Taxation Tidbit Calculating or Avoiding the Mid

advertisement

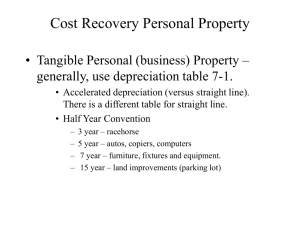

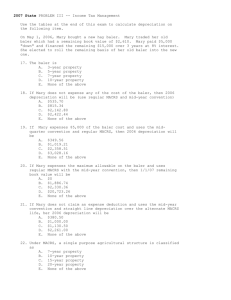

Taxation Tidbit Calculating or Avoiding the Mid-Quarter Convention Parman R. Green, Univ. of Missouri Extension Ag Business Mgmt. Specialist Most depreciable assets* a farmer acquires qualify for the “half-year depreciation convention”. This convention provides that all qualifying property placed in service during the year is allowed one-half year of depreciation, regardless of the date placed in service. An exception to this convention is when more than 40% of the qualifying depreciable assets are placed in service during the last three months of the tax year. If this exception applies, then all depreciable assets that would normally be allowed half-year depreciation must instead be depreciated on the midquarter depreciation schedule. Thus, instead of depreciation being half of a full year’s depreciation regardless of date of purchase, the percentage will be based on the quarter each asset was placed in service: First Quarter 87.5% Second Quarter 62.5% Third Quarter 37.5% Fourth Quarter 12.5% Assets on which the Section 179 expensing election (up to $102,000 for 2004) has been opted are not included in the depreciable asset denominator and numerator. Thus the mid-quarter convention can be circumvented by electing Section 179 on enough assets placed in service during the last quarter to get below 40 percent. * Depreciable assets excluded in this calculation are nonresidential real property, residential rental property, and property placed in service and disposed in the same year.