31 - JustAnswer

advertisement

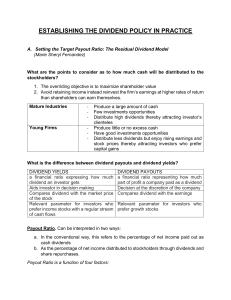

31. Pecking Order Theory. Alpha Corp. and Beta Corp. both produce turbo encabulators. Both companies’ assets and operations are growing at the same rate, and their annual capital expenditures are about the same. However, Alpha Corp. is the more efficient producer and is consistently more profitable. According to the pecking order theory, which company should have the higher debt ratio? Explain. Alpha Corp is more profitable and is therefore able to rely to a greater extent on internal finance (retained earnings) as a source of capital. It will therefore have less dependence on debt, and the lower debt ratio. 19. Dividend Policy. Here are several assertions about typical corporate dividend policies. Which of them are true? Write out a corrected version of any false statements. a. Most companies set a target dividend payout ratio. True. b. They set each year’s dividend equal to the target payout ratio times that year’s earnings. False. Firms smooth out dividends and do not maintain a strict proportional relationship between current earnings and dividends. They move dividends only part of the way toward the target payout ratio when earnings change. c. Managers and investors seem more concerned with dividend changes than dividend levels. True d. Managers often increase dividends temporarily when earnings are unexpectedly high for a year or two False. Firms seem reluctant to reduce dividends and therefore do not increase dividends in response to earnings increases that are not expected to persist, or that are not expected to be representative of long-run earnings prospects.