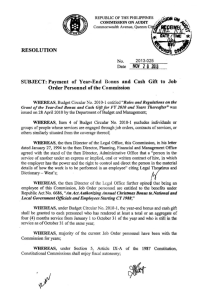

COMMISSION ON AUDIT MEMORANDUM NO. 91-737

advertisement

COMMISSION ON AUDIT MEMORANDUM NO. 91-737 November 6, 1991 TO : All Directors, Unit Heads, Division Chiefs and all Others Concerned. SUBJECT : Grant of One Month Year-end Bonus and P1,000 Cash Gift for Calendar Year 1991 and for Succeeding Years to COA Employees. 1.0 Purpose This Memorandum is issued to implement National Compensation Circular No. 66 dated September 22, 1991 in compliance with Republic Act No. 6686 dated December 14, 1988, authorizing the payment of Christmas bonus equivalent to one (1) month basic salary and an additional cash gift of P1,000. 2.0 Rules and Regulations 2.1 All Officials and employees of this Commission who have rendered at least four (4) months service including leaves of absence with pay in the government from January 1 to October 31 of each year and who are still in the service as of October 31 of the same year shall be entitled to these year-end benefits. 2.2 Those who have rendered less than four (4) months service from January 1 to October 31 and who are employed in the government service as of October 31 of the same year shall be entitled solely to Cash Gift pro-rated as follows: Length of Service 3 months but less than 4 months 2 months but less than 3 months 1 month but less than 2 months Less than 1 month 2.3 Amount P400.00 300.00 200.00 100.00 Those exempted from these year-end benefits are the following: 2.3.1 An official or employee under preventive suspension without pay is not entitled to these year-end benefits. However, when exonerated, he shall be entitled to the same. 2.3.2 An official or employee who is on absence without official leave (AWOL) as of October 31 of the same year shall not be entitled to the benefits granted herein. 2.3.3 An official or employee who may have four (4) months or more of government service in a particular year but is no longer in the service as of October 31 of the same year due to retirement/resignation/separation or for what other reasons, shall not be entitled to year-end benefits referred to herein. 3.0 2.4 An official or employee of COA who is on full-time or part-time detail with another government office/agency or special project shall receive his year-end benefits from this Commission, where he draws his salary. No one shall receive the yearend benefits from the agency where they are reassigned/detailed. 2.5 The year-end benefits of an employee who transferred from COA to another government agency whose total service in the government as of October 31 entitles him to the year-end benefits shall be considered government service for purposes of this Memorandum. Manner of Payment 3.1 Employees included in the centralized payroll shall be paid thru the banks while those under the regionalized payroll shall be paid in the regional offices, for which sub-allotment advices will be issued by the PFMO. 3.2 The year-end benefits granted herein shall be subject to withholding tax but not subject to GSIS premium, medicare, and other similar deductions. 3.3 Payments of the year-end benefits herein authorized shall be made not earlier than November 15 of each year. The Director and Heads of Auditing Units shall supervise the proper implementation of this Memorandum to expedite payment of the year-end benefits and ensure control measures to prevent overpayment thereof. All payments made pursuant to this Memorandum shall be subject to the usual accounting and auditing rules and regulations. For compliance. (SGD.) EUFEMIO C. DOMINGO, Chairman