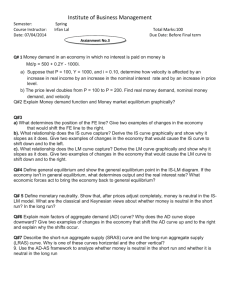

Question 1 (15 points)

advertisement

Intermediate Macroeconomics 311 (Professor Gordon) Second Mid-Term Examination Fall, 2007 YOUR NAME: Circle the TA session you are attending: Costel Friday 9AM Costel Friday 3PM Jerry Friday 9AM Jerry Friday 3PM INSTRUCTIONS: 1. The exam lasts 1 hour. 2. The exam is worth 60 points in total: 30 points for the two analytical questions, and 30 points for the multiple choice questions. 3. Write your answers to Part A (the multiple choice section) in the blanks on page 1. You won’t get credit for circled answers in the multiple choice section. 4. Place all of your answers for part B in the space provided. 5. You must show your work for part B questions. There is no need to explain your answers for the multiple choice questions. 6. Good Luck! PART A Answer multiple choice questions in the space provided below. USE CAPITAL LETTERS. 1. ____ 6. ____ 11. ____ 16. ____ 21. ____ 26. ____ 2. ____ 7. ____ 12. ___ 17. ____ 22. ___ 27. _ _ 3. ____ 8. ____ 13. ____ 18. ____ 23. ____ 28. __ _ 4. ____ 9. ____ 14. _ __ 19. ____ 24. ____ 29. ____ 5. ____ 10. ____ 15. ____ 20. ____ 25. ____ 30. __ _ 1. A nation’s net international investment position is (a) the difference between all foreign assets owned by a nation’s citizens and domestic assets owned by foreign citizens. (b) the difference between its exports of goods and services and its import of goods and services. (c) identical to its current account balance. (d) unaffected by policy driven interest rate changes 2. The relation S (T – G) I NX describing the equilibrium of an economy explicitly demonstrates (a) deficit spending by the government reduces either investment and/or net foreign investment. (b) deficit spending reduces private saving (assuming net foreign investment remains unchanged). (c) as private saving increases net foreign investment must decrease, exports decline. (d) as private saving increases the deficit must decline if investment decreases. 3. During the second quarter of 1989 it is believed that Japanese investors bought a significant proportion of U.S. corporate stocks and bonds sold during this period. The required purchase of dollars (a) reduced the trade deficit of that year. (b) provided yen to purchase imported goods by U.S. citizens. (c) led to a trade surplus for that year. (d) led to a trade deficit for that year. 4. If the interest responsiveness of business firms investment is great then the (a) IS curve is flatter and the AD curve is flatter. (b) IS curve is steeper and the AD curve is steeper. (c) IS curve is horizontal and the AD curve is perfectly vertical. (d) IS curve is horizontal and the AD curve is perfectly horizontal 5. When the expected rate of inflation falls, the short-run Phillips curve (a) shifts upward. (b) shifts downward. (c) remains unaffected. (d) becomes vertical. 6. Assuming constant wages implies that (a) an increase in the price of goods raises profits and SAS is vertical. (b) a decrease in the price of goods lowers profits and SAS is horizontal. (c) an increase in the price of goods lowers profits and SAS is vertical. (d) an increase in the price of goods raises profits and SAS is positively sloped. 7. Suppose the United States and Canada were the only two countries in the world. There is an excess supply of U.S. dollars on the foreign-exchange market. This implies that (a) there is also an excess supply of Canadian dollars. (b) (c) (d) the Canadian balance of payments is in deficit. the U.S. balance of payments is in surplus. the U.S. dollar is overvalued. 8. The purchasing power parity theory predicts that (a) a nation’s exchange rate will decline at a rate equal to the difference between the domestic and the foreign rates of inflation. (b) a nation’s exchange rate will differ from another nation’s exchange rate by an amount depending upon the difference between the domestic and foreign rates of inflation. (c) a nation’s exchange rate is determined by the extent of speculation in the foreignexchange market. (d) a nation’s exchange rate will decline when there is a balance-of-payments deficit. 9. A recession normally causes ______ in government net tax revenues, ______ the budget deficit is an example of ______ automatic stabilization. (a) an increase, increasing, the working of (b) an increase, decreasing, a failure of (c) a decrease, decreasing, the working of (d) a decrease, increasing, a failure of (e) a decrease, increasing, the working of 10. According to PPP theory, the yen price of the dollar would rise in a year from 130 to 135 yen if along with a U.S. inflation rate of 6 percent, the Japanese inflation rate is ______ percent. (a) 11.00 (b) 1.00 (c) 23.08 (d) 2.15 (e) 9.85 11. A doubling of the nominal money supply would create a new AD curve at double the vertical position of the original AD curve because (a) at each price level there is a decrease in autonomous spending. (b) each output level requires the same real money supply as in the original situation. (c) the rise in money supply causes increased expectation of further price increases and investment declines. (d) the rise in the money supply causes an excess supply of money and generates rising interest rates. 12. After a period of sustained unexpected inflation, it is likely that the renegotiation of nominal wages will (a) shift the SAS curve downward thereby increasing output. (b) shift the SAS curve upward thereby increasing output. (c) (d) shift the SAS curve upward thereby decreasing output. shift the AD curve downward thereby increasing output. 13. If a nation’s budget deficit rises, domestic private investment can remain unchanged through some combination of ____ private saving and ____ importing relative to exporting. (a) increased, less (b) increased, more (c) decreased, less (d) decreased, more 14. If the marginal leakage rate is small, then the AD is (a) flatter. (b) steeper. (c) perfectly vertical. (d) perfectly horizontal. 15. A government budget surplus (a) decreases a country’s ability to finance domestic and foreign investment. (b) increases a country’s ability to finance domestic and foreign investment. (c) increases a country’s ability to finance domestic investment and decreases its ability to finance foreign investment. (d) decreases a country’s ability to finance domestic investment and increases its ability to finance foreign investment. 16. The growth of nominal GDP (a) can be broken down into the growth of the price level times the growth of real GDP. (b) is equal to the index of prices times the level of real GDP. (c) can be broken down into the growth of money supply plus the growth of velocity. (d) is the same as the growth of aggregate supply. 17. If the inflation rate is 10% and nominal GDP growth is 8% then real GDP must have (a) increased by 2%. (b) decreased by 18%. (c) decreased by 2%. (d) increased by 18%. 18. The structural surplus is (a) the difference between the actual surplus and the natural employment surplus and it increases whenever income rises. (b) identical to the natural employment surplus and it increases whenever tax rates are cut. (c) identical to the natural employment surplus and it decreases whenever the natural level of output increases. (d) identical to the natural employment surplus and it increases whenever the natural level of output increases. 19. The short-run aggregate supply curve slopes upward because, with a given equilibrium wage rate, a higher actual price level will (a) reduce the actual real wage and induce firms to hire more labor. (b) shift the labor supply curve. (c) increase the aggregate demand for goods, so that output will rise. (d) All of these. 20. According to PPP theory, the yen price of the dollar would fall in a year from 140 to 132 yen if along with a Japanese inflation rate of 2 percent, the U.S. inflation rate is ______ percent. (a) 7.71 (b) –3.71 (c) 6.00 (d) 10.00 (e) 2.11 21. Which of the following are reasons why rational workers and firms may form their expectations by looking backward rather than forward? (a) the existence of long-term wage and price agreements would prevent actual inflation from responding immediately to an acceleration in nominal GDP (b) if in the past acceleration in nominal GDP has caused inflation, then a current acceleration might be expected to increase inflation (c) people may have no reason to believe that the acceleration in GDP growth will be permanent (d) Both (a) and (b). 22. When the real wage falls, as a result of a rise in the price level (a) the demand for labor will fall. (b) the supply of labor will rise. (c) firms will hire more labor as they move down the demand curve for labor. (d) the nominal wage will fall. 23. Everywhere to the right of the long-run Phillips curve (a) actual inflation is less than expected inflation and the expected inflation rate will be reduced. (b) actual inflation is less than expected inflation and the expected inflation rate will be raised. (c) actual inflation is greater than expected inflation and the expected inflation rate will be raised. (d) actual inflation is greater than expected inflation and the expected inflation rate will be reduced PART B QUESTION 1 (15 points) Let the following equations describe a small open economy with a flexible exchange rate system. C = CA + 0.8(Y-T) CA = 300-10r T = 250 (M/P)D = 0.25Y-25r MS/P = 550 IP = 400-30r G = 180 NX = 840-0.2Y-4e (A) Initially let foreign and domestic interest rates be equal (r = rf ) and let the foreign exchange rate (e) equal 80. Find the IS and LM equations. Compute the equilibrium domestic and foreign interest rates (r and rf). Compute equilibrium real output (4 points) k = 1/(0.2+0.2)=2.5 AP = 300-10*r -0.8*250 +400-30*r +180+520= 1200-40*r IS: Y=k*AP or Y = 2.5 (1,200-40*r) ; Y = 3,000 – 100*r LM: MS/P=(M/P)D or 550 = 0.25*Y-25*r ; Y = 2,200 + 100*r Y = 2,600 and r= rf = 4 (B) We now let the small economy’s domestic interest rate diverge temporarily from the foreign interest rate. Suppose the government increases government spending (G) by 80 to 260. 1) Derive the equation for the new IS curve. (1 point) New IS curve: Y=2.5 (1280-40*r) ; Y=3,200-100*r 2) Compute the new (temporary) equilibrium domestic interest rate (r) and output (Y) (2 points) Combine the new IS curve with the LM curve to get: Y=2,700; r=5 3) Compute the final (permanent) equilibrium interest rate and output(Y) (2 points) The final equilibrium is identical to the initial one: Y = 2,600 and r= 4 4) Find the new exchange rate. (6 points) In the final equilibrium, the IS curve shifts back to its initial position. Thus we nust have that the govt spending increase is offset by the decrease in Net Exports: ∆G+∆NX=0; or 80-4*∆e=0; Solving for ∆e = 20, so the new exchange rate is e’=100 Question 2 (15 points) Consider an economy characterized by the following: A 1% increase in the log-output ratio raises inflation by 1%; The expected rate of inflation equals the previous period’s actual inflation a) Write down the equations of the Short-Run Phillips curve (SP) and the DG curve. (3 points) (SP) p p e gYˆ z or p p 1 Yˆ z (DG) Yˆ Yˆ1 xˆ p b) Assume that the economy is in a long-run equilibrium at t = 0 and that x̂ 0 = p0= pe0= 0, z0=0 and Ŷ0 = 0. In periods 1 and 2 there are supply shocks, z1 = -1 and z2 = -2. 1) Assuming an accommodating policy and using the equations derived above fill in the following table. (6 points) Period x̂t zt pt 0 0 0 0 1 2 -1 -3 -1 -2 -1 -3 Relevant equations: p p1 z xˆ p Yˆt 0 0 0 pet 0 0 -1 2) Assuming an extinguishing policy and using the equations derived above fill in the following table. (6 points) Period x̂t zt pt Yˆt pet 0 1 2 0 1 1 0 -1 -2 0 0 0 0 1 2 0 0 0 Relevant equations: Yˆ z xˆ Yˆ Yˆ1