Session 16: Corporate Strategy - Management Styles & Parenting

advertisement

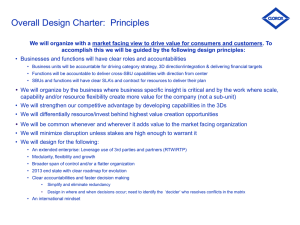

3H Strategy & International Business 2001/2002 Sessions 16 – Management Styles and Parenting In their book, "Strategies and Styles", their article "Adding Value from Corporate Headquarters" and their later articles, Goold and Campbell take a different route in addressing the question about the role of the corporate centre in a diversified corporation. They argue that there are many successful approaches to corporate strategy based upon management styles. Main determinants are the approaches taken to planning influence of the centre and the type of control influence exerted by the centre on the businesses within the group. From this they identify 3 generic stereotypes which companies tend to follow. There are other styles but most tend to converge upon one of these three generic styles. Each style is different in its approach, can offer different advantages to the corporation, but has different strengths and weaknesses. Financial Control Figure 9.11 Financial control CENTRE (Shareholder/banker) Targets ‘single line’ Capital bids Performance appraisal DIVISION / DEPARTMENT This style works when the businesses in the group are largely autonomous and the centre can act to improve performance in each business, often by turnaround of under-performing businesses, and ultimate disposal e.g. Hanson and Ever Ready; BTR; Tarmac. Strategic Planning Figure 9.10 Strategic planning CENTRE (Masterplanner) Masterplanner) Detailed budget Establishment Capital allocation Imposed services and infrastructure Procedures and rule-books DIVISION / DEPARTMENT Bargaining (item by item) This style is best suited to businesses that have important potential synergies between businesses, often requiring large, risky decisions and facing tough international competition. This means concentrating on one or two core businesses and divesting peripheral businesses - the fit between the businesses is critical e.g. Cadbury Schweppes; BOC; Lex; STC. Strategic Control Figure 9.12 Strategic control CENTRE (Strategic shaper) Overall strategy, Balance Optional services and infrastructure Agreed business plan Policies Capital allocations Performance assessment Short-term constraints(e.g. establishment) DIVISION/DEPARTMENT This style seems to require some homogeneity between the businesses in terms of their strategic characteristics so that the centre can have a good feel and understanding for each. However, there does not seem to be a need to concentrate upon just one business or industry, or even a closely related set of core businesses, provided that the diversity is not too great e.g. the demerger of ICI into ICI and Zeneca; Courtaulds. Which Style to Adopt? The portfolio approach (they call it financial control) can be successful, but other situations call for more interdependencies between business units, and hence a greater involvement for the corporate centre in co-ordinating activities (the strategic planning and strategic control styles). The key , argue Goold and Campbell is that managers need to understand the benefits and drawbacks of each style, its strengths and weaknesses, and being able to match the needs of the business to the right management style. Some of these key issues are summarised below in the next slide. Figure 9.9 Centre-division relationships Approach Key features Advantages Strategic planning ‘Masterplanner’ Co-ordination Top-down Highly prescribed Detailed controls Financial control ‘Shareholder/ Responsiveness Lose direction banker’ Centre does not Financial targets add value Control of investment Bottom-up BTR Hanson plc Tarmac Strategic control ‘Strategic shaper’ Strategic and financial targets Bottom-up Less detailed controls ICI Courtaulds Public sector post-1990 Centre/divisions complementary Ability to coordinate Motivation Dangers Examples Centre out of BOC touch Cadbury Divisions tactical Lex STC Public sector pre-1990s Too much bargaining Culture change needed New bureaucracies The Importance of Corporate Parenting In their article, "From Corporate Strategy to Parenting Advantage", Michael Goold and Andrew Campbell the parent company should not only add value to a new business unit, but add more value than any other potential parent - they call this parenting advantage. Some of the key questions that the parent needs to ask of its business units are summarised in the slide below: The Role and Purpose of the Corporate Parent Scope and Portfolio Issues what is the logic of the portfolio? what breadth and relatedness of products/SBUs ? products/SBUs? what geographical scope? Structure, control and parenting issues what is the most appropriate corporate structure what is the role of the centre in relation to SBUs? SBUs? how should the centre control SBUs? SBUs? what value does the centre add to SBUs? SBUs? The authors go on to suggest that the different SBUs can be broken down into a number of catagories, which reflect the relationship between the parent and the SBU, the benefits that the parent can provide, and the fit of the SBUs within the larger group. Corporate Parenting Heartland businesses: a fit between corporate and SBU strategic aspirations which the parent can help develop Ballast businesses: good strategic fit but not requiring help from the parent Value trap businesses: requiring help from the parent but with little fit between corporate and SBU aspirations Alien businesses: no strategic fit and no benefit from the parent The different business units can be plotted on a corporate parenting matrix as follows: Figure 6.7 The parenting matrix High Ballast SBUs Heartland SBUs Alien SBUs Value trap SBUs FIT BETWEEN SBU STRATEGY AND CORPORATE PURPOSE AND ASPIRATIONS Low Low High FIT BETWEEN SBU PARENTING NEEDS AND CORPORATE CAPABILITIES Source: Adapted from the parenting matrix in M. Goold, A. Campbelland M. Alexander, Corporate Level Strategy, Wiley, 1994. The implications of this parenting approach are that decisions on which SBUs to keep within the group depend not only on what the SBU contributes to the group, but also on what the corporate headquarters can contribute to the SBU. Even a “good” SBU may be divested if it is thought a better parent can be found for it. Approaches to Synergy and Management Styles Combined It can be argued that the approaches to the creation of synergy, covered last week, and the management styles outlined above are merely the flip sides of the same coin, one sets out the logic of how the corporation attempts to create value, the other the style of management needed to express such a logic. Approach Portfolio Management Style Financial Control Linkages Strategic Control Core Competences Strategic Planning Comments SBUs manage strategy against tight financial targets set by centre. Centre aims to provide a better investment performance. Portfolios can be very diverse. SBUs largely develop strategy but centre aims to co-ordinate plans and set fairly tight financial & strategic targets. Attempt to create links between businesses to create competitive advantage. Often group consists of 3 or 4 core businesses. Centre drives strategy around a theme (core competences). Businesses concentrate on implementation with centre strongly coordinating actions and creating linkages between units. The implications of this combination of approach to synergy and management styles, in what I term corporate management logic, will be explored further next week.