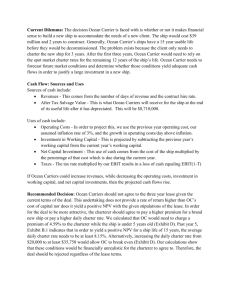

Ocean Carriers

advertisement

Ocean Carriers Questions: 1. Compute the NPV, IRR and payback for the proposed purchase of the capesize ship under the following scenarios (assume that the company will not keep the ship in operation for more than 15 years): a. Profits taxed at 35%; b. Hong Kong taxes. Present your estimates at both constant and current prices. The ship will not be revalued for tax purposes. 2. Assume now that Ocean Carriers is considering the possibility to use an old hull to build the new ship. That hull did cost 8 million in 1998, with a current scrap value of 2 million (assume no tax impacts). The cost to convert it into a new ship is only 37 million. How much value would be gained from using this cheaper alternative? [For simplicity, ignore any time-value of money related issues: assume all investment cash-flows take place on the same year] 3. Suppose that you are evaluating the possibility to extend this ship’s operation up to 25 years. What would be the value generated (or destroyed) today if the new policy is implemented? Note: this company adopts a 9% nominal cost of capital rate