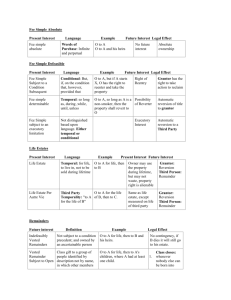

pfrog property law

advertisement