Krzys’ Ostaszewski, http://www.math.ilstu.edu/krzysio/, Exercise 95, 3/10/7

Author of a study manual for exam FM available at:

http://smartURL.it/krzysioFM (paper) or http://smartURL.it/krzysioFMe (electronic)

Instructor for online seminar for exam FM: http://smartURL.it/onlineactuary

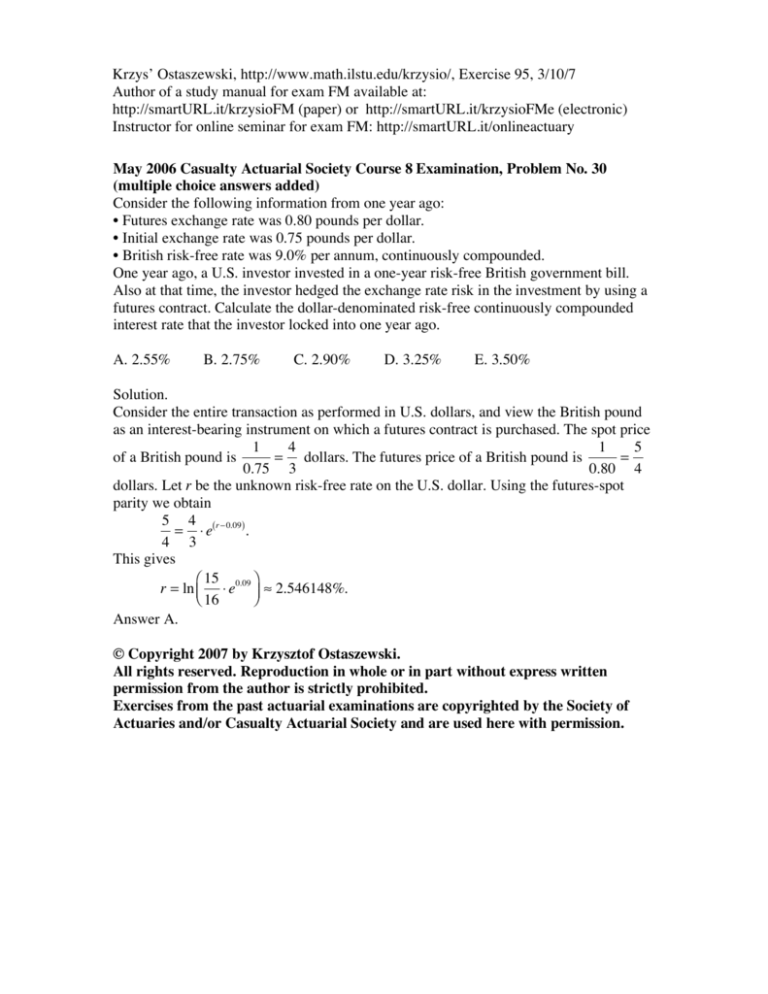

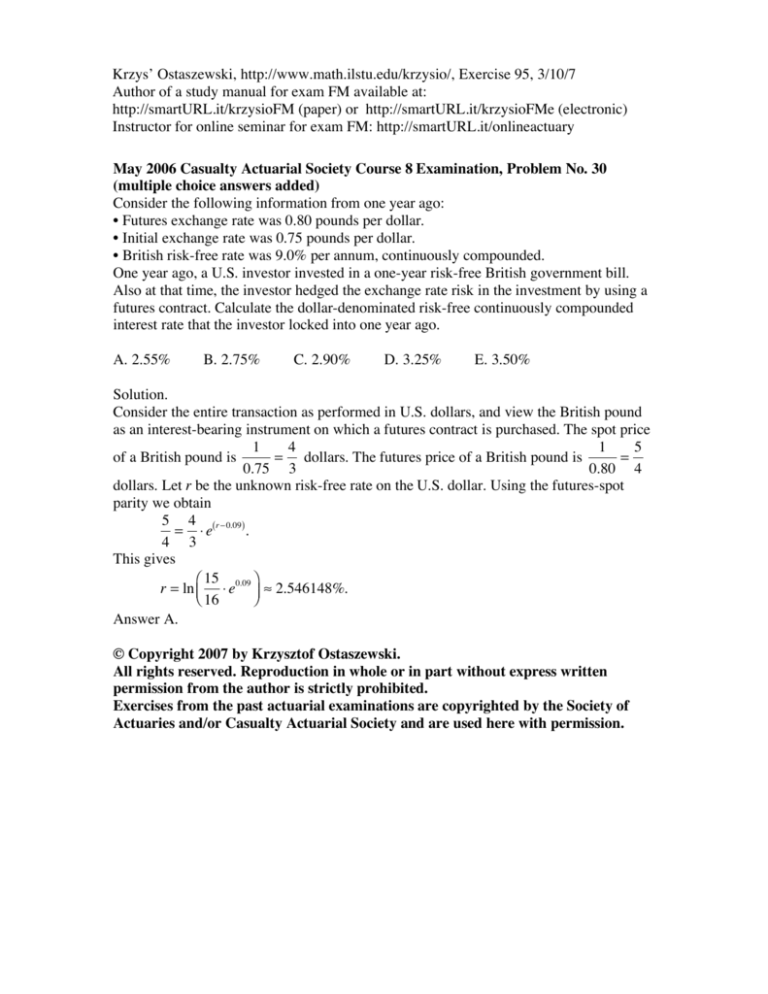

May 2006 Casualty Actuarial Society Course 8 Examination, Problem No. 30

(multiple choice answers added)

Consider the following information from one year ago:

• Futures exchange rate was 0.80 pounds per dollar.

• Initial exchange rate was 0.75 pounds per dollar.

• British risk-free rate was 9.0% per annum, continuously compounded.

One year ago, a U.S. investor invested in a one-year risk-free British government bill.

Also at that time, the investor hedged the exchange rate risk in the investment by using a

futures contract. Calculate the dollar-denominated risk-free continuously compounded

interest rate that the investor locked into one year ago.

A. 2.55%

B. 2.75%

C. 2.90%

D. 3.25%

E. 3.50%

Solution.

Consider the entire transaction as performed in U.S. dollars, and view the British pound

as an interest-bearing instrument on which a futures contract is purchased. The spot price

1

1

4

5

of a British pound is

= dollars. The futures price of a British pound is

=

0.75 3

0.80 4

dollars. Let r be the unknown risk-free rate on the U.S. dollar. Using the futures-spot

parity we obtain

5 4 ( r " 0.09 )

= !e

.

4 3

This gives

" 15

%

r = ln $ ! e0.09 ' ( 2.546148%.

# 16

&

Answer A.

© Copyright 2007 by Krzysztof Ostaszewski.

All rights reserved. Reproduction in whole or in part without express written

permission from the author is strictly prohibited.

Exercises from the past actuarial examinations are copyrighted by the Society of

Actuaries and/or Casualty Actuarial Society and are used here with permission.