INTERNATIONAL FINANCE

advertisement

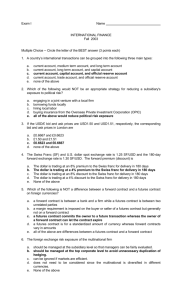

INTERNATIONAL FINANCE Assignment Problems (6) Name: Student#: I. Choose the correct answer for the following questions (only ONE correct answer) (3 credits for each question, total credits 3 x 20 = 60) 1. Which of the following is NOT true regarding forward contracts? A. The maturity of forward contracts is flexible. B. Forward contracts are traded both on organized exchanges and OTC market. C. Forward contracts are used to speculate the discrepancies of the exchange rates. D. The size of a forward contract is usually much larger than that of the futures or options. 2. Which of the following is NOT a contract specification for currency futures trading on an organized exchange? A. maturity date B. maintenance margin requirement C. size of the contract D. All of the above are specified 3. A futures contract is very similar to a forward contract, because __________. A. both are agreements between two parties to deliver relative currencies at a certain time for a certain price B. both are standardized contracts C. both can be used to eliminate the default risk D. both are required to physically deliver the underlying currency 4. If the amount in the margin account drops below the maintenance margin, the futures contract holder will __________. A. close out the contract B. be issued a margin call C. write a new contract D. notify the exchange 5. Which of the following is NOT a difference between a currency futures contract and a forward contract? A. The counterparty to the futures participant is unknown with the clearinghouse stepping into each transaction whereas the forward contract participants are in direct contact setting the forward specifications. B. A single sales commission covers both the purchase and sale of a futures contract whereas there is no specific sales commission with a forward contract because banks earn a profit through the bid-ask spread. C. The futures contract is marked to market daily whereas a forward contract is only due to be settled at maturity. D. All of the above are differences between a currency futures contract and a forward contract. 1 6. Assume that Citibank in New York quotes a 30-day forward rate on euro of $0.7533 while the Singapore International Monetary Exchange (SIMEX) euro futures for delivery in 30 days is being quoted at $0.7522. You can make a riskless profit by __________. A. taking a short position on euro in SIMEX euro futures contract and a long position on euro in the forward contract B. taking a long position on euro in SIMEX euro futures contract and a short position on euro in the forward contract C. taking a short position on dollar in SIMEX euro futures contract and a short position on dollar in the forward contract D. taking a long position on dollar in SIMEX euro futures contract and a long position on dollar in the forward contract 7. The main function of the “Marking to market” procedure comes down to __________. A. avoid default risk inherent in forward contracts B. cover risk exposure arisen from the international transactions C. protect the contract holders from suffering the loss D. all of the above 8. The buyer of a futures contract is required to put a sum of money in the exchange. This sum of money is called __________. A. down payment B. initial margin C. premium D. commission 9. When reading the futures quotation in the newspaper, the column heading indicating the number of contracts outstanding on the previous day is called __________. A. percentage change B. settle C. open interest D. estimated volume 10. A put option on Japanese yen is written with a strike price of ¥ 88/$. Which of the following spot rate maximizes your profit if you choose to execute the contract before maturity? A. ¥70/$ B. ¥80/$ C. ¥90/$ D. ¥100/$ 11. The agreed price in a currency option contract is called the __________. A. forward price B. futures price C. exercise price D. spot price 2 12. For a currency put option if the future spot rate is above the strike price, the option is said to be __________. A. in-the-money B. at-the-money C. out-of-the-money D. break-even 13. The writer of an option contract has __________ whereas the holder has __________. A. obligation; choice B. right; responsibility C. choice; obligation D. priority; privilege 14. Assume you bought a call option with the exercise price of $1.55/₤ in Chicago Mercantile Exchange on September 6. The contract would be expired in December. If the spot exchange rate was $1.50/₤ on October 10, the intrinsic value of this call option on that day would be __________. A. $0.05 B. -$0.05 C. $0 D. None of the above, because the contract doesn’t expire on October 10. 15. The foreign-currency accounts payable can be hedged by buying a __________ option on the foreign currency, whereas accounts receivable can be hedged by buying a __________ option on the foreign currency. A. call; put B. put; call C. American; European D. European; American 16. Mr. Bull tries to speculate on the direction of the entire stock market, the most efficient method he should use is to acquire __________. A. a stock index futures B. a portfolio containing stocks of all traded companies C. a currency forward contract D. a currency futures contract 17. The amount that the option purchaser must pay to obtain an option contract may be described as option __________. A. cost B. premium C. price D. All of the above 3 18. A Canadian dollar option quoted as “C$ Sep 9800 put” is selling on the CME at a price of $0.0026/C$. The size of the contract is C$100,000. Assume the spot exchange rate on the maturity day turns out to be $0.95/C$. You will have __________ if you hold 10 contracts. A. $30,000 net profit B. $30,000 net loss C. $27,400 net profit D. $27,400 net loss 19. A fixed-to-fixed currency swap is used to __________. A. hedge currency risk B. speculate discrepancies of the exchange rate C. make a riskless profit D. All of the above 20. Exxon and Chase Manhattan Bank reached an agreement. In the next two years, Exxon would pay fixed price of oil to Chase Manhattan Bank on June 30, and Chase Manhattan Bank would pay floating price of oil according to the spot price on the same day. This is an example of __________. A. fixed-for-floating currency swap B. commodity swap C. swaption D. equity swap II. Problems (40 Credits) 1. Samuel Samosir trades currencies for Peregrine Funds in Jakarta, Indonesia. He focuses nearly all of his time and attention on the U.S. dollar/Singapore dollar ($/S$) exchange rate. The current spot rate is $0.6000/S$. After considerable study this week, he has concluded that the Singapore dollar will appreciate versus the U.S. dollar in the coming 90 days, probably to about $0.7000/S$. He has the following options on the Singapore dollar to choose from: (3 credits for each question, total credits 3 x 5 = 15 credits) Option Put on S$ Call on S$ Strike Price $0.6500/S$ $0.6500/S$ Premium $0.00003/S$ $0.00046/S$ a. Should Samuel buy a put on Singapore dollars or a call on Singapore dollar? b. Using your answer to part a, what is Samuel’s break-even price? c. Using your answer to part a, what is Samuel’s gross profit and net profit (including the premium) if the spot rate at the end of the 90 days is indeed $0.7000/S$? 4 d. Using your answer to part a, what is Samuel’s gross profit and net profit (including the premium) if the spot rate at the end of the 90 days is indeed $0.8000/S$? e. Using your answer to part a, what is the contract’s time value at the end of the 90 days? 2. Jennifer Magnussen, a currency trader for Chicago-based Black River Investments, uses the futures quotes below on the British pound to speculate on its value: (5 credits for each question, total credits 4 x 3 = 12 credits) British Pound Futures, US$/pound (CME) Initial margin: $2,500/contract Maintenance margin: $1,250 Maturity March June Open High 1.4246 1.4268 1.4164 1.4188 Low Settle Change 1.4214 1.4146 1.4228 1.4162 .0032 .0030 Contract = 62,500 pounds High Low 1.4700 1.3810 1.4550 1.3910 Open Interest 25,605 809 a. If Jennifer buys 5 June pound futures right after CME opens, and the spot rate at maturity is $1.3980/pound, what is the value of her position? b. If Jennifer sells 12 March pound futures with the opening quote, and the spot rate at maturity is $1.4560/pound, what is the value of her position? c. If Jennifer buys 10 June pound futures at $1.3500/₤ in the early afternoon, and the closing rate at the end of the day is $1.3246/pound instead of $1.4162/pound, what will happen? Explain. 3. You head the currency trading desk at Bearings Bank in London. As the middleman in a deal between the U.K. and Danish government, you have just paid ₤1,000,000 to the U.K. government and have been promised DKr8,438,000 from the Danish government in three months. All else constant, you wouldn’t mind leaving this long krone position open. However, next month’s referendum in Denmark may close the possibility of Denmark joining the European Union. If this happens, you expect the 5 krone to drop on world markets. As a hedge, you are considering purchasing a call option on pounds sterling with an exercise price of DKr8.4500/₤ that sells for DKr0.1464/₤. (13 credits total) a. Fill in the call option values at expiration the following table. (3 credits) Spot rate at expiration (DKr/₤): 8.00 8.40 8.42 8.44 8.46 8.48 Call value at expiration (DKr/₤): b, Based on the previous information, draw the payoff profile for a long krone put option at expiration. Note that these exchange rates are reciprocals of those in problem a. (3 credits) Spot rate at expiration (₤/DKr) .12500 .11905 .11876 .11848 .11820 .11792 Put value at expiration (₤/DKr) c. Label your axes and plot each of the points. Draw a profit/loss graph for this long krone put at expiration. (7 credits) 6 Answers to Assignment (6) I. (60 credits) 1. B 2. D 3. A 4.B 5. D 6. B 7. A 8. B 9. C 10. A 11. C 13. A 14. C 15. A 16. A 17. D 18. C 19. A 20.B II. (40 credits) 1. Option problem a. Samuel should buy a call on Singapore dollar. b. Break-even exchange rate for a call option = strike price + premium = 0.6500 + 0.00046 = $0.65046/S$ c. Gross profit = 0.7000 – 0.6500 = $0.05 Net profit = 0.7000 – 0.65046 = $0.04954 d. Gross profit = 0.8000 – 0.6500 = $0.15 Net profit = 0.8000 – 0.65046 = $0.14954 e. time value = 0, no time value when the contract expires. 12. C 2. Futures problem a. Jennifer’s loss = (1.3980 – 1.4164) x (62,500) x 5 = -$5,750 Value of her position: (2,500 x 5) – 5,750 = $12,500 – 5,750 = $6,750 b. Jennifer’s loss = (1.4246 – 1.4560) x (62,500 x 12 = -$23,550 Value of her position: (2,500 x 12) – 23,550 = $30,000 – 23,550 = $6,450 c. Jennifer’s margin account at the end of the day drops to: (1.3246 – 1.3500) x (62,500) x 10 = -$15,875 + 25,000 = $9,125 Jennifer will receive a margin call from the exchange which is 12,500 – 9,125 = $3,375 Jennifer should bring $3,375 more to meet the maintenance margin requirement. 3. Option profile a. Spot rate at expiration (DKr/₤): 8.00 8.40 8.42 8.44 8.46 8.48 Call value at expiration (DKr/₤): 0 0 0 0 0.01 0.03 DKr/₤ DKr/₤ Call option intrinsic value at the expiration = (S –K ) b. Spot rate at expiration (₤/DKr) .12500 .11905 .11876 .11848 .11820 .11792 Put value at expiration (₤/DKr) 0 0 0 0 0.000143 0.000423 DKr/₤ Put option intrinsic value at the expiration = (K – SDKr/₤) c. K = ₤0.118343/DKr Option premium (x): 0.1464/8.45 = x/0.118343 x = ₤0.002050/DKr Premium cost = 0.002050 x 8,438,000 = ₤17,298 Cost of exercise = 0.118343 x 8,438,000 = ₤998,578. Profit/Loss profile Break-even price = 0.11834 – 0.00205 = ₤0.11629/DKr If spot exchange rate at expiration is 0.11610, net profit: (0.11629 – 0.11610) x 8,438,000 = ₤1,603 7 If spot exchange rate at expiration is 0.118343 or below, net loss Premium cost ₤17,297.90 Putt₤/DKr ₤1,603 A Break-even S₤/DKr K 0 0.11610 0.11629 0.11834 0.11848 0.11905 -₤17,298 8