Ch. 4, Pg. 4-17, Stock Rights

advertisement

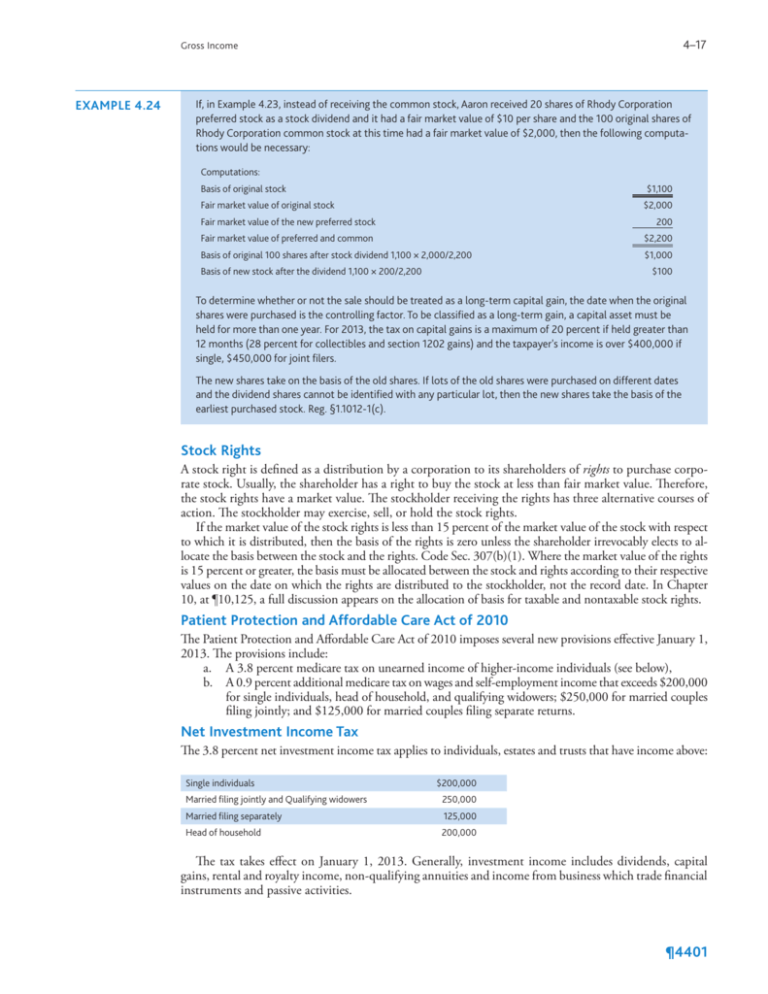

Example 4.24 4–17 Gross Income If, in Example 4.23, instead of receiving the common stock, Aaron received 20 shares of Rhody Corporation preferred stock as a stock dividend and it had a fair market value of $10 per share and the 100 original shares of Rhody Corporation common stock at this time had a fair market value of $2,000, then the following computations would be necessary: Computations: $1,100 Basis of original stock Fair market value of original stock $2,000 Fair market value of the new preferred stock 200 Fair market value of preferred and common $2,200 Basis of original 100 shares after stock dividend 1,100 × 2,000/2,200 $1,000 Basis of new stock after the dividend 1,100 × 200/2,200 $100 To determine whether or not the sale should be treated as a long-term capital gain, the date when the original shares were purchased is the controlling factor. To be classified as a long-term gain, a capital asset must be held for more than one year. For 2013, the tax on capital gains is a maximum of 20 percent if held greater than 12 months (28 percent for collectibles and section 1202 gains) and the taxpayer's income is over $400,000 if single, $450,000 for joint filers. The new shares take on the basis of the old shares. If lots of the old shares were purchased on different dates and the dividend shares cannot be identified with any particular lot, then the new shares take the basis of the earliest purchased stock. Reg. §1.1012-1(c). Stock Rights A stock right is defined as a distribution by a corporation to its shareholders of rights to purchase corporate stock. Usually, the shareholder has a right to buy the stock at less than fair market value. Therefore, the stock rights have a market value. The stockholder receiving the rights has three alternative courses of action. The stockholder may exercise, sell, or hold the stock rights. If the market value of the stock rights is less than 15 percent of the market value of the stock with respect to which it is distributed, then the basis of the rights is zero unless the shareholder irrevocably elects to allocate the basis between the stock and the rights. Code Sec. 307(b)(1). Where the market value of the rights is 15 percent or greater, the basis must be allocated between the stock and rights according to their respective values on the date on which the rights are distributed to the stockholder, not the record date. In Chapter 10, at ¶10,125, a full discussion appears on the allocation of basis for taxable and nontaxable stock rights. Patient Protection and Affordable Care Act of 2010 The Patient Protection and Affordable Care Act of 2010 imposes several new provisions effective January 1, 2013. The provisions include: a. A 3.8 percent medicare tax on unearned income of higher-income individuals (see below), b. A 0.9 percent additional medicare tax on wages and self-employment income that exceeds $200,000 for single individuals, head of household, and qualifying widowers; $250,000 for married couples filing jointly; and $125,000 for married couples filing separate returns. Net Investment Income Tax The 3.8 percent net investment income tax applies to individuals, estates and trusts that have income above: Single individuals Married filing jointly and Qualifying widowers $200,000 250,000 Married filing separately 125,000 Head of household 200,000 The tax takes effect on January 1, 2013. Generally, investment income includes dividends, capital gains, rental and royalty income, non-qualifying annuities and income from business which trade financial instruments and passive activities. ¶4401