – Progressive income tax Regressive income taxQuestions: 1. Read “Introduction” and “What Is the Budget?” 2. Where the Money Comes From Where does the federal government get most of its revenue? __________________________ What is the second-highest source of government revenue? ___________________________ What is the third-highest source of government revenue? _____________________________ Where else does the government get its revenue? ___________________________________ What is the total amount of revenue that the government took in in FY2010? ____________ 3. Spending What is mandatory spending? _________________________________________________ What is discretionary spending? _______________________________________________ What percentage of the budget is mandatory spending? Discretionary? _________________ What is the only way Congress can change the amount spent on mandatory programs? ___________________________________________________________________________ What are the three largest mandatory spending programs? ____________________________ What other entitlements are there? ______________________________________________ How much does the government expect to spend in FY 2010? _________________________ What consumes the largest percentage of federal spending? ___________________________ What interest payments does the government have to make? __________________________ 4. How Does the Government Create a Budget? When does the President typically submit his budget to Congress for the next fiscal year? ___________________________________________________________________________ The major steps in the budget process are outlined in this packet. You’ll want to be very familiar with these steps. 5. Supplemental Spending What is supplemental spending? ________________________________________________ List three examples of supplemental spending. _____________________________________ What is TARP? _____________________________________________________________ What is the American Recovery & Reinvestment Act? _______________________________ 6. Surpluses and Deficits In what years did the government run a surplus? ___________________________________ In what years did the government run a deficit? ____________________________________ How big was the deficit in FY2009? _____________________________________________ Budget Process – Overview: Law requires that by the first Monday in February the President must submit to Congress the proposed federal budget for the next fiscal year, which begins on October 1st. The budget is complicated due the number of agencies within the bureaucracy that require funding. According to the Constitution, Congress has the power of the purse. However, early in the twentieth century, Congress relinquished some of this power to the President, due to the increasing complexity of the federal budget. The President prepares his overall economic agenda with help from the Secretary of Treasury and the Council of Economic Advisors. The President is responsible for preparing a budget blueprint that is submitted to Congress. He does this with assistance from the Office of Management and Budget (OMB). OMB gathers all the funding requests from the numerous agencies and gives these requests to the President. Agency heads will normally request more funding than they received the previous year. Contemporary presidents, for political reasons, have wanted to cut back on the size of the federal bureaucracy. Conflict between these agency heads and the President has been the result. The President will propose the budget to Congress, where it is first reviewed and debated in budget committees in the respective chambers. The annual budget proposal is often controversial for a number of reasons. First, taxing and spending priorities are at the heart of political differences between the two parties. Second, the President’s budget will often include impoundments, and third, many in Congress disagree about deficit spending. Finally certain programs like entitlements are called mandatory spending and cannot be easily cut, leaving the main debate centered on discretionary spending, like defense and other departments. A certain part of our spending is called uncontrollable because we cannot anticipate exactly how much it will cost. Finally, there are often disagreements among policymakers about how to stimulate the economy. Some want to use fiscal policy while others want to use monetary policy. By the end of the 1980’s the national debt had reached trillions of dollars, and since then Presidents have more actively tried to reduce the debt. A law passed in the 1980’s called Gramm-Rudman-Hollings put a cap on the amount of deficit spending that we can have, but the Court declared most of it unconstitutional. A Balanced Budget Amendment to the Constitution was proposed but it did not pass. If the President and the Congress cannot agree on a budget by the start of the fiscal year, the government has no authority to spend and may shut down as it did 1996 during Clinton’s Presidency. The yearly budget is a dramatic event for the White House and the Congress. A formal signing ceremony takes place on White House when the annual budget is complete.