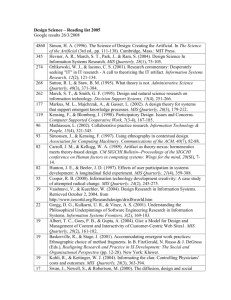

national accounts

advertisement