Internal Theft - Shoplifting - Credit cards

advertisement

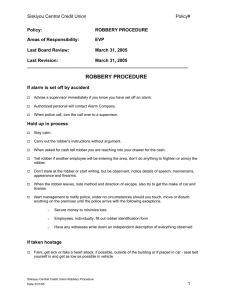

LESSON PLAN COVER SHEET SUBJECT: BUSINESS CRIME PREVENTION INSTRUCTOR(S): ICJS Crime Prevention Instructors UNIT: PHONE: 512-245-6233 PHONE: 877-304-2727 TIME ALLOTTED: 1 HOUR AND 20 MINUTES INSTRUCTIONAL AIDS: POWER POINT PRESENTATION STUDENT MATERIALS: HANDOUTS PREREQUISITE EXPERIENCE OF THE LEARNERS: CRIME PREVENTION OFFICERS (POLICE OFFICERS) AND QUALIFIED CIVILIAN PERSONNEL GOAL (PURPOSE OF THE COURSE) This combined lesson is designed to provide the student with knowledge & skills he/she will need to assist business owners during a Crime Prevention Business “Commercial Security” Survey DATE PREPARED: 1 OCTOBER 2009 DATE REVISED: PREPARED BY: OFFICER JIMMY MEEKS REVISED BY: INSTRUCTOR LESSON PLAN SUBJECT: BUSINESS CRIME PREVENTION UNIT: LESSON OBJECTIVES (Specific points of information to complete the goal statement): •Learning Objective: The student will be able to identify, explain and recommend robbery awareness tips on how to prevent robbery. •Learning Objective: The student will be able to identify, explain and recommend robbery awareness tips on appropriate employee responses to a robbery situation or event. •Learning Objective: The student will be able to identify, explain and recommend enhance security measures designed to reduce risk of robbery in their business. •Learning Objective: The student will be able to identify and explain what is shrinkage. •Learning Objective: The student will be able to identify contributing factors to employee theft – why employees steal from their employer. •Learning Objective: The student will be able to identify and explain procedural controls designed to reduce the risk of employee theft. •Learning Objective: The student will be able to identify shrinkage control methods designed to reduce employee theft. •Learning Objective: The student will be able to identify the types of shoplifters. •Learning Objective: The student will be able to identify the method of operation “Modis Operandi” of shoplifters. •Learning Objective: The student will be able to identify and explain a training plan for business owners and their employees using topics and methods designed to reduce the risk of shoplifting. •Learning Objective: The student will be able to identify, explain and make security recommendations designed to reduce risk of shoplifting. •Learning Objective: Student will be able to identify why business people feel they must accept checks and credit cards. •Learning Objective: Student will be able to identify why business people are reluctant to have strict policies and enforcement when accepting checks and credit •Learning Objective: Student will be able to identify the main cause of loss from fraudulent checks and credit. •Learning Objective: Student will be able to identify acceptable and unacceptable types of identification for check and credit card. •Learning Objective: Student will be able to identify correct procedures for establishing a check cashing and credit card acceptance policy •Learning Objective: Students will be able to list the proper procedures for cashing checks and accepting credit cards. •Learning Objective: Students will be able to explain the magnetic numbers on the check. •Learning Objective: Student will be able to list the items on a check or credit card that can be used to determine the authenticity of a check or credit card. INSTRUCTOR'S LESSON PLAN I. PREPARATION (Student Motivation / Opening Statement) In addition as a New CRIME PREVENTION PRACTITIONER you will be called on by business owners to conduct crime prevention employee training in these related subject areas. Look at how this presentation was put together to train you and let it be a model that you can use to do your trainings in the future. II. PRESENTATION (Implementation of Instruction) ROBBERY AWARENESS Of the crimes that businesses face, robbery involves the least loss of money or other assets. Unlike other crimes, however; robbery puts the employees in physical danger. A business can take some simple preventative measures to reduce their risk of being a robbery victim. The way a business is managed, and the physical conditions of the building can help prevent robberies. Have at least two employees open and close the business Do not release personal information to strangers Keep purses and personal valuables locked in desks or lockers Install a robbery alarm Place a surveillance camera behind the cash register facing the front counter. Replace videotapes regularly Don't use marked "moneybags" that make it obvious to would-be robbers you are carrying money for deposit Keep a low balance in the cash register Place excess money in a safe or deposit it as soon as possible Handle cash carefully. Avoid making your business a tempting target for robbers. Keep the amount of cash in registers low. Drop all large bills right away. If a customer tries to pay with a large bill, politely ask if he or she has a smaller one. Explain that you keep very little cash on hand. Use only one register at night. Leave other registers empty and open. Tilt the register drawer to show there is no money in it Cooperate with the robber for your own safety and the safety of others. Comply with a robber's demands. Remain calm and think clearly. Make mental notes of the robber's physical description and other observations important to law enforcement officers If you have a silent alarm and can reach it without being noticed, use it. Otherwise, wait until the robber leaves Be careful, most robbers are just as nervous as you are Keep your business well-lit, inside and outside. Employees should report any burned-out lights to the business owner or manager. Keep trees and bushes trimmed, so they don't block any outdoor lights. Don't put up advertisements, flyers, displays, signs, posters or other items on windows or doors that might obstruct the view of the register from inside or outside your business. Make sure the sales counter can be seen clearly. The police cruising by your store need to see in. Stay alert! Know who is in your business and where they are. Watch for people who hang around without buying anything. Be aware of suspicious activity outside your place of business. Write down license numbers of suspicious vehicles if visible from the inside of your business Try to greet customers as they enter your business. Look them in the eye, and ask them if they need help. Your attention can discourage a robber If you see something suspicious, call the police. Never try to handle it yourself. It could cost you your life Use care after dark. Be cautious when cleaning the parking lot or taking out the trash at night. Make sure another employee inside the business keeps you within eye contact while you are involved in work details outside of your building Make sure important signs stay posted. For example, the front door should bear signs that say, "Clerk Cannot Open the Time Lock Safe." If your business is robbed put your safety first. Your personal safety is more important than money or merchandise. Don't talk except to answer the robber's questions Don't stare directly at the robber Don't make any sudden moves. Prevent surprises, keep your hands in sight at all times Tell the robber if someone is coming out of the back room or vault or working in another area of your business. Don't chase or follow the robber out of your place of business. Leave the job of catching the robber to the police. INTERNAL THEFT Company is more vulnerable to employee theft than shoplifting “A man’s enemies are men of his own house”…Biblical saying Dishonest employees can steal several items at one time or several items throughout the day Employees steal from their employers for opportunity, desire, and/or excitement. Some steal for retaliation, no raise or boss did not give them day off the employee ask for. A myriad of reasons exist Security experts generally agree that loss to employee theft is greater than loss to shoplifters PROCEDURAL CONTROLS Series of systems that guide employee activities. Procedural controls that are beneficial and can be cost effective and easily implemented Designed for prevention not detection Attitude of management towards their employees Is cost and effort proportionate to the problem? If employee theft is discovered employer should prosecute or thief just moves around PURCHASING CONTROLS Manipulate process for spending company’s money Commonly fall prey to unscrupulous vendors Gratuity policy will help prevent Management, purchasing agents and vendors need to all know the rules or company policies FRAUD practiced in purchasing consist of vendors kicking back part of the sales price to the buyer or other employees who authorize purchases Purchasing agent vendor selection fee Receive & File competitive bids Vendor return a percentage of the gross order to the buyer Added cost for the kick back is borne by the owner Owner receives shoddy service or inferior goods (merchandise) Rotation of vendors Written notification to all biding that contracts are not awarded to vendors who offer gifts Periodic expense analysis performed by outside auditing firm Company policy that spells out no gratuities and sanctions that will be taken against violators RECEIVING IN A PROTECTED AREA Best to receive goods and material within a fenced in area where only suppliers (delivery) vehicles and company vehicles are authorized Do not allow employee parking within 50 feet of receiving door. Layout arranged to eliminate blind spots Prohibit leaving merchandise on receiving dock, keep doors locked. SECURITY ENHANCEMENTS SHRINKAGE CONTROL METHODS MOST FREQUENTLY USED Training Programs HS Lock and chain devices Guards/Detectives Observation Booths – mirrors Fitting room attendants Visible and concealed cameras Secure storage cages, Etc. SHOPLIFTING AWARENESS Stealing a coke from a local convenience store (STOP n ROB) or a pen from a stationary store may not seem like a major crime to the casual observer, but to the small businessperson fighting for survival, it can be disastrous! TYPES of SHOPLIFTERS “The AMATEUR” steals on impulse because he/she desires an item. “The Professional” in the business of stealing as a way of life. Highly skilled - steals items that can be quickly sold. They concentrate on high demand items, TV’s, Stereos, small appliances. Cases or scopes out (Recons) his/her target. METHODS of OPERATION May work alone or in groups. One member starts argument with employee/management other steals. Large bags, packages, coats, newspapers, or wear clothing under their own clothes, Etc. Juveniles and professionals tend to work in groups. Impulse shoplifters work alone EMPLOYEE TRAINING Be alert to shoplifters early warning signals. Watch the way people walk Count number of items customer takes into fitting room Look Shoplifters do not want any attention Customers lingering in one area Look for switched labels Look for person with “DUCK TAPE” around their wrist. SHOPLIFTING – SECURITY RECOMMENDATIONS Maintain adequate lighting Keep protruding wings and end displays low Keep high value pilfers able items behind counter. Noise alarms on un-locked exit doors. Merchandise alarms Two-way mirrors Convex Wall Closed-circuit television Detectives posing as customers Uniformed off-duty Police Officers Uniformed Security Officers ARREST AND APPREHEND As a “Crime Prevention” practitioner be prepared to offer advice to store owners or managers concerning the arrest and prosecution of shoplifters detectives posing as customers “Be prepared as many will be opposed to this form of prevention. Many corporate offices will not allow their store managers do this – due to perception of bad publicity” CHECKS AND CREDIT CARDS Most businesses cash checks for convenience to customers to encourage new or continued patronage. Laxity on the part of business people, combined with their desire to increase sales, makes fraudulent checks and fraudulent use of credit cards (Theft of Service) make them a significant problem. For every careful merchant who refuses to accept a check there is another down the street who will accept it. The criminal need only find his mark. As you do your commercial surveys today you will see for yourself that many businesses do not have an established check cashing procedure or policy Why do business people feel that they have to accept Checks and Credit Cards? Lose business (#1 Reason) Customer convenience Competition does it Encourages impulse buying Reduces cash handling Why are many business people reluctant to have strict policies and enforcement when accepting checks and credit cards? Alienate customers & Lose business Lack of training on how to thoroughly examine checks Time training employees Time and expense of prosecution List the main causes of loss from fraudulent checks and credit cards. Laxity Failure to thoroughly examine check Failure to electronically verify check Failure to require proper ID Fraudulent ID ACCEPTABLE FORMS OF IDENTIFICATION Valid driver’s license or DPS ID with picture Military ID with picture Passport SECURITY RECOMMENDATIONS Employee training Strict enforcement of policy Post policy Electronic verification Don’t return card and DL until verified. Patron signs check in front of clerk Do not accept out-of-state or to a 3rd party check starting with low number, made out to cash Limit amount of purchase Management approval for over amount Thoroughly examine check and ID Compare signatures, and photo, age, etc Compare written and numerical amount Do not accept pre or post dated checks CHECK TAMPERING PROCEDURES Complete legible, accurate, no write-over's Look for signs of tampering Name and address printed American Banker’s Association numbers Bank name and location All printing should be quality Payee signature. Magnetic Ink Character Recognition numbers, dull finish, slightly raised MICR numbers always begin 5+5/8” from right edge At least 1, but as many as 3 perforated edges. What info should clerk record on front of check? Record on front of check: DL # DOB Supporting ID Phone Employee ID. KEY TOPIC POINTS ELABORATION ON KEY POINTS 1.Identify, explain and recommend robbery awareness tips on how to prevent robbery. 2.Identify, explain and recommend robbery awareness tips on appropriate employee responses to a robbery situation or event. 3.Identify, explain and recommend enhance security measures designed to reduce risk of robbery in a business. 4.Identify and explain what is shrinkage. 5.Identify contributing factors to employee theft – why employees steal from their employer. 6.Identify and explain procedural controls designed to reduce the risk of employee theft. 7.Identify shrinkage control methods designed to reduce employee theft. 9.Identify the types of shoplifters. 10.Identify the method of operation “Modis Operandi” of shoplifters. 11.Identify and explain a training plan for business owners and their employees using topics and methods designed to reduce the risk of shoplifting. 12.Identify, explain and make security recommendations designed to reduce risk of shoplifting. 13.Identify why business people feel they must accept checks and credit cards. 14.Identify why business people are reluctant to have strict policies and enforcement when accepting checks and credit 15.Identify the main cause of loss from fraudulent checks and credit. 16.Identify acceptable and unacceptable types of identification for check and credit card. 17.Identify correct procedures for establishing a check cashing and credit card acceptance policy 18.List the proper procedures for cashing checks and accepting credit cards. 19.Explain the magnetic numbers on the check. 20.List the items on a check or credit card that can be used to determine the authenticity of a check or credit card III. APPLICATION: Planning for student to practice or apply new knowledge (where applicable) CONDUCTING A BUSINESS SURVEY IV. EVALUATION: Final check of student's comprehension of material presented TEST TO BE GIVEN AT END OF COURSE V. REFERENCES: •Handbook of Loss Prevention and Crime Prevention (Fourth Edition) Lawrence J. Fennelly. __