BRAZILIAN SHIPPING FINANCE - Mission of Rio Grande do Sul in

advertisement

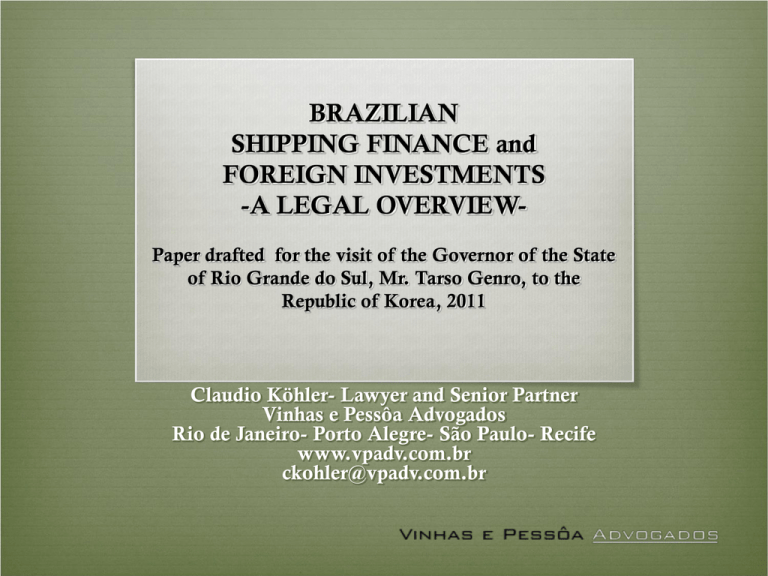

BRAZILIAN SHIPPING FINANCE and FOREIGN INVESTMENTS -A LEGAL OVERVIEWPaper drafted for the visit of the Governor of the State of Rio Grande do Sul, Mr. Tarso Genro, to the Republic of Korea, 2011 Claudio Köhler- Lawyer and Senior Partner Vinhas e Pessôa Advogados Rio de Janeiro- Porto Alegre- São Paulo- Recife www.vpadv.com.br ckohler@vpadv.com.br INTRODUCTION The Brazilian Financing System for the Shipbuilding Industry, main characteristics: All major aspects regulated by the Law transparent and predictable frame; Online electronic tax collection control of the AFRMM in all major Ports; Representatives of major Ministries and Private Industry Associations and Institutions are Voting Members of the most important Institutions of the Financing System (i.e. CDFMM, FGCN, FMM). Decentralized expert decision making. Refined follow up and control system; Very competitive financing conditions in local or foreign currency: fixed rates between 27%; grace period up to 4 years, value correction TJLP or USD/ PTAX, financing term up to 20 years and amount financed up to 90 % of approved projects New and effective Guarantee System by the FGCN, for the construction period of Yards and Vessels extremely important in view of the large finance requirements of the sector AFRMM public take semi private take FMM Banco do Brasil mainly shipbuilding and repair EBN EBN or EstBR Presentation Project: Ship or Shipyard other contributions to the Fund CDFMM Agent BNDES CEF FGCN Project financially approved Prioritized Project PERFORMANCE INSURANCE EBN ASSET Information, follow up and controls EstBR Shipbuilding project Shipyard Building project also repair/ modernization also amplification/ modernization NOMENCLATURE AFRMM- Brazilian Tax on disembarkation of freights Banco do Brasil- Financial Agent for the “semi private” AFRMM take EBN- Brazilian Shipping Company FMM- Brazilian Merchant Marine Fund Agent BNDES- Major Financial Agent for lending FMM funds EstBR- Brazilian Shipyard CDFMM- Steering Committee of the Brazilian Merchant Marine Fund CEF- Caixa Econômica Federal. Financial Agent for the FGCN FGCN- Guarantee Fund of the Brazilian Shipbuilding Industry Performance Insurance- ASSET- Vessel or Shipyard after construction Selected Financing Conditions Vessel/ Project supply origin local content fixed rates volume Cargo Ship national ≥ 65% 2- 4% 90% foreign ≥ 65% 3- 6% 90% national < 65% 2- 4.5% 90% foreign < 65% 3- 7% 70% national ≥ 60% 2- 4.5% 90% foreign ≥ 60% 3- 6% 70% national < 60 % 2- 4.5% 90% foreign < 60% 4- 7% 60% national ≥ 50% 2- 4.5% 90% foreign ≥ 50% 3- 6% 70% national < 50% 2- 4.5% 90% foreign < 50% 4- 7% 60% Supply Vessel Port Serv. Vessel Selected Financing Conditions Vessel/ Project supply origin local content fixed rates volume Passanger Ship national ≥ 30% 2.5- 5% 90- 100% foreign ≥ 30% 2.5- 5% 75% < 30% 2.5%- 5% 90- 100% < 30% 4- 6% 60% national ≥ 60% 2- 4.5% 90% foreign ≥ 60% 4- 6% 70% national < 60% 2- 4.5% 90% foreign < 60% 4- 7% 60% Shipyard construction/mo dernization Entry Market Requirements No entry market restrictions for foreign capital. Foreign investors may own up to 100% of a EBN- Brazilian Shipping Company or a EstBR- Brazilian Shipyard. At least two partners are required in order to incorporate (no single partner Corporation is available in the Brazilian legal system). The most common entities are the Brazilian Limited Liability Company Sociedade Empresária sob Responsabilidade Limitada (for smaller businesses, smaller and personal circle of partners) and the Stock Corporation- Sociedade Anônima (for medium to large size businessesissuance of securities, several categories of stock/ shares, bonds, etc., elaborated multi level administration/ management structure, rights of minority shareholders, shareholders agreements, etc.); There is also no nationality requirement in what regards the Management. Notwithstanding, persons nominated to participate in the management of a corporation with head office in Brazil shall be resident and domiciled in Brazil (visa requirements). An exception is a limited amount of Supervisory Board Members (Conselho de Administração) of a Brazilian Stock Corporation, which could be domiciled abroad; Market Entry Requirements All entities with a foreign partner must be registered before the Brazilian Central Bank. No exchange of currency between any nation and Brazil may occur without it; Widely protected IP Rights through registration at the INPI. International Registrations of Patents and Trademarks may be recognized by international treaties signed by Brazil