Des Moines Area Community College COURSE INFORMATION – Effective FL 2013-01

advertisement

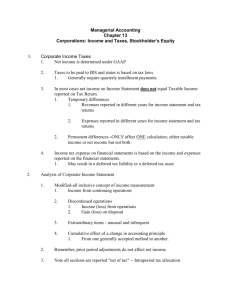

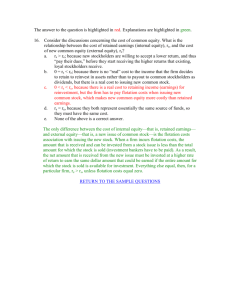

Des Moines Area Community College COURSE INFORMATION – Effective FL 2013-01 Acronym/Number ACC 232 Title Historical Ref ACC 232 Intermediate Accounting II Credit breakout 4 (credit 4 0 0 0 lecture lab practicum work experience) PREREQUISITE(S): Successful completion of ACC 231with a grade of “C” or above COURSE DESCRIPTION: Continuation of Intermediate Accounting I, topics include: long-term debt, investments, equity, pensions, leases, accounting changes, earnings per share and accounting for inflation. COURSE COMPETENCIES: During this course, the student will be expected to: 1. Appraise long-term liabilities. 1.1 Describe the formal procedures associated with issuing long-term debt. 1.2 Identify various types of bond issues. 1.3 Describe the accounting valuation for bonds at dates of issuance. 1.4 Explain the methods of bond discount and premium amortization. 1.5 Relate the accounting procedures for the early extinguishment of debt. 1.6 Explain the accounting procedures for long-term notes payable. 1.7 Discuss off-balance sheet financing arrangements. 1.8 Describe disclosure requirements for long-term debt. 2. Support stockholders' equity: contributed capital. 2.1 Explain the key component of stockholders' equity. 2.2 Discuss the characteristics of the corporate form of organization. 2.3 Point out the rights of stockholders. 2.4 Explain the accounting procedures for issuing shares of stock. 2.5 Identify the major reasons for purchasing treasury stock. 2.6 Demonstrate the cost and par value methods of accounting for treasury stock. 2.7 Describe the major features of preferred stock. 2.8 Distinguish between debt and preferred stock. 2.9 Identify items reported as additional paid-in capital. 2.10 Justify the classifications of additional equity items. 3. Support stockholders' equity: retained earnings. 3.1 Identify the major categories of stockholders' equity. 3.2 Describe the policies used in distributing dividends. 3.3 Identify the various forms of dividend distributions. ACC 232 3.4 3.5 3.6 3.7 3.8 3.9 Point out the accounting for small and large dividends. Distinguish between stock dividends and stock splits. Explain the effect of different types of preferred stock dividends. Assess the reasons for appropriating retained earnings. Explain accounting and reporting for appropriated retained earnings. Prepare a statement of changes in stockholders' equity. 4. Assess dilutive securities and earnings per share. 4.1 Describe the accounting for the issuance, conversion and retirement of convertible securities. 4.2 Explain the accounting for convertible preferred stock. 4.3 Contrast the accounting for stock warrants and stock warrants issued with other securities. 4.4 Differentiate between compensatory and noncompensatory stock compensation plans. 4.5 Describe the accounting for various types of stock based compensation plans. 4.6 Identify the conceptual issues involved with stock compensation plans. 4.7 Compute earnings per share in a simple capital structure. 4.8 Explain the concept of a dual presentation. 4.9 Distinguish the "cash yield test" and "if converted" method. 4.10 Point out the treasury stock method. 4.11 Explain the disclosures and presentation of earnings per share. 5. Interpret temporary and long-term investments. 5.1 Describe the accounting for temporary marketable equity and marketable debt securities. 5.2 Explain the disclosure requirements for temporary investments. 5.3 Describe the accounting for long-term investments in bonds. 5.4 Assess the methods of amortization for bond premium and discount. 5.5 Explain the effect of ownership interest on the accounting for long-term investments in stock. 5.6 Assess the cost, equity, and lower of cost or market methods for long-term investments in stock. 5.7 Discuss special issues related to investments. 5.8 Demonstrate the accounting for cash surrender value. 5.9 Identify and explain the accounting for funds. 6. Appraise revenue recognition. 6.1 Review the revenue recognition principle. 6.2 Describe accounting issues involved with revenue recognition at point of sale. 6.3 Illustrate the percentage-of-completion method for long-term contracts. 6.4 Illustrate the completed-contract method for long-term contracts. 6.5 Produce the proper accounting for losses on long-term contracts. 6.6 Produce alternative revenue recognition bases before delivery. 6.7 Describe the installment method of accounting. 6.8 Explain the cost recovery method of accounting. 7. Explain accounting for income taxes. ACC 232 7.1 7.2 7.3 7.4 7.5 7.6 7.7 7.8 7.9 7.10 7.11 Identify differences between taxable income and pretax financial income. Describe taxable amounts and the recognition of a deferred tax liability. Describe deductible amounts and the recognition of a deferred tax asset. Explain the purpose of a deferred tax asset valuation account. Illustrate the presentation of income tax expense in the income statement. Categorize various temporary and permanent differences. Explain the effect of various tax rates and tax rate changes on deferred income taxes. Illustrate accounting procedures for a loss carryback and a loss carryforward. Describe the presentation of deferred income taxes in financial statements. Identify special issues related to deferred income taxes. Relate the basic principles of the asset-liability approach. 8. Measure pensions and retirement benefits. 8.1 Identify types of pension plans and their characteristics. 8.2 Distinguish between accounting for employer's pension plan and accounting for the pension fund. 8.3 Explain alternative measures for valuing the pension obligation. 8.4 Identify the components of pension expense. 8.5 Develop a facility to utilize a worksheet to develop employer's pension plan entries. 8.6 Describe the amortization of unrecognized prior service costs. 8.7 Illustrate the accounting procedures for recognizing unexpected gains and losses. 8.8 Illustrate the corridor approach to amortizing unrecognized gains and losses. 8.9 Explain the recognition of a minimum liability. 8.10 Describe the reporting requirements for pension plans in financial statements. 9. Assess leases. 9.1 Explain the nature, economic substance, and advantages of lease transactions. 9.2 Describe the accounting criteria and procedures for capitalizing leases by the lessee. 9.3 Compare the operating and capitalization methods of recording leases. 9.4 Identify the classifications of leases for the lessor. 9.5 Describe the lessor's accounting for direct-financing leases. 9.6 Identify special features of lease arrangements that cause unique accounting problems. 9.7 Categorize the effect of residual value, guaranteed and unguaranteed, on lease accounting. 9.8 Describe the lessor's accounting for sales-type leases. 9.9 Demonstrate the lessee's accounting for sale-leaseback transactions. 9.10 Describe the disclosure requirements for leases. 10. Support accounting changes and error analysis. 10.1 Identify the types of and justifications for accounting changes. 10.2 Explain the accounting for changes in accounting principles. 10.3 Explain the accounting for changes in estimates. 10.4 Identify changes in a reporting entity. 10.5 Describe the accounting for correction of errors. ACC 232 10.6 10.7 11. Identify economic motives for changing accounting methods. Explain the effect of errors. Defend the statement of cash flows. 11.1 Describe the evolution and purpose of the statement of cash flows. 11.2 Identify the major classifications of cash flows. 11.3 Differentiate between net income and net cash flows from operating activities. 11.4 Contrast the direct and indirect methods of calculating net cash flow from operating activities. 11.5 Discriminate net cash flows from investing and financing activities. 11.6 Prepare a statement of cash flows. 11.7 Describe sources of information for a statement of cash flows. 11.8 Identify special problems in preparing a statement of cash flows. 11.9 Explain the use of a worksheet in preparing a statement of cash flows. ACC 232 COMPETENCIES REVIEWED AND APPROVED BY: Cynthia McCall DATE: December 2011 FACULTY: 1. Rebecca Brown 2. Brad Smith 3. Patty Holms 4. Tim Prindle 5. Cheri Hernandez 6. Marcia Sandvold 7. Cynthia McCall COMPETENCIES REVIEWED AND APPROVED BY: Cynthia McCall DATE: November, 2007 FACULTY: 1. Rebecca Brown 2. Brad Smith 3. Patty Holms 4. Tim Prindle 5. Cheri Hernandez 6. Marcia Sandvold 7. Cynthia McCall Effective date: August 2012 Originated by: Cynthia McCall Campus: extension: Revision(s): A B C U N W OC 8320 7/99; 1/06; 12/11