Application - University of Missouri

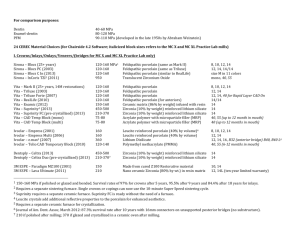

advertisement

The University of Missouri-St. Louis College of Business Administration One University Blvd. St. Louis, MO 63121 PERSONAL INCOME TAX SERVICE (VITA) 2015 Recruiting Managers and Tax Preparers-Student Volunteers TRAINING BEGINS SATURDAY-JANUARY 24th at UMSL January 7, 2015 Dear UM-St. Louis Business Administration and Accounting Students: Beta Alpha Psi and the College of Business Administration are continuing a community service tradition by sponsoring a free personal income tax service for low-income taxpayers and seniors through the UM-St. Louis Volunteer Income Tax Assistance (VITA) program. Business students volunteer by preparing federal and state income tax returns at one of eight locations in the St. Louis metropolitan area. Under this program, you will not sign the tax returns nor have any legal liability. Experience has shown that participation in the UM-St. Louis VITA program has been an important consideration of prospective employers. Other benefits of this program are: one to three hours of undergraduate college credit (which does not affect the total accounting credits limit), practical tax experience, networking opportunities, potential managerial experience and personal satisfaction derived from community service. Scholarship opportunities are available to top-performing volunteers, payable in the following academic year. The requirements for participation in the UM-St. Louis VITA program include: Attendance at the mandatory training workshops Fluency in the English language IRS volunteer E-file and Taxwise certifications (attained during the certification workshops) Minimum 4 hour weekly field service commitment from February 5, 2015 until April 12, 2015 All volunteers must attend both full-day tax training workshops scheduled for: Saturday, January 24, 2015 in room 202 J C Penney (9:30 am) Sunday, January 25, 2015 in room 202 J C Penney (9:30 am) Optional- Volunteers may attend one of the following half-day IRS certification workshops: Saturday, January 31, 2015 (afternoon) in rooms 003/005 ESH Sunday, February 1, 2015 (afternoon) in rooms 003/005 ESH If you would like to participate, please complete the attached application and return it to the UM-St. Louis VITA Office (504 SSB Tower) or e-mail to vita@umsl.edu. A detailed agenda with locations, dates, and time information will be e-mailed out in early January 2015. In the meantime, if you have any questions, please contact UM-St. Louis VITA Program Management at vita@umsl.edu. We are looking forward to your reply. Sincerely, Tonya DeClue Greg Geisler Lindell Chew Volunteer Application for the 2015 Tax Preparation Season Thank you for your interest in participating in the UM-St. Louis VITA program. Please note that submitting this application indicates your interest in serving as a volunteer and reserves your place in the training workshops. Submitting this application does not obligate you to participate. Submitting this application is the only step you need to take prior to January 2015. Please return your completed application to the UM-St. Louis VITA Office (504 SSB Tower) or e-mail to vita@umsl.edu. Name: . Street Address: . City, State, ZIP Code: . E-mail Address: . Phone: (Cell) (Home) What is your affiliation with the University: Undergrad Student Grad Student (Other) Alumnus Faculty/Staff . No Direct Affiliation Are you a member of Beta Alpha Psi: Yes No Candidate Are you interested in participating in UMSL VITA for academic credit: Yes No Unsure Have you participated in the UMSL VITA program before? Yes No If so, when: . Have you participated in any other volunteer/ paid tax preparation programs? Yes No If so, when/ where: . Please briefly describe your tax experience (personal, professional or academic): . Do you have your own laptop computer (PC only) that you would like to use: Yes No Please indicate your preferred level of involvement (1-3, 1 being most preferred): Tax Preparer- Complete income tax returns using Taxwise software. Site Leader- Supervise tax preparers, review tax returns, transmit returns to IRS and manage site operations. Greeter- Administrative assistant responsibilities. Please indicate your preferred site location/ shift time (1-7, 1 being most preferred): Barr Library (Soulard) Friday 11-4 PM Ferguson Library (Ferguson) Thursday 3-7:30 PM Friday 1-5 PM Saturday 9-3 PM Schlafly Library (Central West End) Saturday 8:30-12:45 PM Saturday 12-4:15 PM Spencer Library (St. Charles) Saturday 9-4 PM