CHAPTER 13

CHAPTER 13

COMMERCIAL PROPERTY INSURANCE

When business purchase insurance, we call it commercial insurance.

When individuals purchase insurance, we call it personal insurance.

PROPERTY AND MARINE INSURANCE

Real Property: property permanently attached to land. e.g buildings

& fixtures.

Mobile Property: property to be exported and covered by transportation insurance historically marine insurance.

COMMERCIAL PACKAGE POLICY

The insurance office (ISO) designed the commercial package policy to provide insurance coverage to a broad range of profit and nonprofit organizations including manufacturing firms, schools, retailers and apartments building owners.

The CPP is preceded by DECLERATIONS and CONDITIONS applying to the entire package.

Declarations

1. 1 ST page of the package

1

2. insured`s identity

3. location of the business

4. different components coverage purchased

5. premium charged

Common Conditions

1. covers policy cancellation

2. assignment of the policy

3. other legal rights and duties

In addition

1. specific declarations

2. conditions page

PERILS COVERED

The property component requires a causes-of-loss form to complete the contract. There are three main alternatives.

1. The Basic Form

2. The Broad Form

3. The Special Form

FIRE INSURANCE

Fire is not defined in insurance policies. For A peril to qualify as a fire, there must be a clearly visible flame or glow and the fire must be

`hostile`.

2

A hostile fire is one that is unconfined and beyond designated boundaries.

A friendly fire is to collect for loss the proximate cause must be hostile fire.

If an insured is to collect for a fire loss the proximate cause must be a hostile fire.

PROPERTY INSURANCE RATING

A fire insurance rate is the cost per hundered dollars of exposed value.

Insurers calculate the premium by multiplying the rate times the number of hundreds of dollars of value in the exposure.

There are two different methods:

1. Class Rating operates combining units into a group and then charging a class rate reflecting the loss experience and expenses of the group.

Factors to be considered: *construction of the building

*occupancy ( owner occupied or not)

*community firefighting capability

3

*external surrounding exposures

2. Scheduled Rating analysis each property individually and is used primarily in rating commercial building.

A rate for a standard building in the same city as the building under consideration provides the beginning of the procedure.

Rate:

Standard Building

+Charges(morehazardous conditions)

- Credits ( less hazardous conditions)

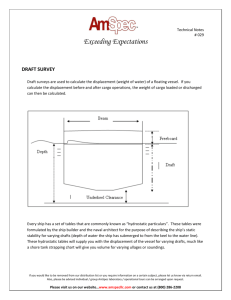

TRANSPORTATION INSURANCE

Marine is one of the earliest forms of insurance protection.

BOTTOMRY was a transaction protecting an owner from financial loss, if his ship were destroyed.

If the ship is acquired by means of a loan, an interest rate was paid to a moneylender.

The moneylender, for a premium beyond the interest rate, would agree to forgive the loan if the ship were destroyed.

Some points are considered:

1. similar units were exposed to similar perils

4

2. non-accidental , losses were excluded from coverage

3. losses are definite and measurable

4. catastrophes were not likely

RESPODENTIA

Loans were comparable to bottomry loans. The ship`s cargo is the subject not the ship.

A merchant, placing cargo on a ship, would take a loan using the cargo as collateral. The money lender, for a premium in addition to the regular interest charged, agreed to forgive the loan if the cargo were lost.

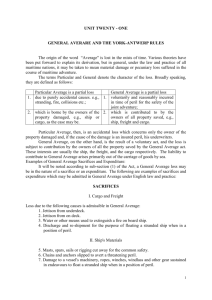

Particular average losses are those borne by the owner of the ship or cargo due to direct damage to the property.

General Average is the loss attributed to the owners of property where there was not necessarily a loss to their property but other property was thrown overboard to save the ship and then loss was borne proportionately by all who had property exposed to loss during the voyage.

OCEAN MARINE RATING

Unlike fire, ocean marine insurance rates are based on the judgement of the underwriter.

5

There are some points to be considered:

1. the seaworthiness of the ship

2. the experience and the ability of the captain and the crew

3. potential for loss of carg o; types of goods that are carried…

4. the route scheduled to be traveled and the season of the year

5. the coverage provided by the policy

FOUR DISTINCT TYPES OF THE LOSS EXPOSURES a. The hull exposure includes the value of the ship and its equipment b. The cargo exposure is the value of the goods being shipped. c. The loss of freight is the loss of income the ship owner would have earned. If the cargo delivered rather than lost. d. The liability loss exposure is the loss a ship owner would suffer.

INLAND MARINE INSURANCE

Insurance is essentially an American distinction. In other countries, if an insurer ( underwriter) wants to write fire insurance, marine or perhaps even life; it is a private decision.

6

Everything (almost) we own has been transported on a truck or train several times before its purchase.

Policies include: i. Bailees customers policies ii. Instrumentalities of transportation policies. iii. Personal and commercial property floaters.

In bailment, property belonging to one party (the bailor) is temporarily in the possession of a second party

( the bailee), ultimate possession is to revert back to the first party.

*parking a car in a public garage

*leaving the clothes at cleaners

*shipping goods on a truck

*lending a lawnmower to a neighbour

If not legally but bailee morally responsible for its safe return to the bailor.

ANNUAL TRANSIT POLICY is designed to protect the interest of the shipped (bailor) whereas

MOTOR TRUCK CARGO insurance a from of baliee`s liability coverage) is designed to protect the interest of the trucking company.

7

INSTRUMENTALITIES OF TRANSPORTATION

It may cover a variety of different structures including, bridges, tunnel, pipelines, dams and traffic signals.

FLOATER INLAND MARINE INSURANCE

It is used to cover property is easily and frequently moved and is generally of high value. e.g. for personal there are articles floater to cover valuable assets such as cameras, jewelry or firs.

For commercial property; there are scheduled floaters that covers items of significant value such as medical equipment, livestock, fine art etc.

AIRCRAFT PROPERTY INSURANCE

This is applicable to helicopters, hot air balloons, hang gliders and space satellites.

It is parallel to ocean marine insurance that is the owners need to purchase insurance to protect hull, freight and cargo and liability exposure.

8