file

advertisement

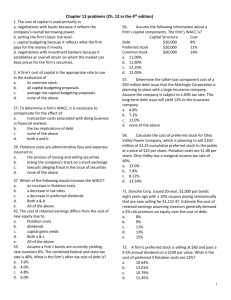

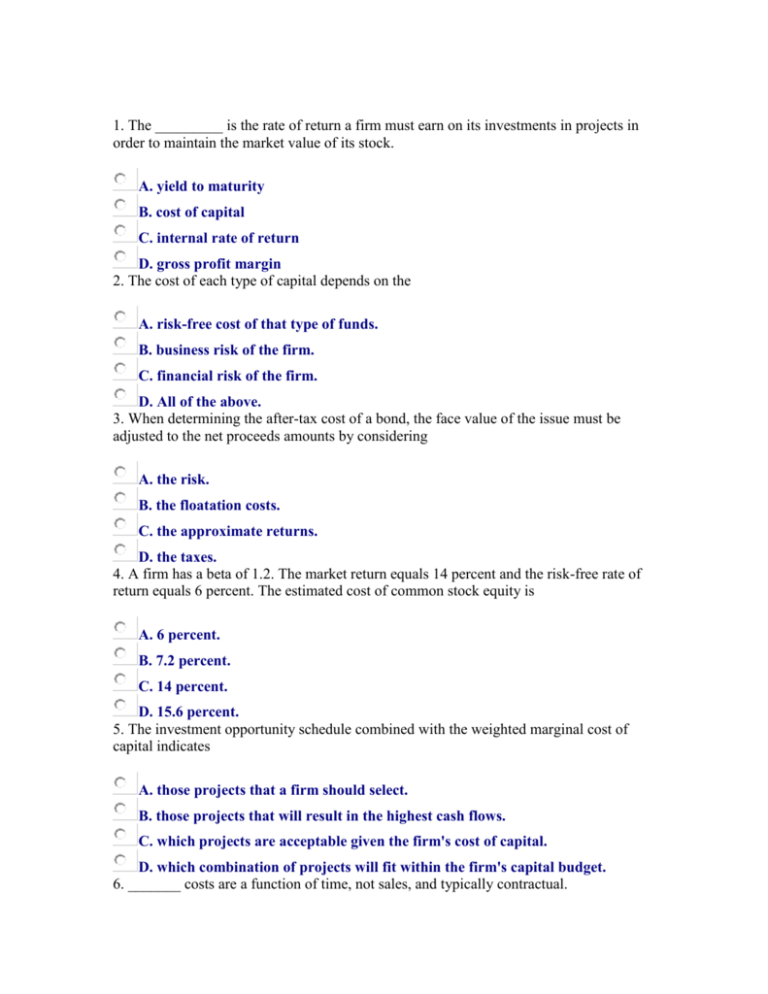

1. The _________ is the rate of return a firm must earn on its investments in projects in order to maintain the market value of its stock. A. yield to maturity B. cost of capital C. internal rate of return D. gross profit margin 2. The cost of each type of capital depends on the A. risk-free cost of that type of funds. B. business risk of the firm. C. financial risk of the firm. D. All of the above. 3. When determining the after-tax cost of a bond, the face value of the issue must be adjusted to the net proceeds amounts by considering A. the risk. B. the floatation costs. C. the approximate returns. D. the taxes. 4. A firm has a beta of 1.2. The market return equals 14 percent and the risk-free rate of return equals 6 percent. The estimated cost of common stock equity is A. 6 percent. B. 7.2 percent. C. 14 percent. D. 15.6 percent. 5. The investment opportunity schedule combined with the weighted marginal cost of capital indicates A. those projects that a firm should select. B. those projects that will result in the highest cash flows. C. which projects are acceptable given the firm's cost of capital. D. which combination of projects will fit within the firm's capital budget. 6. _______ costs are a function of time, not sales, and typically contractual. A. Fixed B. Semi-variable C. Variable D. Operating 7. As fixed operating costs increase and all other factors are held constant, the degree of operating leverage will A. increase. B. decrease. C. remain unchanged. D. change in an undetermined direction. 8. A corporation borrows $1,000,000 at 10 percent annual rate of interest. The firm has a 40 percent tax rate. The yearly, after-tax cost of this debt is A. $40,000. B. $60,000. C. $100,000. D. $166,667. 9. A corporation has $10,000,000 in 10 percent preferred stock outstanding and a 40 percent tax rate. The amount of earnings before interest and taxes (EBIT required to pay the preferred dividends is A. $1,000,000. B. $400,000. C. $600,000. D. $1,666,667. 10. The conflict resulting from a manager's desire to increase the firm's risk without increasing current borrowing costs and lenders' desire to limit lending is one effect of the _______ problem. A. agency B. leverage C. capital D. variable cost 11. In order to enhance the wealth of stockholders and to send positive signals to the market, corporations generally raise funds using the following order: A. retained earnings, equity, debt. B. retained earnings, debt, equity. C. debt, retained earnings, equity. D. equity, retained earnings, debt 12. As debt is substituted for equity in the capital structure and the debt ratio increases, the behavior of the overall cost of capital is partially explained by A. the tax-deductibility of interest payments. B. the increase in the number of common shares outstanding. C. the reduction in risk as perceived by the common shareholders. D. the decrease in the cost of equity. 13. The major shortcoming of the EBIT-EPS approach to capital structure is that A. the technique does not promote the maximization of shareholder wealth. B. the technique does not consider the cost of capital C. the technique only considers leverage-related risk. D. the technique does not maximize earnings per share. 14. At a firm's quarterly dividend meeting held April 9, the directors declared a $.50 per share cash dividend for the holders of record on Monday, May 1. The firm's stock will sell ex-dividends on A. April 9 B. May 5 C. April 25 D. April 27 15. Paying a stock dividend ____________ the retained earnings account. A. decreases B. has no effect on C. increases D. reorganizes 16. Dividend policy is a form of A. capital budgeting policy B. financing policy C. working capital policy D. dividend reinvestment policy 17. A firm has current after-tax earnings of $1,000,000 and has declared a cash dividend of $400,000. The firm's dividend payout ration is A. 2.5% B. 2.0 percent C. 4.0 percent D. 40 percent 18. A stock split has __________ effect on the firm's capital structure. A. little B. no C. a measurable D. a detrimental 19. The repurchase of stock __________ the earnings per share and __________ the market price of stock. A. increases, increases B. decreases, decreases C. increases, decreases D. decreases, increases. 20. The purpose of a stock split is to A. issue additional shares B. increase the dividend C. reduce the price of the stock D. reduce trading activity Reset