VITA Training Instructions – Essential Info & Hints!

advertisement

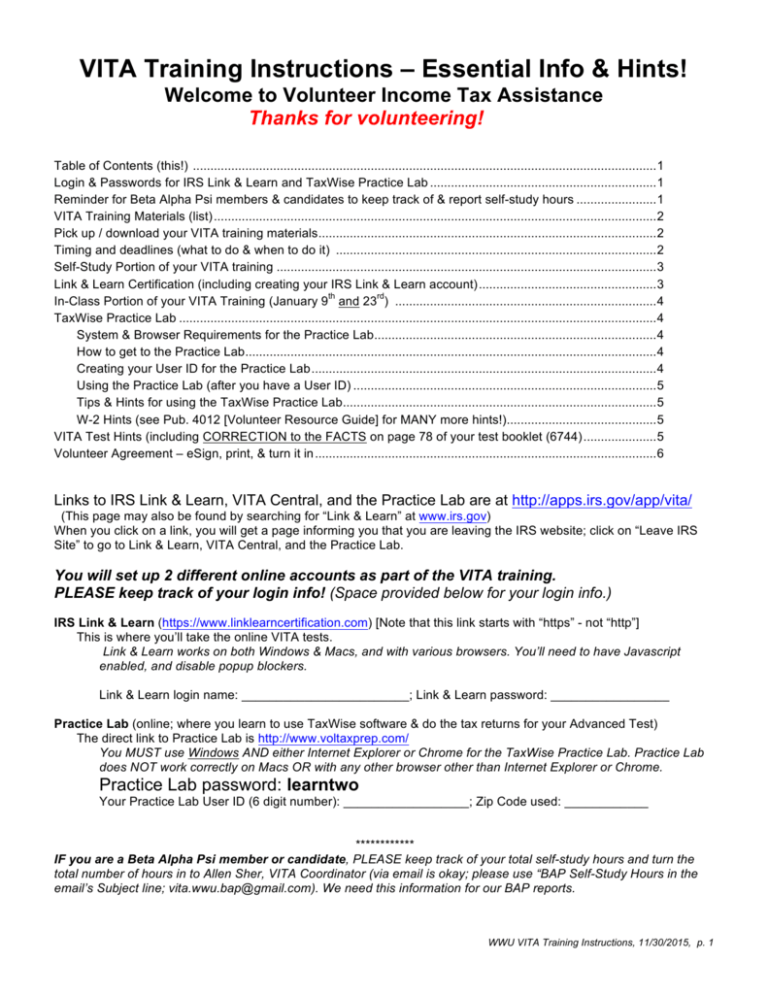

VITA Training Instructions – Essential Info & Hints! Welcome to Volunteer Income Tax Assistance Thanks for volunteering! Table of Contents (this!) ..................................................................................................................................... 1 Login & Passwords for IRS Link & Learn and TaxWise Practice Lab ................................................................. 1 Reminder for Beta Alpha Psi members & candidates to keep track of & report self-study hours ....................... 1 VITA Training Materials (list) ............................................................................................................................... 2 Pick up / download your VITA training materials ................................................................................................. 2 Timing and deadlines (what to do & when to do it) ............................................................................................ 2 Self-Study Portion of your VITA training ............................................................................................................. 3 Link & Learn Certification (including creating your IRS Link & Learn account) ................................................... 3 th rd In-Class Portion of your VITA Training (January 9 and 23 ) ........................................................................... 4 TaxWise Practice Lab ......................................................................................................................................... 4 System & Browser Requirements for the Practice Lab ................................................................................. 4 How to get to the Practice Lab ...................................................................................................................... 4 Creating your User ID for the Practice Lab ................................................................................................... 4 Using the Practice Lab (after you have a User ID) ....................................................................................... 5 Tips & Hints for using the TaxWise Practice Lab.......................................................................................... 5 W-2 Hints (see Pub. 4012 [Volunteer Resource Guide] for MANY more hints!)........................................... 5 VITA Test Hints (including CORRECTION to the FACTS on page 78 of your test booklet (6744) ..................... 5 Volunteer Agreement – eSign, print, & turn it in .................................................................................................. 6 Links to IRS Link & Learn, VITA Central, and the Practice Lab are at http://apps.irs.gov/app/vita/ (This page may also be found by searching for “Link & Learn” at www.irs.gov) When you click on a link, you will get a page informing you that you are leaving the IRS website; click on “Leave IRS Site” to go to Link & Learn, VITA Central, and the Practice Lab. You will set up 2 different online accounts as part of the VITA training. PLEASE keep track of your login info! (Space provided below for your login info.) IRS Link & Learn (https://www.linklearncertification.com) [Note that this link starts with “https” - not “http”] This is where you’ll take the online VITA tests. Link & Learn works on both Windows & Macs, and with various browsers. You’ll need to have Javascript enabled, and disable popup blockers. Link & Learn login name: ________________________; Link & Learn password: _________________ Practice Lab (online; where you learn to use TaxWise software & do the tax returns for your Advanced Test) The direct link to Practice Lab is http://www.voltaxprep.com/ You MUST use Windows AND either Internet Explorer or Chrome for the TaxWise Practice Lab. Practice Lab does NOT work correctly on Macs OR with any other browser other than Internet Explorer or Chrome. Practice Lab password: learntwo Your Practice Lab User ID (6 digit number): __________________; Zip Code used: ____________ ************ IF you are a Beta Alpha Psi member or candidate, PLEASE keep track of your total self-study hours and turn the total number of hours in to Allen Sher, VITA Coordinator (via email is okay; please use “BAP Self-Study Hours in the email’s Subject line; vita.wwu.bap@gmail.com). We need this information for our BAP reports. WWU VITA Training Instructions, 11/30/2015, p. 1 VITA Training Materials Handed out in printed format (also available online at wwubap.org): • The VITA Training Instructions (this handout, also available at wwubap.org in pdf format). • Volunteer Study Plans created by WWU’s VITA (with various possible start dates for your self-study). • VITA Training Guide (Pub. 4491) • VITA Resource Guide (Pub. 4012; in Pub 4480 bundle) [Primary reference booklet for VITA] • VITA Test Booklet (Pub. 6744; in Pub 4480 bundle) Available online only – the direct link to the VITA Resources page at wwubap.org is below: • VITA Volunteer Standards of Conduct (VSOC) - Ethics Training (Pub. 4961) • VITA Intake/Interview & Quality Review Training (Pub. 5101) • Instructions for Form 1040 (not yet released for 2015) • “Your Federal Income Tax” (Pub. 17, not yet released for 2015) Pick up / download your VITA training materials The VITA Coordinator will let you know when & where to pick up your printed VITA training materials. Some materials are available only in electronic format, and will need to be downloaded. However, electronic copies of all of the VITA Training Materials (except for those not yet released) are available for download on the WWU Beta Alpha Psi website (direct link: http://www.wwubap.org/volunteer-activities/vita-resources/). Or – go to the WWU Beta Alpha Psi website (www.wwubap.org) and click on Volunteer Activities, then VITA Resources. You may download the files individually, OR download zipped/compressed bundles of the VITA Training Materials. Timing and deadlines Start the self-study portion of your VITA training as soon as possible! We STRONGLY recommend that you use our VITA Volunteer Self-Study Plans (created by WWU VITA) to help with the timing of your self-study training. The Self-Study Plans are available with the VITA Training Materials at http://www.wwubap.org/volunteer-activities/vita-resources/ (see Pick up / download VITA training materials). Now: • Start your self-study training using Publication 4491 (VITA Training Guide). See the Self-Study Plans for timing. Before January 9th: • Complete VSOC (Volunteer Standards of Conduct) training using Pub. 4961, plus manually do the test & retest questions on pp. 9-13 of your printed Test Booklet (Pub. 6744), then use those test & retest questions to complete the online VSOC test on the Link & Learn website. (You’ll need to create your Link & Learn account.) • Complete Intake/Interview and Quality Review training using Pub. 5101, plus manually do the test & retest questions on pp. 17-20 of your printed Test Booklet (Pub. 6744), then use those test & retest questions to complete the online Intake/Interview and Quality Review test on the Link & Learn website. • Complete as much as possible of your self-study VITA Training Guide (Pub. 4491) before January 9th. You will get the maximum benefit from the in-class training if you have completed Pub. 4491. On January 9th: st • Come to the 1 Saturday of the in-class VITA Training at WWU, starting in Parks Hall 146. Free parking in WWU “C” lots – see http://www.wwu.edu/ps/doc/pk/ParkingGuide.pdf for map). Before January 23rd: • Complete Affordable Care Act (ACA) Training in Pub 4491. [Tested on the Advanced Test.] • Manually complete most (hopefully all) of the Advanced Test (Test & Retest Questions) in the Test Booklet (Pub 6744). IMPORTANT CORRECTION on page 78 of Test Booklet: Change Logan Floyd’s birthdate to 4/6/2003. On January 23rd: nd • Come to the 2 Saturday of in-class VITA Training at WWU, in Parks Hall 210. Free parking in “C” lots. By January 26th: • Pass your VITA Tests (VSOC, Intake/Interview & Quality Review, and Advanced) online. (Need at least 80% on each test to volunteer; maximum number of attempts = 2) • Electronically “sign” your Volunteer Agreement, print, and turn your Volunteer Agreement in to Allen Sher (WWU VITA Coordinator). [WCC volunteers – turn in your Volunteer Agreement to John Fasler.] • Before you can volunteer, your VITA Coordinator is also required to check your photo ID to make sure it matches your Volunteer Agreement. st th WWU’s VITA site opens the week of Feb 1 . Whatcom Community College’s site opens Feb 8: . WWU VITA Training Instructions, 11/30/2015, p. 2 Self-Study Portion of your VITA training Use our VITA Volunteer Self-Study Plans (created by WWU VITA) to help with the timing of your self-study training. The Self-Study Plans are with the VITA Training Materials (see Pick up / download your VITA training materials). Learn the subject matter. Most people learn best from using the VITA Training Guide (Pub. 4491). This guide is easy to read, and easy to follow. However, if you choose, you can supplement your training with the IRS Link & Learn online training at https://www.linklearncertification.com/d/ (also available through VITA Central at http://apps.irs.gov/app/vita/) Or – choose a blend of whatever format (Pub. 4491 and/or Link & Learn) you prefer! The VITA Training Guide (Pub. 4491) is designed to cover Basic, Advanced, and Military topics. Our VITA program is limited to the Advanced training (which INCLUDES the Basic training, but you will NOT cover the Military topics (marked with a star). As you complete each lesson in Pub. 4491, go to the Volunteer Resource Guide (Pub. 4012) and review the material related to the lesson that you just completed. (A list of Pub. 4491 lessons and their corresponding materials in Pub. 4012 are on the Volunteer Self-Study Plans.) PLEASE use Pub. 4012, and other IRS reference materials throughout training and testing. These are the same references that you’ll use while you’re volunteering to help people with their taxes, and are GREAT resources! The primary references you’ll use are: • Publication 4012 – Volunteer Resource Guide (provided with your training materials) • Publication 17 “Your Federal Income Tax” (300-page reference book with LOTS of great examples) • Form 1040 Instructions The Volunteer Standards of Conduct (Ethics) Training is in Pub. 4961. Manually answer the test & retest questions on pp. 9-13 of your printed Test Booklet (Pub. 6744), then use the test & retest questions to complete the online VSOC test on the Link & Learn website (see Link & Learn Certification) The Intake/Interview and Quality Review training is in Pub. 5101. Manually do the test & retest questions on pp. 17-20 of your printed Test Booklet (Pub. 6744), then use those test & retest questions to complete the online Intake/Interview and Quality Review test on the Link & Learn website (see Link & Learn Certification) Please write down any questions you have and bring them to the in-class training sessions! See Timing and Deadlines for additional information on VITA training timing and deadlines. Link & Learn Certification (and creating your IRS Link & Learn account) • Once you are ready to start the VITA training and tests (e.g., Volunteer Standards of Conduct, etc.), go to https://www.linklearncertification.com/d/ and create an account for yourself, so that you can start. When you create an account, your “Group” is “01-VITA Volunteer.” (Site Coordinators need to choose “Site Coordinator.”) If you volunteered last year, and still have your username and password from last year, you may be able to use that. Your “Training Source” is Publication 4491, unless you have chosen to use Link & Learn only. Then you’ll enter your first name, last name, a login name (choose one you’ll remember!), a password that you’ll remember, and your email address. [Remember to record your login info on the first page of this handout.] Then enter your mailing address, the time zone (Pacific), and the number of years you have volunteered BEFORE this year. You won’t have a PTIN unless you’re already a professional tax preparer. Then click the Register button to create your Link & Learn account. • After you have created your Link & Learn account, you will be able to complete the Volunteer Standards of Conduct (VSOC) test, then the Intake/Interview and Quality Review test. (see above for more info) You may need to disable pop-up blockers to be able to use the VITA test website. IRS Link & Learn seems to work well with both Windows and Mac computers, and with commonly used browsers. You must complete the VSOC test, then the Intake/Interview & Quality Review test, before you will be allowed to do any other tests for VITA certification. ALL of our volunteers will do the Advanced (not Basic) VITA test, so click on the “Advanced” tab in Link & Learn. (Your Link & Learn account opens to the “Basic” tab by default, so click on the “Advanced” tab.) Do NOT do the Health Savings Account Exam. HSA is NOT within the scope of the WWU & WCC VITA sites. • • • • WWU VITA Training Instructions, 11/30/2015, p. 3 In-Class Portion of your VITA Training on January 9th and 23rd th rd Come to both of the in-class VITA training sessions on Saturday, January 9 and Saturday, January 23 from 9am th to 4pm in Parks Hall at WWU. We’ll start in Parks Hall 146 the morning of January 9 , then move to Parks Hall 210 rd (computer lab). The training on January 23 will be entirely in Parks Hall 210. Parking is free on weekends in WWU’s “C” lots. (Map at http://www.wwu.edu/ps/doc/pk/ParkingGuide.pdf) During our in-class training, we will cover several topics that are not emphasized in the VITA Training Guide. For example, we plan to spend time on issues of importance to college students, such as educational expenses and scholarships. We’ll also cover the Affordable Care Act, VITA procedural issues, and have TaxWise practice sessions. We hope that you’ll complete (at least) all of Lessons in the VITA Training Guide (Pub. 4491) for the Advanced VITA test (which includes all the Basic topics) and complete the Volunteer Standards of Conduct Training & Test, as well as th the Intake/Interview and Quality Training & Test, before the January 9 in-class training. See the Study Plan for a th schedule to help you complete all of the required self-study training before January 9 . Work on the Advanced Test questions in your Test Booklet (Pub 6744). In general, most people will go online and enter their answers for the th Advanced Test (which includes Basic topics) after the January 9 in-class training. PLEASE bring your printed training materials (plus any printouts you’ve made of training materials) to the classroom training! Also, please bring any questions you have to the in-class training sessions! TaxWise Practice Lab The TaxWise Practice Lab (online software) is a wonderful resource that gives VITA volunteers hands-on practice for preparing returns at VITA sites and for completing the tax returns needed for your Advanced VITA test. Practice Lab is an “early release” version of the full TaxWise Online (that we’ll use for VITA), and is NOT updated or customized to our VITA sites. The full version of TaxWise Online will be up to date and customized for our sites. System and Browser Requirements for the Practice Lab: IMPORTANT: For TaxWise Online and the Practice Lab you must use Windows and either Internet Explorer or Chrome. TaxWise Online does not work properly with other browsers or on Macs – essential elements to the program are missing unless you use Windows and Internet Explorer/Chrome. You will NOT be able to enter all the information correctly unless you use Windows and Internet Explorer/Chrome! (Link & Learn works on both Windows and Mac computers and with other browsers – but TaxWise does NOT – you MUST use Windows and Internet Explorer/Chrome for the TaxWise Practice Lab) How to get to the Practice Lab: • Go to www.irs.gov and ‘search’ (in the upper right hand corner), type in ‘Link & Learn’ st • Click on the 1 selection, ‘Link and Learn Taxes’ – this opens a descriptive page • Near the top of this page, click on the ‘Link & Learn’ link (this opens the Link & Learn course page). Direct link to Link & Learn: http://www.irs.gov/app/vita • Scroll down & take a look at this page. (Click on the Advanced Certification Path tab to get to the training modules (Volunteer Standards of Conduct, Intake/Interview & Quality Review, and Advanced). • To go to the Practice Lab, click on the Home tab, then scroll down the page and look for Additional Resources, then click on Tax Software Practice Lab • Click on ‘leave IRS site’ (this opens the Practice Lab access page; if not, you can use the link below) Direct link to the Practice Lab: http://www.voltaxprep.com/ • Enter the password: “learntwo” (This is “Learntwo” (two is an abbreviation of TaxWiseOnline) & needs to be all in lower case) You’ll need to use the learntwo password each time you enter the Practice Lab. Creating your User ID for the Practice Lab: • The first time, you do not (yet) have a User ID, so click on “Create new user” at the bottom of the page. Then enter your zip code and your email address, then click “Create User ID.” (Note for returning volunteers: if you still have your Practice Lab User ID from last year, it MAY still work – or just create a new User ID.) • IMPORTANT: Make a note of your User ID: (It’s a 6 digit number) and the zip code you used! (There is a place for this info on the first page of these VITA Training Instructions.) • There is no way to recover a lost or forgotten password. The only option is to create a ‘new user.’ If you lose your User ID, you won’t be able to access returns you’ve already done in the Practice Lab. WWU VITA Training Instructions, 11/30/2015, p. 4 Using the Practice Lab (after you have a User ID): • • • • • • • Click on login, and log in using your User ID and zip code. Once you’re in the Practice Lab, go to Pub 4012’s Tab N (Using TaxWise Online) to learn the basics. To do a tax return (e.g., from your test booklet [Pub. 6744]), click on “New Return” at the top left. You’ll be asked to enter the Social Security number of the taxpayer. Replace the 6 Xs in the SSN with the 6-digit User ID you created. (For example, assume that a taxpayer’s SSN is shown as 021-XX-XXXX. So, if your User ID was 123456, you’d enter the SSN as 021-12-3456.) You’ll need to use this replacement method for all SSNs and EINs in the Practice Lab – any time you see the six Xs. Once you’ve entered and confirmed the SSN for a return, click on “Go to Interview” NOTE: Practice Lab is sometimes fairly SLOW… so don’t be alarmed if there are delays… The Interview collects some of the information needed for the return, and helps set up the forms needed to complete the return after you’ve done the interview. (NOTE: We do NOT do any state returns.) Once you’re done with the interview, the next logical step is to go to the input forms for information (e.g., W-2, 1099, etc.) and enter ALL of the information from each form, then make sure you’ve entered all other information for the return. (NOTE: Pub 4012 has a LOT of information on preparing a return with TaxWise, ALSO, look through Pub 4012’s Tab D (Income) for specific information on how to fill out TaxWise forms.) Tips & Hints for using the TaxWise Practice Lab: • The last six digits (Xs) of every SSN and EIN in the Practice Lab must be replaced by your User ID. • Use the Tab key to go from entry field to entry field. • Use Pub. 4012 for TaxWise Online help. To create a new return, see page N-3 in Pub 4012. • Once you’re done with the interview, and wish to enter W-2 info, look in the left column for a W-2. If there isn’t a W-2, click on Forms List and search for W2 (not W-2), then click on Add to add a W-2. For hints on how to fill in the W-2, see p. D-6 in Pub 4012. This is particularly useful if you change the automatic calculations, such as when you need to take the calculations off of lines 3, 4, 5, & 6 on Form W-2. • Foreign Tax Credit hint: Open Form 1116 (special situation – see top for instructions and enter amount) • You may need to “Save Return” a lot in order to be able to enter amounts, etc. Therefore, if you can’t enter an amount in a space, click “Save Return” – then try again. • No punctuation is allowed in TaxWise, so you’ll get a warning if you accidentally type a period or comma. • Once you have finished the interview, look on the left for forms marked in red – these need entries, so click on the form to open it. It is often best to start by entering W-2 and 1099 information (after you have done the Interview). • NOTE: Practice Lab is an early release version of the TaxWise Online software, and is not customizable. (The final version of TaxWise Online will be customized by the time we start preparing tax returns in February.) Since we can’t customize Practice Lab, you’ll have RED warnings (incomplete warnings) for such items as EFINs, PTINs, EROs, Taxpayer PINs. W-2 Hints (there are MANY HINTS in Pub. 4012): • You may have to click on SAVE RETURN a LOT while filling in forms – or you won’t be able to enter info! • On W-2, if Lines 3, 4, 5 and/or 6 don’t match the actual W-2, click on the box near the top of the W-2 to remove the calculations from these lines. Then press “save return” and enter the correct amounts. • On W-2, Line 15, after you enter the state and state ID, press “save return” to have the state wages appear on Line 16. Then you’ll be able to enter the state tax on Line 17. • All of the above additional instructions (and more!) for the W-2 start on page D-6 in your Pub. 4012. Use it! • For all of the sample and test problems, “Your City, State, Zip” means to enter your zip code (TaxWise will fill in the rest), and “YS” means to enter your state abbreviation (WA). Don’t worry that Washington State doesn’t have an income tax – these are just exercises. Just be sure to enter ALL info from the Forms W-2, 1099, etc. ***************************************** VITA Test Hints • All of the questions on the online VITA Tests are in Form 6744 Test/Retest Booklet. The Advanced scenarios, test questions, and retest questions are on pages 63-113 of the Test Booklet, with the retest questions on pages 106113. You MUST do the tests first in the Test/Retest booklet – NOT ONLINE. Also, for the Advanced Test, do all scenarios with returns electronically using the TaxWise Practice Lab. • As you do each scenario – be sure to answer BOTH the Test AND the Retest questions for EACH scenario, so you’re fully ready to fill in the online Advanced VITA test. The fact situations for the Test and the Retest for each scenario are identical – the questions differ. The online test chooses questions from the Test and Retest at random. You only have about 45 minutes to do each test online – so you MUST have ALL Test and Retest questions answered BEFORE starting your test, so that you can refer to your answers and enter them online. WWU VITA Training Instructions, 11/30/2015, p. 5 • Please do NOT copy answers from someone else or allow someone to copy your answers. The tests are designed to determine if you have sufficient understanding to help the community with their taxes, so you MUST do your own work. • If a question (on the test) asks you to enter an amount, just enter the number. (NO dollar signs or commas.) • Before you submit your answers for a test, you’ll see an Exam Review screen. It’s a good idea to print this screen, so that you’ll know exactly what you answered if you have incorrect answers. (You may need to right click and select this particular “frame” to print.) Then, after you submit your answers, you’ll get a Test Results screen. If you have incorrect answers, you may want to print this, or at least compare it to your Exam Review printout to help determine why you have incorrect answers. Understanding and correcting your errors will help you be a better VITA tax assistor. • Remember that you ONLY get 2 attempts to pass each test. If you don’t pass a test with at least 80% on the first attempt, be sure to rework the questions and make ABSOLUTELY sure that you understand the material BEFORE doing your second attempt. Discussing issues and confusing provisions (with the VITA nd Coordinator, instructors, and/or fellow volunteers is strongly recommended! If you fail your 2 attempt at a test, you will NOT be able to volunteer to help people do their taxes. • DO use your primary resources (Pub. 4012, Pub. 17, & the Instructions for Form 1040) while doing your VITA test, since these are the SAME resources that you will be using when you’re at a VITA site. • In Pub. 4012 (Volunteer Resource Guide), follow the flowcharts and checklists carefully. These are incredibly valuable resources, and should be your starting point. Pub. 4012 also contains help for using TaxWise. Additional clarifying information is contained in Pub. 17 and the Instructions for Form 1040. • When you are ready to do the Advanced VITA Test, log into Link & Learn, and click on the tab for Advanced. Do NOT do the separate Basic Test, since the Basic items are included in the Advanced Test. Do NOT do the Health Savings Account (HSA) Exam, or the Military, International, or Puerto Rico exams. • Common errors (on ALL returns, not just the tests): o Errors in entering names, addresses, dates of birth, and SSNs. These are the most common errors! [At VITA sites, double-check names, SSNs, and date of birth. Also, if the taxpayer has more than one last name, ask them which last name is registered with the Social Security Administration (SSA). Name changes must be processed by the SSA before filing, or the return will be rejected. The Bellingham SSA office is at 710 Alabama St, near Trader Joe’s. [www.ssa.gov] o Forgetting to check the EIC box for dependents. (Check this if there is ANY chance that the EIC applies. Checking the EIC box will make the EIC worksheet appear with questions for you to answer.) o Failing to enter ALL information from Forms W-2, 1099R, etc. Make sure that you enter all codes, checked boxes, amounts in boxes, state (“YS” in the test booklet = Your State, so just enter a state abbreviation), and BE SURE to enter the state income tax withheld! (Entering state income tax withheld is required for the VITA test to get the correct answers, even though we know that WA doesn’t have income tax!) Also make sure that the employer’s EIN is entered correctly. o In general, don’t override the computation fields in TaxWise. (This results in calculation errors and missing qualifications for various provisions.) • IMPORTANT CORRECTION on page 78 of Test Booklet (Pub 6744): Change Logan Floyd’s birthdate to 4/6/2003. Volunteer Agreement – eSign, print, & turn in the Volunteer Agreement AFTER you have finished (and passed) ALL THREE VITA tests (Volunteer Standards of Conduct, Intake/Interview & Quality Review, and Advanced Test), your https://www.linklearncertification.com/d/ page should show that you have passed the exams. Follow these steps: • • • Near the top right of the main https://www.linklearncertification.com/d/ page, click on the box to electronically sign your Volunteer Agreement. Then (below the check box), click on “Click here to open and complete your Volunteer Agreement.” This creates a pdf file of your Volunteer Agreement. Print the Volunteer Agreement for the VITA Coordinator. We must have the completed Volunteer Agreement before you can volunteer. Turn it in to the WWU VITA Coordinator (Allen Sher), in the BAP mailbox in Parks Hall 451. (Mailing address: WWU VITA Coordinator, BAP, Dept of Accounting, WWU, 516 High St, MS 9071, Bellingham, WA 98225-9071) If you have questions, contact, Allen Sher, WWU VITA Coordinator, at vita.wwu.bap@gmail.com. Whatcom CC volunteers are to deliver their Volunteer Agreement to John Fasler at Whatcom Community College. WWU VITA Training Instructions, 11/30/2015, p. 6