Corporate Strategy

advertisement

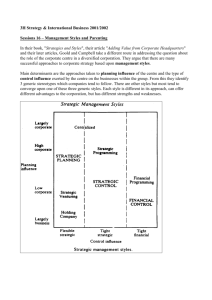

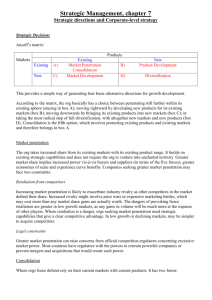

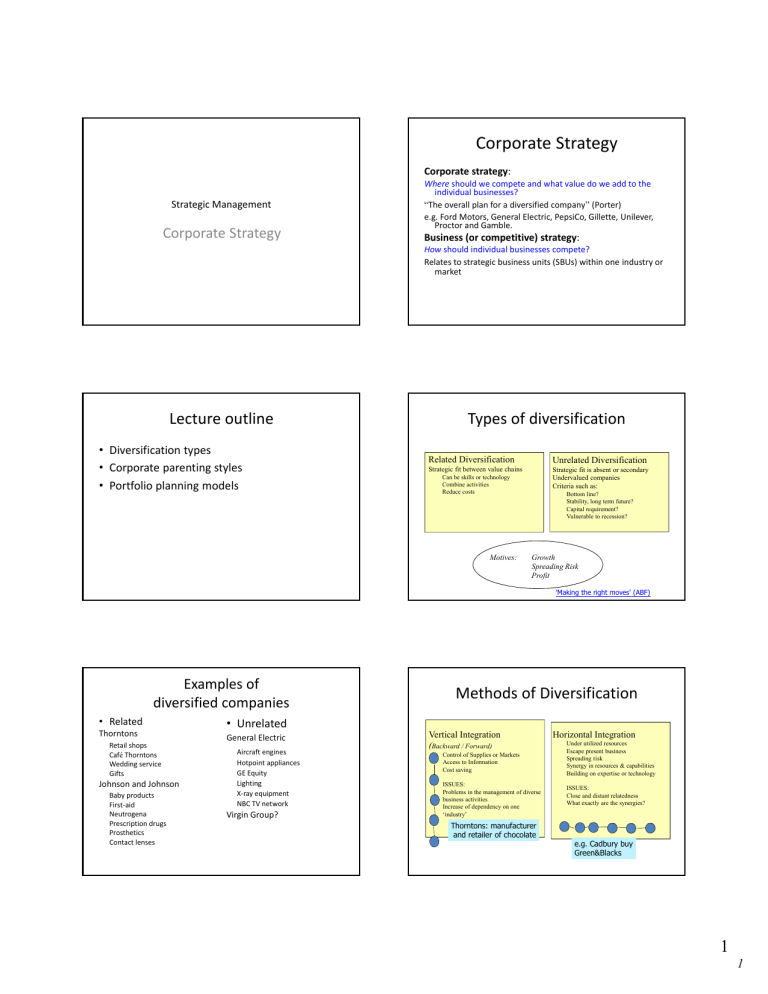

Corporate Strategy Corporate strategy: Strategic Management Corporate Strategy Where should we compete and what value do we add to the individual businesses? “The overall plan for a diversified company” (Porter) e.g. Ford Motors, General Electric, PepsiCo, Gillette, Unilever, Proctor and Gamble. Business (or competitive) strategy: How should individual businesses compete? Relates to strategic business units (SBUs) within one industry or market Lecture outline • Diversification types • Corporate parenting styles • Portfolio planning models Types of diversification Related Diversification Unrelated Diversification Strategic fit between value chains Strategic fit is absent or secondary Undervalued companies Criteria such as: Can be skills or technology Combine activities Reduce costs Motives: Bottom line? Stability, long term future? Capital requirement? Vulnerable to recession? Growth Spreading Risk Profit 'Making the right moves' (ABF) Examples of diversified companies • Related Thorntons Retail shops Café Thorntons Wedding service Gifts Johnson and Johnson Baby products First‐aid Neutrogena Prescription drugs Prosthetics Contact lenses Methods of Diversification • Unrelated General Electric Aircraft engines Hotpoint appliances GE Equity Lighting X‐ray equipment NBC TV network Virgin Group? Vertical Integration (Backward / Forward) Control of Supplies or Markets Access to Information Cost saving ISSUES: Problems in the management of diverse business activities Increase of dependency on one ‘industry’ Thorntons: manufacturer and retailer of chocolate Horizontal Integration Under utilized resources Escape present business Spreading risk Synergy in resources & capabilities Building on expertise or technology ISSUES: Close and distant relatedness What exactly are the synergies? e.g. Cadbury buy Green&Blacks 1 1 Conditions for adding value Corporate Parenting Styles (Goold and Campbell 1994) SYNERGY MANAGER PORTFOLIO MANAGER PARENTAL DEVELOPER RESTRUCTURER Parenting Matrix ‐ assessing fit High Ballast SBUs Heartland SBUs Fit between: SBU Critical Success Factors, and Parent’s skills, resources, characteristics Low • Room for improvement of SBU? • Can parent add anything that SBU can’t do better on its own? • Does parent understand Critical Success Factors? Adapted from Goold, Campbell & Alexander, Corporate Level Strategy, Wiley 1994 Alien SBUs Low Value trap SBUs How do corporate parents destroy value? • Add an extra layer of bureaucracy that delays decision‐making • Encourage ‘careerism’ in managers • Increase mistrust managers • Advise incorrect methods because don’t understand the industry • Force all businesses to follow the same strategic planning methods • Force synergy between businesses that doesn’t add any benefit High Fit between: SBU parenting opportunities, and Parent’s skills, resources, characteristics GE/McKinsey matrix Portfolio planning models - Evaluate business unit performance - Assess balance of the corporate portfolio - Formulate business unit objectives Models - GE/McKinsey matrix - BCG Growth-Share matrix (Boston Box) strong Industry Attractiveness Purpose Business unit position Medium weak high Medium low Popular in 1970s but not now (see Henry 2008, p243) 2 2 BCG Matrix (Boston Box) Portfolio planning models ‐ critique (See Henry 2008 p239) Annual real rate of market growth (%) HIGH LOW high stable, growing Earnings: low, unstable, growing Cash flow: neutral Cash flow: negative Strategy: invest for growth Strategy: analyze to determine whether business can be grown into a star, or will degenerate into a dog Earnings: high stable Cash flow: high stable Strategy: milk Earnings: HIGH Earnings: low, unstable Cash flow: neutral or negative Strategy: divest Relative market share ? • These models were popular in the 1970s/1980s but are now seen as over‐ simplifications • Assumes no linkages between businesses • Selling a ‘dog’ business could have negative consequences for remaining businesses LOW Conclusion References • Corporate parenting decisions are made at the highest level often involving 1000s of employees and $billions. • Perhaps there is no ‘formula’ for making the right decision because there are so many variables and a great deal of uncertainty. • Businesses that are up for sale tend to be overvalued – therefore difficult to recover the cost of purchase • Collis, D and Montgomery C (1998) ‘Creating Corporate Advantage’, Harvard Business Review, May‐June 1998, pp71‐83. • Goold et al (1995) ‘The quest for corporate parenting advantage’, Harvard Business Review, March‐April 1995, pp120‐132. • Grant, R (2005) Contemporary Strategy Analysis, Blackwell (fourth edition onwards) • Henry, A (2008) Understanding Strategic Management, OUP. • Johnson, Scholes and Whittington (2008) Exploring Corporate Strategy (8th edition) – (note 6th and 7th edition also useful) FTPH. • (note – the main authors in this area are Michael Goold, Andrew Campbell and Marcus Alexander) 3 3