FIN 456 - Prof Dimond

advertisement

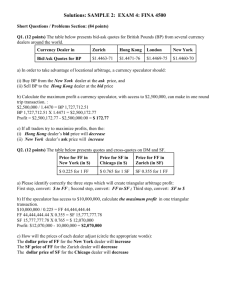

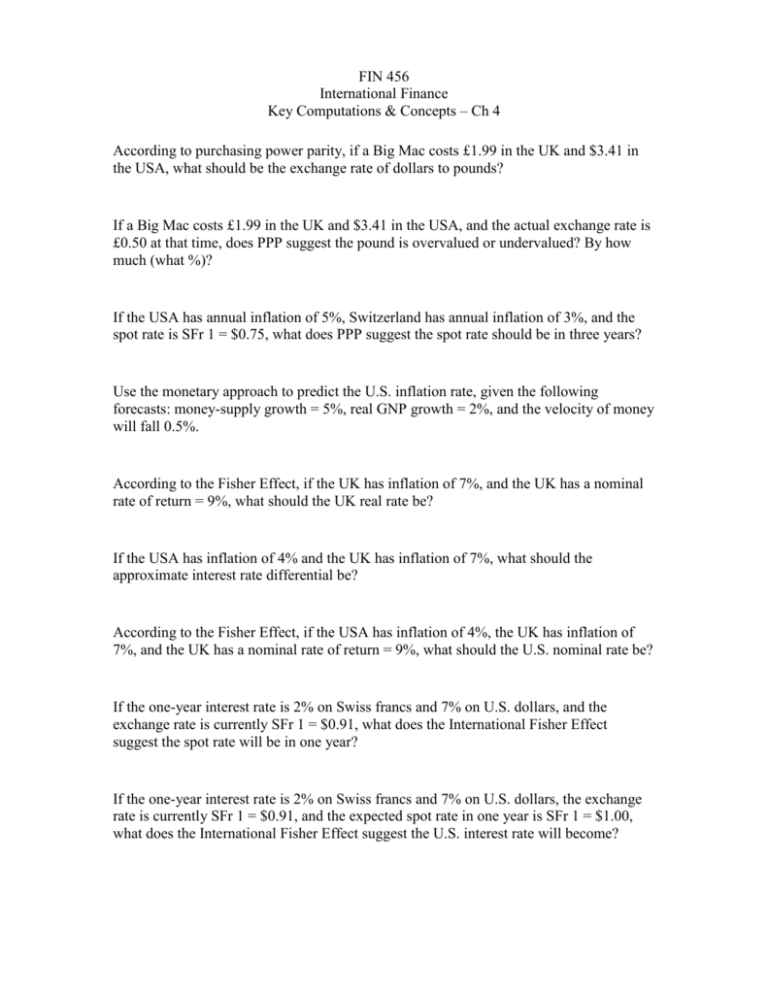

FIN 456 International Finance Key Computations & Concepts – Ch 4 According to purchasing power parity, if a Big Mac costs £1.99 in the UK and $3.41 in the USA, what should be the exchange rate of dollars to pounds? If a Big Mac costs £1.99 in the UK and $3.41 in the USA, and the actual exchange rate is £0.50 at that time, does PPP suggest the pound is overvalued or undervalued? By how much (what %)? If the USA has annual inflation of 5%, Switzerland has annual inflation of 3%, and the spot rate is SFr 1 = $0.75, what does PPP suggest the spot rate should be in three years? Use the monetary approach to predict the U.S. inflation rate, given the following forecasts: money-supply growth = 5%, real GNP growth = 2%, and the velocity of money will fall 0.5%. According to the Fisher Effect, if the UK has inflation of 7%, and the UK has a nominal rate of return = 9%, what should the UK real rate be? If the USA has inflation of 4% and the UK has inflation of 7%, what should the approximate interest rate differential be? According to the Fisher Effect, if the USA has inflation of 4%, the UK has inflation of 7%, and the UK has a nominal rate of return = 9%, what should the U.S. nominal rate be? If the one-year interest rate is 2% on Swiss francs and 7% on U.S. dollars, and the exchange rate is currently SFr 1 = $0.91, what does the International Fisher Effect suggest the spot rate will be in one year? If the one-year interest rate is 2% on Swiss francs and 7% on U.S. dollars, the exchange rate is currently SFr 1 = $0.91, and the expected spot rate in one year is SFr 1 = $1.00, what does the International Fisher Effect suggest the U.S. interest rate will become? If the spot rate is $1.95/£ and the one-year forward rate is $1.87/£, Does this imply a forward premium or forward discount on pounds? What is the amount (%)? In London, interest paid on pounds sterling is 12%. If the spot rate is $1.95/£ and the oneyear forward rate is $1.87/£, what is the covered yield on pounds? Is there a covered interest differential if the interest paid in New York on dollars is 7%? An arbitrageur sees an opportunity for a covered interest arbitrage. In London, interest paid on pounds sterling is 12%, while in New York, interest paid on dollars is 7%. If the spot rate is $1.95/£ and the one-year forward rate is $1.87/£, how much profit will the arbitrageur make if he can borrow $1,000,000 to put into a covered interest arbitrage? (NOTE: Assume the spread on borrowing & lending rates is zero and the bid-ask spread is zero). What is the 90-day forward rate if U.S. interest is 10%, Japanese interest is 7%, and the spot rate is $0.003800/¥? Use a 360-day year and assume interest rate parity (i.e. there are no arbitrage opportunities). What is the annualized (%) premium? If the interest rate on dollars is 6%, the interest rate on euros is 5%, and the spot rate is $0.90/ €, what is the implied value of the euro in five years?