john samore iii, cpa, cfe, mba

advertisement

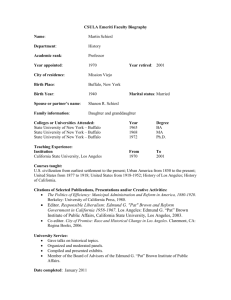

JOHN SAMORE III, CPA, CFE, MBA 1324 Idaho Avenue, Apt. F Santa Monica, California 90403 (310) 395-7959 jsamoreiii@yahoo.com EXPERIENCE True Partners Consulting LLC, Los Angeles, CA Senior Manager Promoted to Senior Manager from Manager, effective January 1, 2008 Performed a variety of unclaimed property services for clients, including compliance, voluntary disclosures agreements, and audit defense strategies. Complete review of documents and financial information pertaining relating to unclaimed property to identify strategies to mitigate exposure under a state initiated audit examination. Developed best practices for clients to actively manage, monitor, and report its unclaimed property on an annual basis, as well as provide guidance to improve operational efficiencies. Managed client budgets and client relationships as it correlates to the specific project. Identified, proposed and successfully brought in new clients increasing the revenue stream for the practice and firm. Heavy experience in a variety of industries including retail, telecommunications, entertainment, manufacturing, healthcare, and technology. Adlink Cable Advertising, LLC, Los Angeles, CA Consultant/Interim Accounting Manager May 2006 – Present January 2006 – April 2006 Gathered and analyzed financial data to prepare the property and business tax returns for Los Angeles County and the City of Los Angeles, respectively. This included reviewing the sales and revenue activity, conducting a payroll analysis reclassifying employees as appropriate, and analyzing both the fixed assets and operating expenses for the Company. Read and reviewed contracts entered into with outside sales agencies and corporate partners to ensure that the contract was complete and the Company was in compliance with the terms of the contract. Created lead and supporting schedules for both balance sheet and income statement accounts that were provided to the Company’s outside auditors for its annual fiscal year audit. Robert Half Management Consultants Consultant J.G. Boswell Company July 2005 – December 2005 Worked with the company and its manufacturing subsidiary, Rio Bravo Tomato Company, to coordinate, prepare, and review supporting financial and accounting documentation to provide to its outside auditors for the current year financial statement audit: Created lead schedules, analyzed financial information, and resolved questions by the outside auditors as it pertained to the nature of a transaction. Identified areas of improvement in the financial reporting and accounting process at the Rio Bravo Tomato Company subsidiary. Worked on the consolidated financial statements, including preparing schedules, and drafting both memorandums and footnotes. Researched and prepared a salary analysis for potential new hires based on certain criteria, such as experience, location, and requirements of the company. International Lease Finance Corporation June 2005 – July 2005 Worked with both company management and professionals from Bottom Line Consulting, Inc. to assist this AIG subsidiary with over $3.2 billion in revenues restate their financial statements for the calendar years ended 2001 - 2004: Acted as the Project Manager for the restatement by incorporating all financial information prepared by company personnel into one database and created journal entries required in order to accurately reflect the financial statements for the various periods. Prepared comparison worksheets comparing the previous reported figures against the restated financial information. Additional, performed ratio analysis to determine if debt covenants, lease margins, and other financial information were consistent with the previously reported amounts. Drafted a report describing the differences in the accounting treatment and reporting of many of the Company’s financial transactions between generally accepted accounting principles (GAAP) in the U.S. as compared to the International Financial Reporting Standards. Belkin Corporation July 2004 – September 2004 Independently worked under the direction of the Finance department to streamline and understand the sales commission reporting process for this private company with $700 million in annual revenue. Met with the Directors of the Finance, Sales, and Information Technology departments to understand what data is available, who the users of the information are, and what information was needed by the users to accurately report product sales made to customers that buy from both Belkin directly and from third party distributors. Documented and drafted a prescribed set of procedures that identify the total data available, where the data is stored, and what information needs to be captured for the sales commission analysis. Manning, Selvage & Lee, Los Angeles, CA September 2004 – June 2005 Director of Financial Services Responsible for all financial and accounting duties for the Los Angeles and San Francisco offices Planned and prepared the 2005 budget and 1st quarter reforecast, including working with all Account Supervisors to plan individual client budgets and timing of work for their clients. Managed the local tax function, including city and county business tax reporting. Responsible for the internal financial reporting process and reports to ensure timely and accurate reporting for the revenue and expense activities for both offices on a monthly basis. Drafted and implemented procedures to measure financial performance of the office, reduce costs, manage office efficiency, and to utilize available staff effectively to ensure high employee productivity and to manage freelance personnel expense costs. Ensured that accounts receivables that were due to the company were collected in a timely manner to increase cash inflows to use for investment hires and capital expenditures. Planned and coordinated the move of the SF office to be integrated with a sister company. This included assessing and analyzing projected costs to be incurred and overall expense savings. Worked on special projects, including an internal litigation matter, salary and cost reduction analyses mandated by corporate, as well as assisted the client service teams to create, manage, and track their client’s budget for a particular assignment. KPMG LLP, Los Angeles, CA Manager April 2001 – June 2004 Promoted to Manager from Senior Associate, effective October 1, 2003 Led teams that investigate allegations of fraud including earnings management, corporate officer embezzlements, investment frauds, “Ponzi” schemes, and other “white collar” offenses. Investigated whistleblower allegations against SEC registrants specifically mentioning improper use of reserve accounts, improper revenue recognition, failure to accrue liabilities, and general corporate governance issues, such as tone at the top and management integrity. Analyzed a variety of financial information, including both complex financial transactions and complex business structures. Knowledgeable about both GAAP and GAAS as it related to financial statement reporting and the prevention and/or detection of improper accounting treatments, amongst many industries. Provided recommendations to clients on improving internal controls weaknesses to prevent misapplication and misuse of corporate assets. Trained in the implementation of Sarbanes-Oxley Act 404 and assisted clients in both the implementation and testing of SOX 404. Presented on topics to identify areas of risk, recent accounting pronouncements, adherence to federal laws, and how to prevent, deter, and detect fraud within an organization to accounting, finance, and internal audit departments. Participated in college recruiting events and speaking engagements to identify potential candidates for our practice and to give insight as to the type of work the Forensic group engages in. Acted as a mentor for both new hires to the practice, as well as undergraduate students interested in the field of Forensic Accounting. EDUCATION University of Southern California, Los Angeles, CA Marshall School of Business Masters of Business Administration Leventhal School of Accounting Bachelor of Science, Accounting May 2003 August 1994 PROFESSIONAL AFFILIATIONS American Institute of Certified Public Accountants - Member California Society of CPAs President, Los Angeles chapter – FY2009 Other Los Angeles chapter positions include Treasurer, Secretary, Vice President, 1 st Vice President – June 2004 – May 2008, respectively Litigation Section, Member and Los Angeles Committee Co-Chair – 2001 – 2003 State Council Representative – June 2006 – Present American Institute of Certified Fraud Examiners – Member University of Southern California Accounting Circle Board Member Marshall School of Business Career Advantage Program Mentor – Fall 2005 - Present Federal Bureau of Investigations Citizens Academy – Graduate 2002 and current alumni member