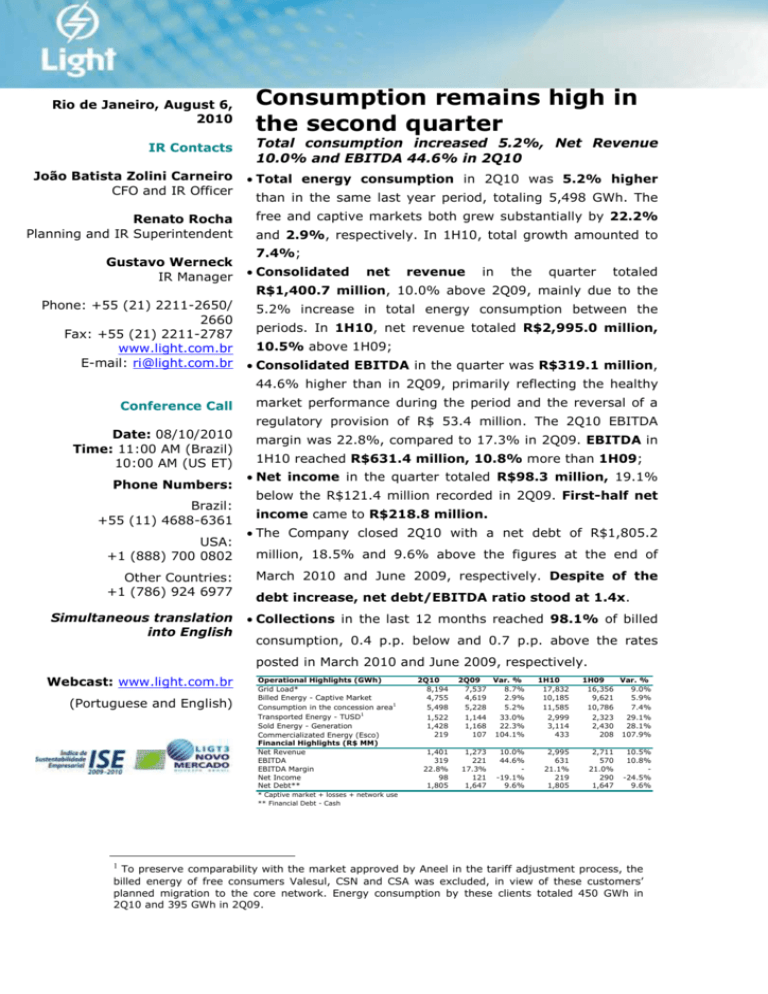

Net Income

advertisement