Chapter 14 - Thorsteinssons LLP Tax Lawyers

advertisement

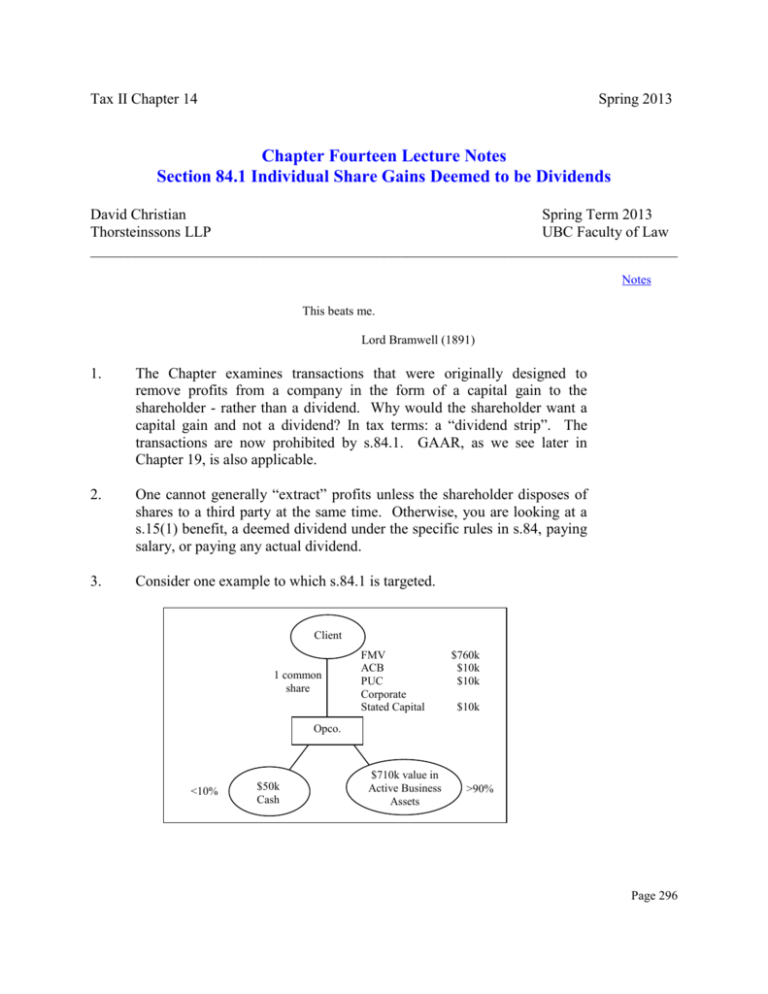

Tax II Chapter 14 Spring 2013 Chapter Fourteen Lecture Notes Section 84.1 Individual Share Gains Deemed to be Dividends David Christian Spring Term 2013 Thorsteinssons LLP UBC Faculty of Law ______________________________________________________________________________ Notes This beats me. Lord Bramwell (1891) 1. The Chapter examines transactions that were originally designed to remove profits from a company in the form of a capital gain to the shareholder - rather than a dividend. Why would the shareholder want a capital gain and not a dividend? In tax terms: a “dividend strip”. The transactions are now prohibited by s.84.1. GAAR, as we see later in Chapter 19, is also applicable. 2. One cannot generally “extract” profits unless the shareholder disposes of shares to a third party at the same time. Otherwise, you are looking at a s.15(1) benefit, a deemed dividend under the specific rules in s.84, paying salary, or paying any actual dividend. 3. Consider one example to which s.84.1 is targeted. Client 1 common share FMV ACB PUC Corporate Stated Capital $760k $10k $10k $10k Opco. <10% $50k Cash $710k value in Active Business Assets >90% Page 296 Tax II Chapter 14 Spring 2013 Say the after-tax profit each year in Opco is $50. Client expects 15 years of after-tax profits $50k, which would total $750k. Client wants the $50k each year as a capital gain, and is prepared to take a $750k capital gain this year to get $750k cash tax-free over the next 15 years. The Client knows about the $750k capital gain exemption for QSBC Shares. “Why not sell the one common share in Opco to my new holding company for $760k?” Consider then: Holdco buys Opco for $760k cash. The bank funds the $750k in a “daylight loan”. $760k Loan $760k repay Client common share $760k purchase price cash Bank $760k loan Holdco FMV ACB PUC Corporate Stated Capital one common share $760k $760k $10k $10k Opco $50k $710k Active Business Assets The Client thinks: “I have an immediate capital gain on the sale of Opco shares”. Opco Common Share Cash Proceeds $760k ACB (10k) Capital Gain $750k Page 297 Tax II Chapter 14 Spring 2013 “Furthermore, I can shelter this $750k gain with my $750k capital gain exemption for QSBC Shares, right?” Section 84 does not apply, because the transaction is not between the Client and Opco. The transaction is between the Client and Holdco, a third party. Opco is not involved as a party. The Client thinks: “Now, I can extract profits from Opco tax-free, right?” How? The transaction has set up the future extraction of profits out of Opco without tax. Client $760k loan $760k as repayment of loan Holdco dividends (s.112 deduction, no Part IV tax) Opco Cash Active Business Assets Up to $760k of after-tax profits in Opco, taxed at 13.5% (Chapter 3), can be paid to the Client free of any more tax? Opco can pay tax-free intercorporate dividends to Holdco, which can then repay the shareholder loan from the Client. The shareholder loan has a tax cost equal to its value, so no tax. The Client has used the $750k capital gain exemption to effectively shelter tax on future distributions from Opco, through Holdco, up to $750k in our example, which would otherwise have been taxable dividends out of Opco’s after-tax profits to the Client personally. (The difference between $760k and $750k was $10k of tax PUC and ACB, which could have been extracted from Opco before this transaction under s.84 in any event.) Page 298 Tax II Chapter 14 Spring 2013 Has the Client succeeded? If you stop at s.84, the answer is yes. Read s.84.1. Imagine reading s.84.1 without any context. 4. Section 84.1(1), as applied to the Client: First, the preamble, which sets the preconditions: a taxpayer other than a corporation (i.e., and individual), disposes of shares that are capital property (these are the “subject shares”), the subject shares are shares of a corporation resident in Canada (this is the “subject corporation”), the shares are disposed of to another corporation (this is the “purchaser corporation”), the taxpayer “does not deal at arm’s length with” the purchaser corporation (read s.251(1) again), and, immediately after the transfer, the subject corporation is “connected with” purchaser corporation “within the meaning assigned by s.186(4)”. Read s.186(7). If these preconditions are met, paragraph (a) and (b) will apply. Look at paragraph (b) first. a dividend is deemed paid to the Client by the purchaser corporation (Holdco, in our example) in a formula amount = (A + D) – (E + F). Look at A, D, E & F separately: A is zero. No “new shares” of the purchaser corporation have been issued as consideration. (We come back to this for paragraph (a) below.) Page 299 Tax II Chapter 14 Spring 2013 F is zero. (We come back to this for paragraph (a) as well below.) left with “D minus E”, D is the “non-share consideration” received on the sale. $760k cash E is greater of: the tax PUC of the subject shares (Opco shares), “subject to s.84.1(2)(a) & (a.1)”, discussed below, the ACB to the Client of the subject shares (Opco shares). So “D minus E” is in this case is $760k - $10k = $750k. This amount is deemed to be a dividend paid by Holdco to the Client. This is taxable just as much as any other dividend the Client might receive, at a top rate of 33.71%, assuming the dividend is not an eligible dividend (Chapter 5). What happened to the capital gain of $750k the Client thought had been realized, and sheltered by the exemption? Look, again, at the definition of “proceeds of disposition” in s.54: paragraph (k). “Proceeds” does not include an amount that is deemed by s.84.1 to be a dividend. The proceeds are $10k ($760k less $750k). So, bad news for the Client. You pay tax (plus reassessment interest) on a $750k dividend, and do not have a tax-exempt capital gain on QSBC Shares. Consider Willis Louis Insurance Ltd. company. Same numbers as above. Sale by father to son’s new Page 300 Tax II Chapter 14 Spring 2013 Son Holdco Father Bank Sale Opco Active Business 5. A “substantive business sale”, within the family, can trigger s.84.1 dividends. This is the heart of s.84.1. The other parts are equally important, but revolve around this same idea. First, the “PUC grind”. What if the Client did not get cash from Holdco? Instead, the Client received one preferred share in Holdco with a redemption value and corporate stated capital of $760k as consideration from Holdco for the Opco shares? Client 1 pref share FMV ACB Corporate Stated Capital Tax PUC $760k $760k FMV ACB Corporate Stated Capital Tax PUC $760k $760k $760k $760k (?) Holdco 1 common share $10k $10k Opco The capital gain reported was $750k. No s.85(1) election is made. Page 301 Tax II Chapter 14 Spring 2013 Proceeds $760k ACB ($10k) Capital Gain $750k What would you think the result is? How would the Client get at the profits in Opco? Dividend to Holdco, reduce tax PUC or redeem preferred shares of Holdco. Could this come out of Holdco tax-free? Look at s.84.1(1)(a): We know the pre-conditions are met, so go to paragraph (a) Are shares of the purchaser corporation issued “as consideration for” the Opco shares? Yes, Holdco issued the one preferred share worth $760k. In computing the tax PUC of the shares of the purchaser company, you must deduct from that PUC a formula amount (another “PUC grind”): “(A – B) x C/A” Look at “C/A” first. This is, simply, an allocation of the increase in corporate stated capital of the purchaser company among different classes of shares, if more than one class of shares of the purchaser corporation is issued as consideration on the purchase. Here there is one class of shares of Holdco issued as consideration, so the ratio of C/A is 1/1, or 1. Now, “A minus B”: A is increase in corporate stated capital of the shares of the purchaser company as a result of its purchase of the Opco shares. That is $760k here. B is greater of: tax PUC of the Opco shares transferred. Page 302 Tax II Chapter 14 Spring 2013 and “Subject to s.84.1(2)(a) and (a.1)”, discussed below, the ACB to the Client of the Opco shares transferred, less the FMV of any non-share consideration paid by the purchaser company. So, in computing the PUC of the one preferred share in Holdco issued to the Client on the purchase, s.84.1(1)(a) says you deduct “[A – B] x C/A”, or [$760k - $10k] x 1 = $750k. The “PUC grind” is $750k. The “PUC grind” to the one preferred share can be shown as follows. The PUC of the Holdco preferred share is computed as follows: Start: Corporate Stated Capital PUC grind s.84.1(1)(a) tax PUC $760k $750k $10k Thus: Client 1 pref share FMV ACB Corporate Stated Capital Tax PUC $760k $760k FMV ACB Corporate Stated Capital Tax PUC $760k $760k $760k $10k (this is the key) Holdco 1 common share $10k $10k Opco Page 303 Tax II Chapter 14 Spring 2013 There is no immediate deemed dividend. Paragraph 84.1(1)(a) prevents future distributions tax-free. There is not sufficient tax PUC in the Holdco preferred share. 6. Consider another example. Change the consideration to $200k cash and $560k of one preferred share. Now apply s.84.1(1)(a) and s.84.1(1)(b). s.84.1(1)(a): (A – B) x C/A. C/A is 1. Consider: “A – B” A = increase in PUC of 1 pref share in Holdco ($560k) B = greater of: o tax PUC of Opco share ($10k) o ACB ($10k) less the cash ($200k), or 0. A – B = $560k. This is the “PUC grind” to the one preferred share, bringing its tax PUC to zero. s.84.1(1)(b): (A + D) – (E + F) A = $560k D = $200k E = $10k F = $560K So the deemed dividend is = o (560 + 200) – (10 + 560) o or $190k. 7. Consider ACB of the Opco shares. Can you see a potential further transaction involving the sale of the Holdco share? Go back to the “greater of” limitation in both s.84.1(a) and (b). What is the ACB to the Client of the one preferred share of Holdco in the example in paragraph 5? Page 304 Tax II Chapter 14 Spring 2013 “Subject to s.84.1(2)(a) and (a.1).” For example, read (a.1)(ii). The focus is on any capital gain exemption previously claimed by the taxpayer or a person not dealing at arm’s length with the taxpayer. If there is any of that amount “built into” the ACB of the share of the subject corporation sold, that amount is ignored for s.84.1 purposes. Walk through an example where Client now sells Holdco to, say, Holdco 2 for $760k cash. Client $760k purchase price $760k Loan $760k repay Holdco 2 FMV ACB PUC Bank $760k loan $760k $760k (soft) $10k Holdco Opco The apparent $760k ACB of the Client’s shares of Holdco is reduced under s.84.1(2)(a.1) by the prior $750k capital gain exemption claimed – so the apparent ACB protection disappears, and s.84.1 causes a $750k dividend in this Holdco2 transaction. Walk though the paragraph (b) dividend computation: (D-E). 8. Read (a)(i) and (a.1)(i). These ignore the “V-day value bump” (December 31, 1971) in computing ACB of the subject corporation shares. Instead, you look at the historical or original cost. Recall Tax I and V-day value bump to ACB. Now consider the preamble preconditions in s.84.1 again: the taxpayer “does not deal at arm’s length with” the purchaser corporation? Page 305 Tax II Chapter 14 9. Spring 2013 Recall section 251: related persons do not deal with each other at arm’s length (paragraph 251(1)(a)). It is a question of fact whether unrelated persons do not deal with each other at arm’s length “arm’s length” (paragraph 251(1)(c)). Read the Supreme Court of Canada decision in The Queen v. McLarty, attached to this chapter. Taxpayer The test: taxpayer is not dealing at arm’s length with purchaser corporation. Purchaser Company Subject Company Read paragraph 84.1(2)(b): this is a specific deeming rule “for greater certainty” that can be a trap: test immediately before: Is the taxpayer one of a group of less than 6 persons who control the subject company? test immediately after: is the taxpayer one of a group of less than 6 persons who control purchaser company, and each member of this group was a member in of the group in (i)? If so, the taxpayer is deemed not to deal at arm’s length with the purchaser corporation. Read subsection 84.1(2.2): deeming rules for paragraph 84.1(2)(b). Page 306