Sample Test

advertisement

Financial Management

MGRS 365 – Final Exam

NAME:

Ali Nejadmalayeri

May 13, 2002

ID: R 0 0 0 __ __ __ __ __ __ __ __ __

Each question has 12 ½ points. Please answer all questions and show your work. Good Luck.

Use the following to answer questions 1 – 4:

Kottinger's Kamp Supplies’s stock price sells at $50. The firm has 1.7M shares outstanding. The firm's 8% annual

coupon, 10 year maturity bond has $150M face value and sells for 110. The firm has just paid a $1.50 dividend and

expected to grow 5% annually forever. The flotation costs of debt and equity are 5% and 10%, respectively. The

firm's combined marginal federal and state tax rate is 40%.

1. What is Kottinger's market value debt to equity ratio?

Market value of debt = 110% $150M = $165M

Market value of equity = 1.7M $50 = $85M

Debt to Equity ratio = 165/85 = 1.9411

Debt to Assets ratio = =165/(165+85) = 165/250 = 0.66

2. After considering flotation costs, what is Kottinger's before tax cost of debt?

PV = (100% – 5%) 110 = 104.5

N = 10

PMT = 8

FV = 100

I/Y = 7.349%

Before tax cost of debt = 7.349%; After tax cost of debt = 7.349% (1 – 0.4) = 4.409%

3. After considering flotation costs, what is Kottinger's before tax cost of equity?

Before tax Cost of Equity = Div0 (1 + growth) / {(1 – floatation cost) P0} + growth

= 1.50 1.05 / {(100% -10%) 50} + 5% = 8.5%

After tax Cost of Equity = Before tax Cost of Equity = 8.5%

4. After considering flotation costs, what is Kottinger's WACC?

WACC = D/A rd ( 1 – ) + (1 – D/A) re

= 0.66 7.349% 0.6 + 0.34 8.5% = 5.8%

Financial Management

MGRS 365 – Final Exam

Ali Nejadmalayeri

May 13, 2002

NAME:

ID: R 0 0 0 __ __ __ __ __ __ __ __ __

Use the following to answer questions 5 – 7:

Project

A

B

Year 0

-$200

-$300

Year 1

$100

$175

Year 2

$100

$125

Year 3

$100

$125

5. Based on the payback rule, which of the aforementioned projects should be undertaken? Explain why?

PBA = 1 + 1 = 2

PBB = 1 + 1 = 2

Based on Payback rule both projects are equally valuable.

6. If the discount rate is 14%, which of the aforementioned projects should be undertaken? Explain why?

Here we need NPV analysis, so

NPVA = 100/(1.14) + 100/(1.142) + 100/(1.143) – 200 = $32.16

NPVB = 175/(1.14) + 125/(1.142) + 125/(1.143) – 300 = $34.06

Project B is an economically more profitable project.

7. Based on the IRR rule, which of the aforementioned projects should be undertaken? Explain why?

Here we need IRR analysis, or we need to find the rate at which NPV = 0;

NPVA = 100/(1+IRRA) + 100/(1+IRRA) 2 + 100/(1+IRRA) 3 – 200 IRRA = 23.375%

NPVB = 175/(1+IRRB) + 125/(1+IRRB) 2 + 125/(1+IRRB) 3 – 300 IRRB = 21.130%

Project A gives higher return on investment. Note that final vote on this requires us to find

the crossover rate. If crossover rate is between the two IRRs then the decision is

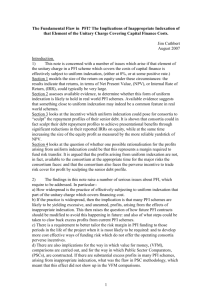

8. What is the crossover rate for these two projects? What is the significance of crossover rate? Explain.

First we need to find the incremental project, or A – B;

For A – B, the cash flows are: –100, 75, 25 and 25, so IRR A–B = 15.424% is the crossover

rate. Now since discount rate is less than CR, then we should choose B, which has the lower

IRR, because it gives better NPV. Had CR been less than discount rate then we should have

chosen A.

The graph below shows the NPV of both project and you can see why the relation between

crossover rate and discount rate matters.

Financial Management

MGRS 365 – Final Exam

Ali Nejadmalayeri

May 13, 2002

NAME:

ID: R 0 0 0 __ __ __ __ __ __ __ __ __

$80.00

A

B

$60.00

$40.00

$20.00

$0.00

0%

5%

10%

15%

20%

25%

30%

35%

($20.00)

($40.00)

If we blow up the scale you can see that if discount rate < crossover rate the

project with lower IRR (point at which NPV cross horizontal line) is better

and vice versa if discount rate > crossover rate, the project with higher IRR is

better (i.e., gives larger NPV)

$60.00

A

B

$50.00

$40.00

$30.00

$20.00

$10.00

$0.00

0%

5%

10%

15%

20%

25%