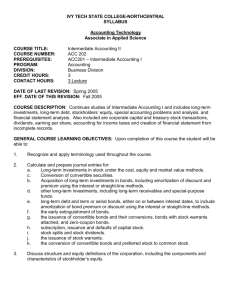

EBA.202

advertisement

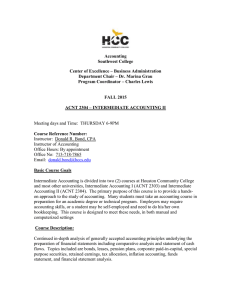

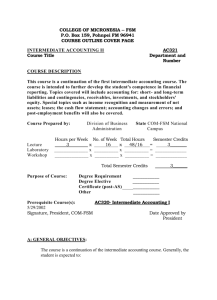

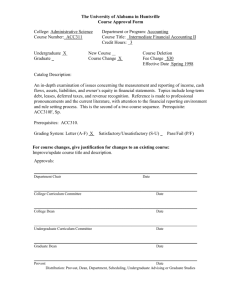

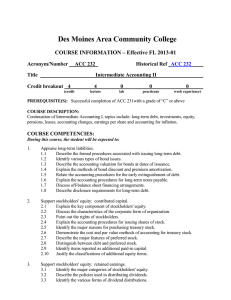

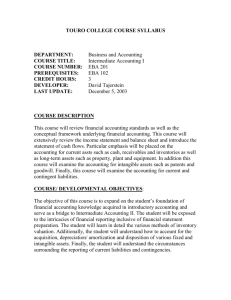

TOURO COLLEGE COURSE SYLLABUS DEPARTMENT: Business and Accounting COURSE TITLE: Intermediate Accounting II COURSE NUMBER: EBA 202 PREREQUISITES: EBA 201 CREDIT HOURS: 3 DEVELOPER: David Tajerstein LAST UPDATE: December 5, 2003 COURSE DESCRIPTION This course will focus on the accounting for long-term debt, leases, pensions, investments and income taxes. In addition, this course will review in great detail the stockholders equity section of the balance sheet, inclusive of earnings per share calculations. Finally, this course will examine the issues of revenue recognition and the treatment of various accounting changes and errors. COURSE DEPARMENTAL OBJECTIVES The objective of this course is to expand on the student’s knowledge of financial accounting acquired in Intermediate Accounting I and serve as a bridge to Advanced Accounting. The student will be exposed to the intricacies of the stockholder’s equity section of the balance sheet, inclusive of earnings per share considerations. Moreover, the student will learn how to recognize and treat accounting errors and changes as they occur. Addition, the student will be exposed to and learn how to approach complex financial accounting areas such as leases, pensions, investments, accounting for income taxes and long term debt. Finally, the student will learn to deal with various issues surrounding revenue recognition. COURSE INSTITUTIONAL OBJECTIVES This course is intended to augment the students’ knowledge of Financial Accounting while preparing them to deal with the types of accounting issues they will be exposed to while employed in the public or private accounting sector. In addition this course will aid in the students Preparation to successfully complete the financial accounting of the Uniform CPA Examination. The successful completion of all four parts of the Uniform CPA Examination is an institutional goal that this course is designed to assist in accomplishing. COURSE CONTENT Long-Term Debt The first part of this course deals with the accounting for long-term debt. First the course looks at the issuance of notes in exchange for good and services, in particular the treatment of non-interest bearing instruments. To finish this area the course will examine the area of bonds. The accounting for the issuance of bonds at a premium or discount will be discussed in detail. Finally, amortization of premiums and discounts via the effective interest method will be studied. Stockholders Equity The second part of this course will focus in great detail on the stockholders section of the balance sheet. It will deal with the issuance of common and preferred stock, the repurchase of stock as treasury stock, the accounting for various dividends, and earning-per-share calculations. Investments The third part of the course deals with investment accounting. In particular the course will examine the equity method or accounting for investments as well as the fair value method (FASB # 115) Revenue Recognition The fourth part of the course will examine revenue recognition. Specific topics will include construction accounting as well as the installment sales method of accounting. Income Taxes, Leases and Pension The fifth part of the course will explore three topics that are generally introduced here for the firs time in a students accounting education. Accounting for income taxes discusses the provision for income taxes (both the current and deferred portion) in the income statement as well as the presentation of deferred tax assets and liabilities in the balance sheet. The topic of leases examines the distinction between operating leases and capital leases. The course will focus on lesson and lessees accounting with emphasis placed on the latter. Finally, the area of pension accounting will be introduced. Particular attention will be paid to the components of pension expense as well as the calculation of minimum pension liability. HARDWARE/ SOFTWARE/ MATERIAL REQUIREMENT Not Applicable COURSE REQUIREMENTS Students must read assigned chapters in textbook Students must complete homework assignments Students must attend class and participate in classroom discussion Students must take an exams GRADING QUIDELINES: Midterm Examination 45% Final Examination 50% Homework, Attendance Class Participation 5% 100% METHODOLOGY: The course should be carried out via lecture with in-class reference to pertinent illustrations and case studies in the textbook .The lectures should be enhanced but introducing curr3ent developments in the accounting profession, including recently released accounting principles and practices published by authoritative bodies. COURSE TEXT Kieso, Weygandt, Warfield, Intermediate Accounting 11th ed., Wiley, 2003 ISBN# 047107208 BIBLIOGRAPHY Journal of Accountancy – monthly by AICPA www.aicpa.org www.fasb.org Dyckman, Dukes, and Davis, Intermediate Accounting 5th ed., Mcgraw Hill, 2001, ISBN# 0072508051. Spiceland, Sipe, & Tommassini: Inermediate Accounting 3rd Ed. Intermediate Accounting, Eighth edition, By Nikolai & Bazley Intermediate Accounting, by Skousen, and Stice, 15th edition, ITP. South Western Publishing Co.