FN 3000

advertisement

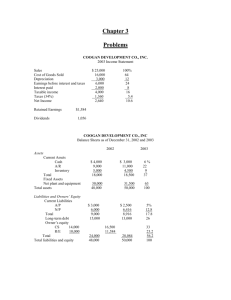

Dr. Sudhakar Raju FN 3000 ASSIGNMENT ANSWERS TO CHAPTER 3 (Working with Financial Statements) 1. To find the current assets, use the net working capital equation. Thus: NWC = Current assets – Current liabilities $1,100 = Current assets – $4,180 Current assets = $5,280 Now, use this number to calculate the current ratio and the quick ratio. The current ratio is: Current ratio = Current assets / Current liabilities Current ratio = $5,280 / $4,180 Current ratio = 1.26 times And the quick ratio is: Quick ratio = (Current assets – Inventory) / Current liabilities Quick ratio = ($5,280 – 1,600) / $4,180 Quick ratio = .88 times 2. To find the return on assets and return on equity, we need net income. We can calculate the net income using the profit margin. Doing so, we find that net income is: Profit margin = Net income / Sales .08 = Net income / $43,000,000 Net income = $3,440,000 Now we can calculate the return on assets as: ROA = Net income / Total assets ROA = $3,440,000 / $29,000,000 ROA = .1186 or 11.863% We do not have the equity for the company, but we know that equity must be equal to total assets minus total debt, so the ROE is: ROE = Net income / (Total assets – Total debt) ROE = $3,440,000 / ($29,000,000 – 9,500,000) ROE = .1764 or 17.64% 3. The ACP (average collection period) can be calculated as: ACP = [A/C Receivables] / [Credit sales per day] 1 ACP = [$527,381] / [$4,386,500 / 365] ACP = 43.88 days The ACP (which is the also called day’s sales in receivables) was 43.88 days. 4. The inventory turnover for the company was: Inventory turnover = COGS / Inventory Inventory turnover = $4,378,650 / $865,371 Inventory turnover = 5.06 times Using the inventory turnover, we can calculate the days’ sales in inventory as: Days’ sales in inventory = 365 days / Inventory turnover Days’ sales in inventory = 365 days / 5.06 Days’ sales in inventory = 72.14 days On average, a unit of inventory sat on the shelf 72.14 days before it was sold. 5. To find the debt-equity ratio using the total debt ratio, we need to rearrange the total debt ratio equation. We must realize that the total assets are equal to total debt plus total equity. Doing so, we find: Total debt ratio = Total debt / Total assets .55 = Total debt / (Total debt + Total equity) .45(Total debt) = .55(Total equity) Total debt / Total equity = .55 / .45 Debt-equity ratio = 1.22 And the equity multiplier is one plus the debt-equity ratio, so: Equity multiplier = 1 + D/E Equity multiplier = 1 + 1.22 Equity multiplier = 2.22 6. We need to calculate the net income before we calculate the earnings per share. The sum of dividends and addition to retained earnings must equal net income, so net income must have been: Net income = Addition to retained earnings + Dividends Net income = $380,000 + 220,000 Net income = $600,000 So, the earnings per share were: EPS = Net income / Shares outstanding EPS = $600,000 / 400,000 EPS = $1.50 per share 2 The dividends per share were: Dividends per share = Total dividends / Shares outstanding Dividends per share = $220,000 / 400,000 Dividends per share = $0.55 per share The book value per share was: Book value per share = Total equity / Shares outstanding Book value per share = $5,500,000 / 400,000 Book value per share = $13.75 per share The market-to-book ratio is: Market-to-book ratio = Share price / Book value per share Market-to-book ratio = $32 / $13.75 Market-to-book ratio = 2.33 times The P/E ratio is: P/E ratio = Share price / EPS P/E ratio = $32 / $1.50 P/E ratio = 21.33 times 7. With the information given, we must use the DuPont identity to calculate return on equity. Doing so, we find: ROE = (Profit margin)(Total asset turnover)(Equity multiplier) ROE = (.09)(1.45)(1.70) ROE = .2219 or 22.19% 8. We can use the DuPont identity and solve for the equity multiplier. With the equity multiplier we can find the debt-equity ratio. Doing so we find: ROE = (Profit margin)(Total asset turnover)(Equity multiplier) .2050 = (.11)(1.25)(Equity multiplier) Equity multiplier = 1.49 Now, using the equation for the equity multiplier, we get: Equity multiplier = 1 + Debt-equity ratio 1.49 = 1 + Debt-equity ratio Debt-equity ratio = .49 9. With the information provided, we need to calculate the ROE using an extended ROE equation. We first need to find the equity multiplier which is: Equity multiplier = 1 + Debt-equity ratio Equity multiplier = 1 + .90 3 Equity multiplier = 1.90 Now we can calculate the return on equity as: ROE = (ROA)(Equity multiplier) ROE = .079(1.90) ROE = .1501 or 15.01% The return on equity equation we used was an abbreviated version of the DuPont identity. If we multiply the profit margin and total asset turnover ratios from the DuPont identity, we get: (Net income / Sales)(Sales / Total assets) = Net income / Total assets = ROA With the return on equity, we can calculate the net income as: ROE = Net income / Total equity .1501= Net income / $520,000 Net income = $78,052 10. To find the internal growth rate, we need the retention ratio (RR). The retention ratio (also called the plowback ratio) is: RR = 1 – .25 RR = .75 Now, we can use the internal growth rate equation to find: Internal growth rate = [(ROA)(RR)] / [1 – (ROA)(RR)] Internal growth rate = [.12(.75)] / [1 – .12(.75)] Internal growth rate = .0989 or 9.89% 11. To find the internal growth rate we need the retention ratio. The retention ratio is: RR = 1 – .35 RR = .65 Now, we can use the sustainable growth rate equation to find: Sustainable growth rate = [(ROE)(RR)] / [1 – (ROE)(RR)] Sustainable growth rate = [.185(.65)] / [1 – .185(.65)] Sustainable growth rate = .1367 or 13.67% 12. We need the return on equity to calculate the sustainable growth rate. To calculate return on equity, we need to realize that the total asset turnover is the inverse of the capital intensity ratio and the equity multiplier is one plus the debt-equity ratio. So, the return on equity is: 4 ROE = (Profit margin) (Total asset turnover) (Equity multiplier) ROE = (.087)(1/.60)(1 + .40) ROE = .2030 or 20.30% Next we need the retention ratio. The retention ratio is one minus the payout ratio. The payout ratio is given by dividends divided by net income, so that the retention ratio is: RR = 1 – ($9,000 / $40,000) RR = .78 Now we can use the sustainable growth rate equation to find: Sustainable growth rate = [(ROE)(RR)] / [1 – (ROE)(RR)] Sustainable growth rate = [.2030(.78)] / [1 – .2030(.78)] Sustainable growth rate = .1867 or 18.67% 13. The DuPont equation to calculate ROA is: ROA = (Profit margin) x (Total asset turnover) We can solve this equation to find total asset turnover as: .10 = .07(Total asset turnover) Total asset turnover = 1.43 times Now, solve the ROE equation to find the equity multiplier which is: ROE = (ROA) (Equity multiplier) .18 = (.10) (Equity multiplier) Equity multiplier = 1.80 times 14. To calculate the ROA, we first need to find the net income. Using the profit margin equation, we find: Profit margin = Net income / Sales .08 = Net income / $23,000,000 Net income = $1,840,000 Now we can calculate ROA as: ROA = Net income / Total assets ROA = $1,840,000 / $24,000,000 ROA = .0767 or 7.67% 15. To calculate the internal growth rate, we need to find the ROA and the RR. The ROA for the company is: 5 ROA = Net income / Total assets ROA = $14,209 / $72,500 ROA = .1960 or 19.60% And the RR is: RR = 1 – .40 RR = .60 Now, we can use the internal growth rate equation to find: Internal growth rate = [(ROA) (RR)] / [1 – (ROA) (RR)] Internal growth rate = [.1960(.60)] / [1 – .1960(.60)] Internal growth rate = .1333 or 13.33% To calculate the sustainable growth rate, we need to find the ROE and the retention ratio (or plowback ratio). The ROE for the company is: ROE = Net income / Equity ROE = $14,209 / $44,300 ROE = .3207 or 32.07% Using the sustainable growth rate, we calculated in the previous problem, we find the sustainable growth rate is: Sustainable growth rate = [(ROE) (RR)] / [1 – (ROE) (RR)] Sustainable growth rate = [(.3207)(.60)] / [1 – (.3207)(.60)] Sustainable growth rate = .2383 or 23.83% 16. The total asset turnover is: Total asset turnover = Sales / Total assets Total asset turnover = $14,000,000 / $6,000,000 = 2.33 times If the new total asset turnover is 2.75, we can use the total asset turnover equation to solve for the necessary sales level. The new sales level will be: Total asset turnover = Sales / Total assets 2.75 = Sales / $6,000,000 Sales = $16,500,000 17. To find the ROE, we need to figure out the value of total equity. Since we have total debt, if we can find total assets, we can calculate total equity. Using the total debt ratio, we find total assets as: Debt ratio = Total debt / Total assets .60 = $165,000 / Total assets Total assets = $275,000 6 Total liabilities and equity is equal to total assets. It is also equal to total debt plus equity. Using these relationships, we find: Total liabilities and equity = Total debt + Total equity $275,000 = $165,000 + Total equity Total equity = $110,000 Now, we can calculate the ROE as: ROE = Net income / Total equity ROE = $15,250 / $110,000 ROE = .1386 or 13.86% 18. The earnings per share are: EPS = Net income / Shares EPS = $7,400,000 / 3,600,000 EPS = $2.06 The price-earnings ratio is: P/E = Price / EPS P/E= $65 / $2.06 P/E = 31.62 The book value per share is: Book value per share = Book value of equity / Shares Book value per share = 32,450,000 / 3,600,000 Book value per share = $9.01 per share And the market-to-book ratio is: Market-to-book = Market value per share / Book value per share Market-to-book = $65 / $9.01 Market-to-book = 7.21 19. To find the profit margin, we need the net income and sales. We can use the total asset turnover to find the sales and the return on assets to find the net income. Beginning with the total asset turnover, we find sales are: Total asset turnover = Sales / Total assets 2.85 = Sales / $9,500,000 Sales = $27,075,000 And the net income is: ROA = Net income / Total assets 7 .12 = Net income / $9,500,000 Net income = $1,140,000 Now we can find the profit margin which is: Profit margin = Net income / Sales Profit margin = $1,140,000 / $27,075,000 Profit margin = .0421 or 4.21% 20. We can rearrange the DuPont identity to calculate the profit margin. So, we need the equity multiplier and the total asset turnover. The equity multiplier is: Equity multiplier = 1 + Debt-equity ratio Equity multiplier = 1 + .75 Equity multiplier = 1.75 And the total asset turnover is: Total asset turnover = Sales / Total assets Total asset turnover = $8,750 / $2,680 Total asset turnover = 3.26 times Now, we can use the DuPont identity to find total sales as: ROE = (Profit margin)(Total asset turnover)(Equity multiplier) .15 = (PM)(3.26)(1.75) Profit margin = .0263 or 2.63% Rearranging the profit margin ratio, we can find the net income which is: Profit margin = Net income / Sales .0263 = Net income / $8,750 Net income = $229.71 21. From the financial statements we can calculate the following ratios. Current ratio = Current assets / Current liabilities Current ratio2008 = $17,533 / $3,807 = 4.61 times Quick ratio = (Current assets – Inventory) / Current liabilities Quick ratio2008 = ($17,533 – 9,840) / $3,807 = 1.72 times Total asset turnover Total asset turnover = Sales / Total assets = $87,480 / $58,856 = 1.49 times Total debt ratio = (Current liabilities + Long-term debt) / Total assets 8 Total debt ratio2008 = ($3,807 + 13,840) / $58,856 = .30 Debt-equity ratio = (Current liabilities + Long-term debt) / Total equity Debt-equity ratio2008 = ($3,807 + 13,840) / $41,209 = .43 Equity multiplier Equity multiplier2008 Profit margin Profit margin = 1 + D/E ratio = 1 + .43 = 1.43 = Net income / Sales = $16,750 / $87,480 = .1915 or 19.15% Return on assets = Net income / Total assets Return on assets = $16,750 / $58,856 = .2846 or 28.46% Return on equity = Net income / Total equity = $16,750 / $41,209 = .4065 or 40.65% The DuPont identity for Smolira is given by: ROE = (PM) x (Total asset turnover) x (Equity multiplier) ROE = (Net income / Sales)(Sales / Total assets)(Total assets / Total equity) ROE = ($16,750 / $87,480)($87,480 / $58,856)($58,856 / $41,209) ROE = 0.4065 or 40.65% To find the price-earnings ratio we first need the earnings per share. The earnings per share are: EPS = Net income / Shares outstanding EPS = $16,750 / 10,000 EPS = $1.675 So, the price-earnings ratio is: P/E ratio = Share price / EPS P/E ratio = $24 / $1.675 P/E ratio = 14.33 The dividends per share are: Dividends per share = Total dividends /Shares outstanding Dividends per share = $4,800 / 10,000 shares Dividends per share = $0.48 per share 9 To find the market-to-book ratio, we first need the book value per share. The book value per share is: Book value per share = Total equity / Shares outstanding Book value per share = $41,209 / 10,000 shares Book value per share = $4.12 per share So, the market-to-book ratio is: Market-to-book ratio = Share price / Book value per share Market-to-book ratio = $24 / $4.12 Market-to-book ratio = 5.82 times 22. To find the profit margin, we can solve the DuPont identity. First, we need to find the retention ratio. The retention ratio for the company is: RR = 1 – .35 RR = .65 Now, we can use the sustainable growth rate equation to find the ROE. Doing so, we find: Sustainable growth rate = [(ROE)(RR)] / [1 – (ROE)(RR)] .07 = [ROE(.65)] / [1 – ROE(.65)] ROE = .1006 or 10.06% Now, we can use the DuPont identity. We are given the total asset to sales ratio, which is the inverse of the total asset turnover, and the equity multiplier is one plus the debt-equity ratio. Solving the DuPont identity for the profit margin, we find: ROE = (Profit margin)(Total asset turnover)(Equity multiplier) .1006 = (Profit margin)(1 / 1.40)(1 + .60) Profit margin = .0881 or 8.81% 23. To find the total asset turnover, we can solve the ROA equation. First, we need to find the retention ratio. The retention ratio for the company is: RR = 1 – .60 RR = .40 Now, we can use the internal growth rate equation to find the ROA. Doing so, we find: Internal growth rate = [(ROA) (RR)] / [1 – (ROA) (RR)] .05 = [ROA(.40)] / [1 – ROA(.40)] ROA = .1190 or 11.90% Now, we can use the ROA equation to find the total asset turnover is: 10 ROA = (PM) (TAT) .1190 = (.09) TAT Total asset turnover = 1.32 times 24. To calculate the sustainable growth rate, we need to calculate the return on equity. We can use the DuPont identity to calculate the return on equity if we can find the equity multiplier. Using the total debt ratio, we can find the debt-equity ratio is: Total debt ratio = Total debt / Total assets .40 = Total debt / Total assets 1 / .40 = Total assets / Total debt 1 / .40 = (Total debt + Total equity) / Total debt 1 / .40 = 1 + Total equity / Total debt Total equity / Total debt = (1 / .40) – 1 Total debt / Total equity = 1 / [(1 /.40) – 1] Total debt / Total equity = .67 Debt-equity ratio = .67 So, the equity multiplier is: Equity multiplier = 1 + Debt-equity ratio Equity multiplier = 1 + .67 Equity multiplier = 1.67 Using the DuPont identity, the ROE is: ROE = (Profit margin)(Total asset turnover)(Equity multiplier) ROE = (.075)(1.25)(1.67) ROE = .1563 or 15.63% To calculate the sustainable growth rate, we also need the retention ratio. The retention ratio is: RR = 1 – .30 RR = .70 Now we can calculate the sustainable growth rate as: Sustainable growth rate = [(ROE)(RR)] / [1 – (ROE)(RR)] Sustainable growth rate = [.1563(.70)] / [1 – .1563(.70)] Sustainable growth rate = .1228 or 12.28% And the return on assets is: ROA = (Profit margin)(Total asset turnover) ROA = (.075)(1.25) ROA = .0938 or 9.38% 11 25. To find the sustainable growth rate, we need the retention ratio and the return on equity. The payout ratio is the dividend payment divided by net income, so: RR = 1 – ($3,400 / $8,000) RR = .575 And the return on equity is: ROE = Net income / Total equity ROE = $8,000 / $33,000 ROE = .2424 or 24.24% So, the sustainable growth rate is: Sustainable growth rate = [(ROE) (RR)] / [1 – (ROE)(RR)] Sustainable growth rate = [.2424(.575)] / [1 – .2424(.575)] Sustainable growth rate = .1620 or 16.20% The total assets of the company are equal to the total debt plus the total equity. The total assets will increase at the sustainable growth rate, so the total assets next year will be: New total assets = (1 + Sustainable growth rate)(Fixed assets) New total assets = (1 + .1620)($49,000 + 33,000) New total assets = $95,281.69 We can find the new total debt amount by multiplying the new total assets by the debt-equity ratio. Doing so, we find the new total debt is: New total debt = [Total debt / (Total debt + Total equity)](New total assets) New total debt = [$49,000 / ($49,000 + 33,000)]($95,281.69) New total debt = $56,936.62 The additional borrowing is the difference between the new total debt and the current total debt, so: Additional borrowing = New total debt – Current total debt Additional borrowing = $56,936.62 – 49,000 Additional borrowing = $7,936.62 The growth rate that could be achieved with no outside financing at all is the internal growth rate. To find the internal growth rate we first need the return on assets, which is: ROA = Net income / Total assets ROA = $8,000 / ($49,000 + 33,000) ROA = .0976 or 9.76% So, the internal growth rate is: Internal growth rate = [(ROA)(RR)] / [1 – (ROA)(RR)] 12 Internal growth rate = [(.0976)(.575)] / [1 – (.0976)(.575)] Internal growth rate = .0594 or 5.94% 13