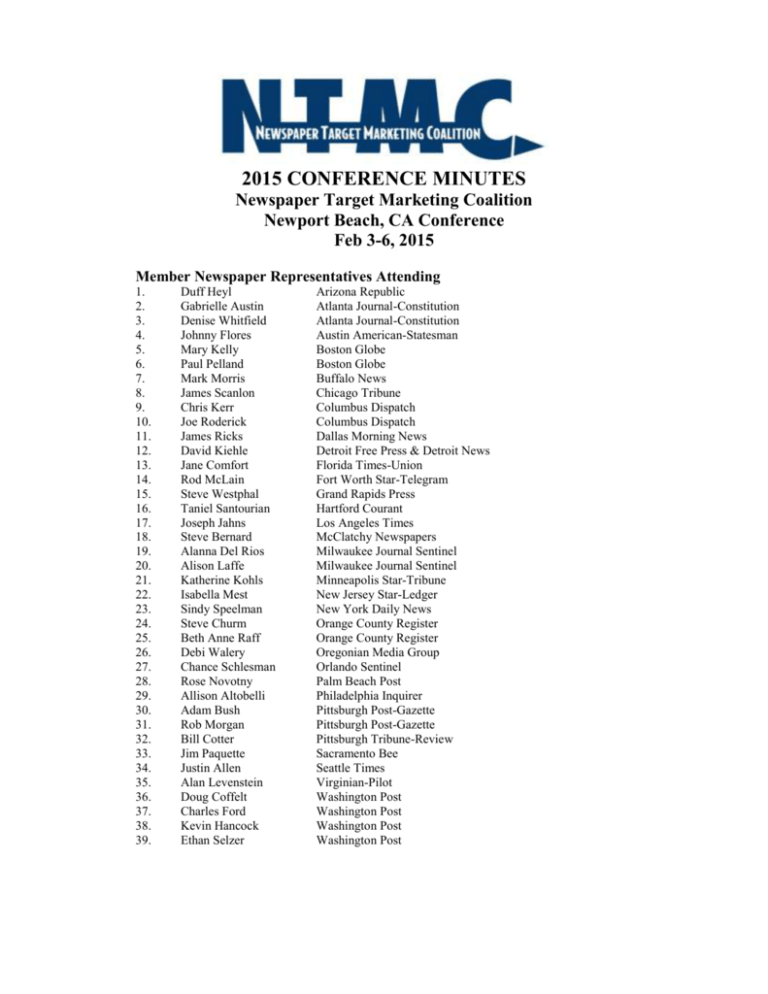

Newspaper Target Marketing Coalition

advertisement

2015 CONFERENCE MINUTES Newspaper Target Marketing Coalition Newport Beach, CA Conference Feb 3-6, 2015 Member Newspaper Representatives Attending 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. Duff Heyl Gabrielle Austin Denise Whitfield Johnny Flores Mary Kelly Paul Pelland Mark Morris James Scanlon Chris Kerr Joe Roderick James Ricks David Kiehle Jane Comfort Rod McLain Steve Westphal Taniel Santourian Joseph Jahns Steve Bernard Alanna Del Rios Alison Laffe Katherine Kohls Isabella Mest Sindy Speelman Steve Churm Beth Anne Raff Debi Walery Chance Schlesman Rose Novotny Allison Altobelli Adam Bush Rob Morgan Bill Cotter Jim Paquette Justin Allen Alan Levenstein Doug Coffelt Charles Ford Kevin Hancock Ethan Selzer Arizona Republic Atlanta Journal-Constitution Atlanta Journal-Constitution Austin American-Statesman Boston Globe Boston Globe Buffalo News Chicago Tribune Columbus Dispatch Columbus Dispatch Dallas Morning News Detroit Free Press & Detroit News Florida Times-Union Fort Worth Star-Telegram Grand Rapids Press Hartford Courant Los Angeles Times McClatchy Newspapers Milwaukee Journal Sentinel Milwaukee Journal Sentinel Minneapolis Star-Tribune New Jersey Star-Ledger New York Daily News Orange County Register Orange County Register Oregonian Media Group Orlando Sentinel Palm Beach Post Philadelphia Inquirer Pittsburgh Post-Gazette Pittsburgh Post-Gazette Pittsburgh Tribune-Review Sacramento Bee Seattle Times Virginian-Pilot Washington Post Washington Post Washington Post Washington Post Nonmember Representatives Attending 40. 41. Mike Mori Heather Foor Toledo Blade Toledo Blade Sponsors Attending 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68. 69. Douglass Grossman Manuel Collazo Angelo Ramirez Paul Taylor Corina Wandrey Jude Fontenot Keith Bartlett Lee Anne Ashurst Monica Bartling Jim Mace John Short Mike Shoals Heidi Houghton Tom Dressler Roy Dunn David Henderson Chad Swannie Jack Klausing Chris Hummel Larry Santillo Chris Lovern Gerry Fuhrmeister Allyn Hallisey Bill Falconer Lisa Szal Laura Tarabini Jeff Ferrazzano Desiree Ferrazzano ACI Media CIPS Marketing Group CIPS Marketing Group CIPS Marketing Group CIPS Marketing Group Data- Dynamix, Inc. doodad doodad Marketing Solutions Group NewsNotes® Advertising NewsNotes® Advertising NewsNotes® Advertising NewsNotes® Advertising PCF PCF Preferred Marketing Solutions Preferred Marketing Solutions Preferred Marketing Solutions Quad/Graphics Quad/Graphics Quad/Graphics Quad/Graphics Rockledge Software, Inc Rockledge Software, Inc. Tactician Media Tactician Media/NDX Ultimate PrintSource Ultimate PrintSource Speakers Attending 70. 71. 72. 73. 74. 75. 76. 77. 78. 79. 80. 81. Karli Sikich Chris Cope Eric Henry Jim Hart Keith Gilpin Dawn Hartman Jamie Schultheis Rich Schiekofer Jim Conaghan Therese Mulvey Michael Lombardo Larry Berg ACG Media ACG Media CMPartners LLC Integrated Advertising Solutions Keith Gilpin Consulting MediaWorks MediaWorks NAA NAA PREformance Marketing Tactician Media Valassis NTMC Attending 82. Philip Brown NTMC A. Tuesday, February 3rd i. 5:00- 9:30 pm - Board of Director’s Meeting & Dinner ii. 9:30 pm – Welcome Reception –Fairmont Bambu Lounge Room 400 - Sponsored by Quad/Graphics. B. Wednesday, February 4th – Morning Sessions i. 8:00- 9:00 am – Breakfast Buffet – Sponsored by Data-Dynamix Supporting Sponsor Comments: Chris Lovern, Sales Director, Quad/Graphics Jude Fontenot, Director of Sales Training, Data-Dynamix Early Bird Drawing #1: Kevin Handcock- Spa Gift Certificate (provided by Fairmont) Ethan Seltzer- Spa Gift Certificate (provided by Fairmont) Joe Roderick- Spa Gift Certificate (provided by Fairmont) Mark Morris- Fleece (provided by Pittsburgh Tribune-Review) Bill Cotter – Gift card Therese Mulvey- Gift card ii. 9:00- 9:30 am - NTMC Welcome: President Rod McLain remarks, Anti-trust statement (included at end), Attendee introductions iii. 9:30- 10:00 am – Orange County Register Publisher Welcome: Steve Churm, Vice President Freeman Communications & Orange County Register: Discussed current state of OC Register and introduces Rich Mirman. Rich Mirman, Publisher Orange County Register & Press Enterprise: Discussed his background in Casino industry & similarity to current state of Newspaper industry. Stresses importance of local/regional content as the industry’s competitive advantage. Expresses that is the best way to take advantage of the aging population while making inroads with younger demos. iv. 10:00- 10:15 am - Break v. 10:15- 11:00 am – Business Session #1 – Challenges/Opportunities Discussion: vi. Topics discussed: Duplication issues with opt-in/opt-out vs.TMC & paid. Are community editions the best jackets for TMC? AAM auditing of TMC/SMC products – is this needed to legitimize the product? Hybrid Opt-in/Opt-out models – is it a good idea to allow advertisers to purchase only the opt-in portion? Rectifying opt-ins? Do recipients need to “re-opt-in” each year? 11:00-11:45 am – Advertiser Session #1 – Karli Sikich, Director of Corporate Communications, ACG Media: Goal is to drive best ROI for clients. Challenge of understanding multi-channel audience. Higher scrutiny on print…seen as a high-cost media. Higher investment made in POS systems from advertisers, leads to more data-driven decision-making. Paid distribution still works best, TMC second, Sunday Select-models third. Audited media performs better. Preprints remain a valuable component of media mix and drive positive ROI. Retailers still want sub-ZIP distribution options & don’t want to be forced to run unwanted distribution. Local content is key for engagement. Engagement with content drives engagement with preprints. Newspapers should be the experts on their market. Local market research is helpful. Opt-in products are valued if they are audited. Stay in contact with print media buyers. Utilize video conferences if in-person is not an option. Be proactive on any issues or new developments. vii. 11:45 am – Distinguished Lunch Sponsor Comments from Jeff Ferrazzano, President, Ultimate PrintSource viii. Noon-1:00 pm – Lunch – Sponsored by Ultimate PrintSource C. Wednesday, February 4th – Afternoon Sessions i. 1:00-1:15 pm - Distinguished Presenting Sponsor Comments from Manuel Collazo, President & CEO, CIPS Marketing Group ii. 1:15- 2:00 pm – Advertiser Session #2 – Therese Mulvey, Consumer Engagement Officer, PREformance Marketing: Audiences are exposed to over 5,000 brand impressions per day. Media influence has changed over the years, but all types are still there. It’s more about finding the right mix that is best for that particular advertiser. Three types of purchases…the 3-Rs – Routine, Reminder & Research. All have a mix of traditional and new media. Consider using traditional media to trigger online activity. Also, there are different behaviors associated with traditional media purchases vs. new media. Consider having them work in tandem to complement each other. Consumer Trade Area – concept of day-parting impressions & media mix around the user’s day. Know how well your products are performing to better help your advertisers know which ones are best for them. Explain to customers how we can help them to optimize their spends with their data. iii. 2:00-2:45 pm - Sponsor Exchange Gift Card Winners: Isabella Mest – NJ Star-Ledger Adam Bush – Pittsburgh Post-Gazette Chris Kerr – Columbus Dispatch Charles Ford – Washington Post Debi Walery – Oregonian Media Group Steve Bernard – McClatchy James Scanlan – Chicago Tribune Mary Kelly – Boston Globe Rod McLain – Ft Worth Star-Telegram Jane Comfort – Florida Times-Union Mark Morris – Buffalo News Alison Laffe – Milwaukee Journal Sentinel Chance Schlesman – Orlando Sentinel iv. 3:00– 3:45 pm - Business Session #2 – 2014 Newspaper Preprint Survey: Keith Gilpin, Principle, Keith Gilpin Consulting: A total of 31 newspapers provided responses. Used the term “Select” when referring to opt-in, Sunday Select and requested delivery. Key findings: The number of days newspapers are delivering inserts is declining. 53% deliver just 3-5 days a week. Monday & Saturday have been the days cut out the most Wed, Fri & Sun are the most newspapers all run inserts Avg. Sunday penetration is 18.4% with a median of 21.5%. In 2008 the avg. was 37.9% 82% have a Select program. All run Sat-Sun. Average total penetration for select products was 46% Select products tend to be less zoned than TMC , but have a larger jacket size Average number of inserts in a select program was 16. The median is 12. 72.4% have a TMC penetration of 90% or more when combined with paid. 59% have multiple zones to the TMC wrap. Average zone size was 392,146 for all papers. For those that have multiple zones the average were 154,000. 77% use the USPS to deliver part of their TMC. 27% use alternative delivery partners for delivery. Average number of inserts in TMC was 13.9 v. 4:45 pm – Distinguished Dinner Sponsor Comments from John Short, Director of News Notes Advertising vi. 6:00- 9:30 pm – Reception and Dinner – Fairmont Orchid Terrace: vii. Reception Sponsored by Preferred Marketing Solutions Dinner Sponsored by News Notes Advertising 9:30 pm – Evening Networking D. Thursday, February 5th – Morning Sessions i. 8:00- 9:00 am – Breakfast Buffet – Sponsored by Tactician Media Supporting Sponsor Comments: David Henderson, National Sales Rep, Preferred Marketing Solutions Lisa Szal, Industry Analyst, Tactician Media Monica Bartling, President, Marketing Solution Group Early Bird Drawing #2: Allison Altobelli – gift box (provided by New Jersey Star-Ledger) Paul Pelland – gift card Allyn Hallisey – gift box (provided by New Jersey Star-Ledger) Jim Paquette – gift card Rob Morgan – gift card ii. 9:00- 10:00 am – Advertiser Session #3 – Larry Berg, VP & GM Valassis Solutions: Valassis is focused on turning data into ROI. Goal is to influence consumers along their path to purchase: plan, shop, buy & share. Over the years, they have evolved to provide solutions in other media to accelerate client results. Advo/Red Plum – for distribution, newspaper channel, digital channel via display, digital offers & email acquisition, Instore via at-shelf, basket/card & on the floor. Still a focus on paid distribution, but with more of a focus on Community papers to reach the consumer at the point of planning. Newspaper alliances are distribution agreements between Valassis & newspapers. They share postage/distribution costs & combine content. Three kinds of alliances: Traditional – delivery is a combo of newspaper (topped), mail & alternative. Distribution Alliance – combining both packages together to be delivered via USPS. Distribution Only – delivering each product together but not combining the content via alternative delivery or mail. They have three alternative carrier zones currently. iii. 10:00 am – Business Session #3 - Jim Hart, President, Integrated Advertising Solutions P&D’s are an expensive point of entry for an SMB. 58% spend less than $1,000 and 43% only run one time. Focusing on the top deciles of accounts and moving them to spend more will drive more revenue than focusing on low-spending advertisers. Focus on new accounts drives down the average spend per account if there is not revenue per account target. Time is better spent focusing on increasing revenue per account. Set benchmarks for average RPA (revenue per account) to help you decide who to target. TMC – what’s right for you. Zone size, sales bandwidth, revenue mix, level of RPA. Play to your strengths –the smaller the zones the better chance you have to grow revenue as it offers as a good entry point for SMBs. However smaller zones require more sales bandwidth. Consumers view the newspapers as two separate products. Content and shopping (inserts). The struggle is to create a marketplace for your TMC jacket…something that consumers want to receive and see the value in. Restaurants are a must. Content can help lure major account advertisers, but it’s advertising content is what drives user engagement. iv. 11:00 am – Distinguished Lunch Sponsor – Keith Bartlett, President, Doodad v. 11:30- 11:45am – Group Photo: Pool Deck, Sponsored by Marketing Solutions Group vi. 12:15- 1:15pm – Lunch sponsored by Doodad E. Thursday, February 5th – Afternoon Sessions i. 1:00- 1:45 pm – Business Session #4 – NAA Update & 2014 HASS Study – Rich Schiekofer, Senior VP Business Development; and Jim Conaghan, VP Research & Industry Analysis How America Shops & Spends – survey conducted via phone & panel. Younger demos 18-34 are more likely to check advertising at least once a week. 57% of respondents have used newspapers in either print or online for advertising. Online total was 58% (includes newspaper sites). Newspaper performed best for bringing sales to your attention, trustworthiness, and type of advertising that consumers look forward to. Main benefits of newspaper inserts where the ease to browse content. In terms of use by store type, grocery food ranked the best at 85% usage. Department & discount stores were second. Higher ticket items ranked lower. 69% say newspapers are the preferred source for coupons. Coupon usage is tied towards grocery/food when it comes to frequency of use. Online shopping – used to compare prices, check availability and store hours. 85% of online shopping takes place at home in the evening. Online circulars – 51% go to stores website. 16% go to a newspaper website. ii. 1:45- 2:30 pm – Business Session #5 – Capitalizing on Scale & Advertising Measurement to Deliver Client Results – Jamie Schultheis & Dawn Hartman, National Sales Directors, MediaWorks Addressing the needs of advertisers & how they view newspapers: difficult to buy, lack of metrics, diminishing circulation. Need to capitalize on the strengths of the newspaper’s brand. The conversation should be about optimization vs. penetration. By using customer data vs. subscriber data, they can drill down to shopping by channel of distribution. They represent the top 30 markets in the US…70% of the total population, so they can provide a scalable solution. They can also identify digital solutions by using the data. The solutions are usually revenue-neutral, so the same spend is being used but is allocated differently. Transactional data is key to identifying high-value households which need to be reached. Offer transparent reporting on who received the insert, if they purchased & what they purchased. By proving the results, it can turn into a revenue growth strategy. Can show how many pieces need to be added to the buy in order to reach a certain percentage of total market revenue. iii. 2:30- 3:00 pm – Business Session #6 – Successes/Discovery Discussion of pros-cons of Newspaper alliances with Valassis Discussed the successes using segmentation analytics to grow business in certain verticals like real estate iv. 3:00 pm – Distinguished Dinner Sponsor Remarks – Doug Grossman, ACI Media v. 3:05 pm – Don Balser Most Outstanding Contributor Award Recipient, Los Angeles Times Award presented to Sindy Speelman vi. 3:15 pm - Break vii. 3:30– 4:30 pm – Newspaper Session #1: 2013-2014 US FSI Transactional Study – Michael Lombardo, CEO, Tactician Media LLC – Joseph Jahns, 2014 Standardized rate and run information by advertiser & publisher. Lumped advertisers into vertical markets (grocery, furniture/mattress, dept stores, etc). Looked at budget allocations by month for each vertical and also by day of week. Sunday has the largest revenue allocation, but there are spikes mid-week for QSR/Restaurant, grocery, furniture & local services. Measured price pressure by determining the average rate paid by tab size and then measured by vertical how much over or under they are paying at that rate. So, if the average rate of a single sheet is $25 overall, the QSR vertical is paying 15% less than that. When there is high competition in that vertical there is more pricing pressure. Share by media class. Paid is still the biggest allocation at 64%, with TMC at 20%. SMC is 10.5%. Then measured pricing pressure by media class to show average rates paid by vertical for each distribution method. Looked at each publisher to see in which market vertical they have the best pricing pressure. These present the best revenue growth opportunities. Certain verticals are seeing a higher share of revenue in the past year. Looked at pricing trends for each vertical market. Recommendations – benchmark your FSI program against the national metrics. Evaluate your own vertical market trends, risks & opportunities. Understand pricing and revenue pressure points. Develop ongoing business intelligence and monitoring utilizing industry best practices. Most important – communicate the value of your audience to each vertical market. viii. 6:00- 9:30 pm – Reception and Dinner, The Cannery: Reception Sponsored by PCF Dinner Sponsored by ACI Media ix. 9:30 pm – Evening Networking F. Friday, February 6th – Morning Newspaper Sessions i. 8:00- 9:00 am – Breakfast Buffet – Sponsored by Quad/Graphics Supporting Sponsor Comments: Tom Dressler, VP Growth & Development and Roy Dunn, Director of Business Development, PCF Allyn Hallisey, CEO, Rockledge Software Early Bird Drawing #3: Alan Levenstein – umbrella (provided by Minneapolis Star-Tribune) Steve Westphal - Gift card Hernan Ponce - Gift card Gabrielle Austin - Gift card Taniel Santourian- umbrella (provided by Minneapolis Star-Tribune) ii. 9:00- 9:30 am - NTMC Elections Jane Comfort – elected Treasurer Harry Jackson – elected Secretary At-Large – candidates: Isabella Mest – NJ Star Ledger Katherine Kohls – Minneapolis Star-Tribune Rose Novotny – Palm Beach Post Taniel Santourian – Hartford Courant David Kiehle – Detroit News & Detroit Free Press - elected Paul Pelland – Boston Globe - elected iii. 9:30- 11:30 am – Newspaper Session #2 – Negotiation Skills, Eric Henry, CMPartners Using influence vs. control when dealing with other people & growing emotional intelligence in order to gain self-masterly of influencing others. Single loop learning: relation to action vs. results. Do you change the action if you don’t get the results you want or do you stay the course & keep the action the same? Double-loop learning: before you decide to change your action or keep it the same, you re-evaluate the thinking that caused you to take the initial action in the first place. The best negotiators are striving to find a joint value solution rather than having one side win or lose. This is called Interest-based Negotiating. The best negotiators spend 75%90% of their time in the interest circle: clarifying interests identify and consider possibly options, maximize criteria with data. One way to uncover someone’s interests if they won’t share them with you is to tell them your assumptions as to what those interests are. Always measure the outcome vs. your walk-away alternatives (Best Alternative To A Negotiated Agreement). We can only take in a sub-set of all the data we are exposed to all the time. Then you give meaning to the data you select to recognized and then draw conclusions to it. Those conclusions become operating assumptions & over time those conclusions can become filters so no new data can come in. We all take in different subsets of data even within the same conversation. Most conversations are held at the conclusion-level with the other person through advocacy. To avoid this, use inquiry to drill down and understand what subset of data their assumptions & interests are based on. iv. 11:30 am – President Rod McLain Closing remarks v. 12:00- 5:00 pm – Afternoon Outings: Laguna Beach Tour Oak Creek Country Club Golf Outing Anti-Trust Statement While our meetings tend to be casual and creative, there is one area where we need to display self-control and caution, and that is with antitrust concerns. Federal law prohibits combinations, conspiracies, and agreements that restrain trade or competition in commerce. Trade associations are by their very nature a “combination”, since they consist of a group of competitors joined together for a common business purpose. Accordingly, associations must refrain from actions having anti-competitive potential. It is important to remember that there are many topics that you, as an individual, can discuss within your company that would not be appropriate to discuss here, together as a group. Examples of forbidden topics include: Specific current or future prices or rates charged by a particular company. However, it is permissible to discuss the average prices previously charged by a group of four or more companies. The price averages should be based on data that is more than three months old. Endorsements of particular companies or products to the exclusion of others. Discussions of this group should not encourage the boycotting or refusal to deal with certain companies or products or services. However, it is permissible to discuss your experiences with particular vendors or with other companies. Allocation of markets, territories or customers. Any action or understanding that limits competition or causes disadvantage to third parties. Everyone in these meetings needs to help insure that we observe and comply with these anti-trust guidelines. Thank you in advance for your help and cooperation!