File - Chalice Oak Foundation

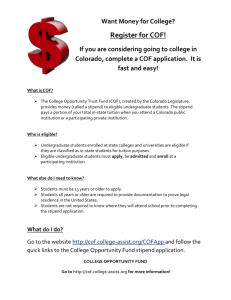

advertisement

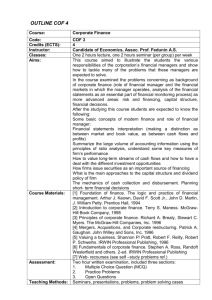

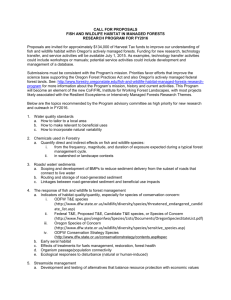

Steps to Fiscal Sponsorship (Model C) 1. Project submits the COF fiscal sponsorship application 2. If accepted, a grantor-grantee relationship is established between COF and project in a board resolution. 3. Project receives fiscal sponsorship and nonprofit status under Chalice Oak Foundation’s 501(C)3 status. Project has its own legal, tax, and accounting identity, which means that project has completed these steps (in this order): A. Registered as a nonprofit corporation in your state Typically this is done through your state's Secretary of State office. Application will ask for your board member's information and sometimes about monies taken in prior to registration and articles of incorporation. The fee to register is typically less than $100. Please note: you will also be required to renew your registration annually or biennially, depending on your state's requirements. B. Apply for a Federal employer identification number (EIN) by filling out IRS form SSC. Open a business bank account 4. COF and project sign a written grant agreement 5. Project may raise money under COF's 501(c)3 NOTE: COF reviews all fundraising materials in advance 6. Project or COF or some combination of the two solicit funds for the specific grant(s) to be made by COF to the project. NOTE: COF Bylaws say that such solicitations shall be made only on the condition that COF retains complete control and discretion over the use of all contributions it receives. Also, that element of COF's discretion and control should be made known, in writing, to the funding sources. (see sample letter to funders, attached) Revised 7.19.2015 1 7. All project grant requests are submitted to COF which sends them to potential grantors 8. All money project raises must be deposited through COF in a restricted fund NOTE: Grants and individual donations will be made payable to: Chalice Oak Foundation, for the benefit of [PROJECT NAME] 9. COF disburses money raised, minus fees, as a grant to project NOTE: COF charges an administration fee of 12% for all funds raised. 10. Project receives COF technical assistance for no charge. 11. Project submits funder and project reports to COF which sends them to funders. 12. COF files IRS 990 annually showing monies granted to fiscal project 13. Project is responsible for its own tax reporting, employment taxes, insurance, debts, liabilities and other legal obligations. Revised 7.19.2015 2 Chalice Oak Foundation Letter to Funders [date] _______________________ ________________________ ________________________ Dear ____________: This letter is to confirm to you that the Chalice Oak Foundation (COF) is the fiscal sponsor of [project]'s charitable program. As such, we have reviewed and hereby submit the enclosed application to you for a grant of $_______ to support their [charitable activities]. COF is a California nonprofit public benefit corporation qualified as exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code (IRC) and classified as a public charity under IRC Sections 509(a)(1) and 170(b)(1)(A)(vi). A copy of our federal determination letter has been included for your convenience. As of this date we have received no notice from the Internal Revenue Service that our status has been changed. For legal and accounting purposes, we need to notify you of our “variance power” over funds donated to us in support of this program. Under our fiscal sponsorship agreement with [project], COF retains full discretion and control over the use of such funds to accomplish the charitable purposes of the approved program. This power includes the unilateral right to redirect funds to a different beneficiary who can accomplish the purposes of this program if for some reason [project] cannot. Please feel free to call me at (207) 239-7162 or email me at executivedirector@chaliceoak.org if you have any questions. Thank you for your interest in one of our projects. Sincerely, Laurel Amabile, Executive Director Revised 7.19.2015 3