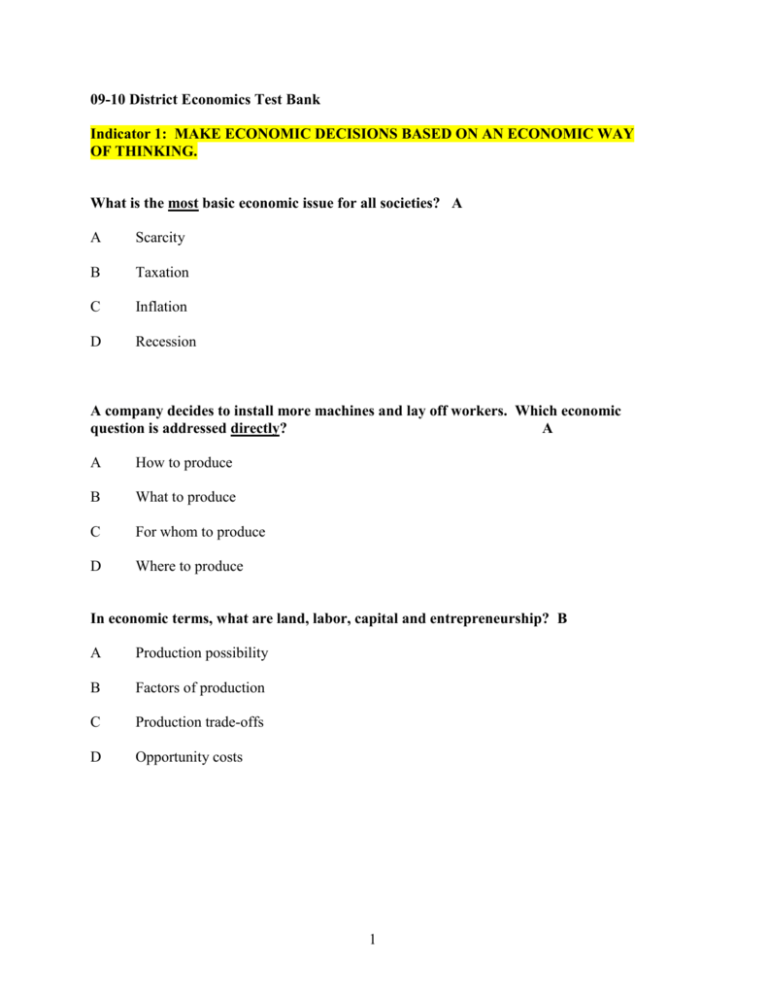

09-10 District Economics Test Bank

advertisement

09-10 District Economics Test Bank Indicator 1: MAKE ECONOMIC DECISIONS BASED ON AN ECONOMIC WAY OF THINKING. What is the most basic economic issue for all societies? A A Scarcity B Taxation C Inflation D Recession A company decides to install more machines and lay off workers. Which economic question is addressed directly? A A How to produce B What to produce C For whom to produce D Where to produce In economic terms, what are land, labor, capital and entrepreneurship? B A Production possibility B Factors of production C Production trade-offs D Opportunity costs 1 Jenny has enough money to buy either a CD or to go to a movie with her friends. In economics, what is the choice that Jenny “gives up” called? C A Positive cost B Negative cost C Opportunity cost D. Marginal cost What is the main idea behind the study of economics? A. Monetary policy B Efficiency of production C Allocation of scarce resources D Business decisions Read the statement below. “There is no free lunch.” In economic terms, what does this mean? A A Someone must pay for everything. B All production is designed to reduce scarcity. C Choices are never based on self-interest. D People only think of others when making choices. 2 C, How does the process of specialization change an economy? C A Eliminates unemployment B Decreases competition C Improves efficiency of production D Increases government to control Use the following “equation” to answer the two questions below. Unlimited Wants + Limited Resources = ????? Which of the following best completes the above “equation”? A A Scarcity B Competition C Savings D Equilibrium To deal with the problem described in the “equation” above, societies establish which of the following? B A Governments B Economic systems C Hierarchies D Private businesses 3 In every economic system, what must people choose to do? B A Satisfy all the wants of their society B Make the best use of scarce resources C Create an equal distribution of income D Save money to reduce the national debt Which of the following is an opportunity cost of building a new public high school? D A Cost of hiring teachers for all subjects at the new school B Change in the annual tax rate to pay for the new school C Cost of constructing the new school at a later date D Other goods and services given up in order to build the school Which of the following is a result of the specialization of labor? A Increased inflation B Identical income C Increased output D Less interdependence C In which of the following economic systems is the “factors of production” privately owned? A A Capitalism B Socialism C Socialism D Confucianism 4 Indicator 2: IDENTIFY PERSONAL INVESTMENT STRATEGIES. In economic terms, what is a “stock”? A A A share, or part ownership, of a company B Pieces of paper that represent money C Ownership of an entire company D A place where individuals raise money Which of the following decisions will guarantee that a person will make money in the stock market? E2 B A Buying the stock of a big company like Microsoft B Nothing will guarantee making money in the market C Buying the stock of a small company like Starbucks Coffee D Purchasing stocks after the market has dropped for a week 5 What is “compounding interest?” B A Interest subtracted from the principle once or twice a year B Interest gained on the principle and on interest already earned C Adding 5% or more interest to an item purchased the previous year D Liquefying your assets when a decision to move to another state is made What is the greatest advantage to diversification in a stock portfolio? C A Investors get more annual reports. B Investors concentrate on one stock. C Investors reduce their risks. D Investors are guaranteed a profit. Which of the following is true of an investment in bonds? C A They are insured by the Federal Deposit Insurance Corporation. B They are held for three to six weeks, then sold. C They are a low-risk investment. D They entitle the holder to a share of ownership in a corporation. Why is investing in a money-market mutual fund a higher risk than investing in a certificate of deposit? B A It is not insured by the Federal Deposit Insurance Corporation. B It does not earn a fixed rate of interest. C It is not protected by the Securities and Exchange Commission. D It must be held for a preset amount of time. 6 Which of the following describes what you are doing when you invest in a mutual fund? D A Getting insurance from the Federal Deposit Insurance Corporation B Getting a fixed return on your investment C Investing money in insurance policies from the federal government D Investing in a variety of stocks and bonds In June, Leslie won a cash prize of $2,000. She plans to use this money to pay her tuition bill four months later in September. Why would Leslie put this money in a savings account instead of a 1- year, 12 month, and certificate of deposit? C A Get a higher rate of return B Avoid paying property taxes C Assure liquidity of the account D Make a long-term investment Which of the following statements will help to maximize your stock investment? C A Buy low, sell low B Buy high, sell low C Buy low, sell high D Buy high, sell high Which of the following is the Rule of 72 intended to approximate? B A Net gain from a stock purchase B Number of years to double an investment C Risk profile of an investment D Average rate of return on an investment 7 Because bonds are considered a safe investment, which characteristic would you expect them to have? D A They take a short time to mature. B They have high interest rates. C They take a long time to mature. D They have lower rates of return. Which of the following describes a publicly held corporation? B A Stocks are not available to company owners. B Large numbers of stockholders can buy/sell stock C Stocks are not usually traded at stock exchanges D Family members are excluded from holding stock Your running shoes were designed in the United States and assembled in Asia. What type of a enterprise does this involve? B A General partnership B Multinational corporation C Trade association D Domestic monopoly Why invest in mutual funds instead of a single stock? A To diversify capital B To reduce risk C To increase profits D To decrease profits 8 E2 B Which strategy is most likely to improve a person’s financial situation over his/her lifetime? B A Using credit to spend more than one earns each pay period B Starting to save as soon as one begins earning an income C Gaining work experience early instead of staying in school D Making each financial decision quickly based on a hunch Indicator 3: COMPARE AND CONTRAST ECONOMIC SYSTEMS. In a market economy, what is the government’s role? A Decides what goods are manufactured B Owns and operates major industries C Encourage competition among businesses D Sets prices on goods and services C There is a country in which the government owns all the industries, businesses, and farms. The government sets production and wages. The government provides all education, childcare, and medical care for all the people. What type of economy does this describe? C A Market B Traditional C Command D Transitional 9 When comparing a traditional economy with a command economy, which of the following is true of both? A A Slow economic growth B Freely fluctuating prices C Private ownership of business D Support of business competition What is the economic system in which customs and religion of previous generations determine how the economy will use its scarce resources? D A Market B Transitional C Command D Traditional Which of the following is a characteristic of traditional economies? D A Fast growing communities B High standard of living C Light industrial production D Slow economic growth A government sets quotas and prints and distributes posters to inspire workers to increase their productivity. In which type of economy would this most likely take place? A A Command B Traditional C Market D Transitional 10 What is the benefit of competition in a free market system? B A Make sure everyone gets an equal share of resources B Create a variety of new and cheaper products C Cause producers to try to put each other out of business D Follow the traditional methods of production In general, what type of economy does the United States have? B A Transitional B Market C Command D Traditional What is the primary incentive that motivates a manufacturer to sell a product? A A Making profits on sales B Putting others out of business C Pleasing the government D Reputation of the product Which type of economy produces the highest standard of living for its citizens? B A Transitional B Market C Traditional D Command 11 Why would an inefficient factory close down under capitalism? A A Low or negative profits B Government mandates C A central planner’s decision D Adverse effects on income distribution Which of the following countries exhibit the characteristics of a market economy? A A United States B Cuba C North Korea D China Which characteristic best describes a traditional economy? A Labor unions and wages B Customs and religions C Communism and inflation D Markets and systems B Which of the following is a main feature of a command economy? B A Private ownership B Central planning C Heavy reliance on markets D Profit driven decision making 12 15 How are the basic questions of economics answered in a traditional economy? A People rely heavily on how things have always been done. B Large corporations compete for business. C The government generally owns all means of production. D Technological advancements encourage growth. Indicator 4: EXPLAIN HOW THE PRICE SYSTEM AFFECTS PRODUCERS AND CONSUMERS. In a market economy, what determines the price and quantity of most goods produced? B A Substitute goods B Supply and demand C Economic policies D Quality of goods In a market economy, when consumers and producers act in their own self-interest, which is most likely to be the overall result? C A The market will have less variety and fewer products will be made. B The consumer will pay excessively high prices for goods and services. C The producers are likely to earn a profit making products people want. D The individuals or businesses will lose money no matter what they sell. 13 What is the most likely to happen when consumers want to buy more scooters than the store has available for sale? B A Profit on scooter sales will be smaller. B Price of the scooter will increase. C Manufacturers will stop making it. D Stores will make a different model. Assume the government subsidizes the production of a good every year. Which of these would be the most likely result if that government stopped the subsidies? C A Increase in the number of producers B Better selection of products C Increase in the price of products D Better wages for workers On a supply and demand graph, what is the point called at which quantity demanded equals quantity supplied? B A Surplus B Equilibrium C Shortage D Equidistant Sugar is an important input in the production of cookies. If the price of sugar decreases, what would we expect to happen to the supply of cookies? B A No change B Increases C Decreases D Disappears 14 Which of the following is the best example of the law of supply? A A A sandwich shop increases the number of sandwiches when the price increases. B A supplier provides more shoes to local stores as prices of ladies shoes fall. C A catering company buys a new dishwasher to make employees’ work easier. D A milling company builds a new factory to process flour to export. Which of these actions would most likely result in a decrease in consumer spending? A A Increasing income taxes B Decreasing the interest rate C Increasing government spending D Decreasing the reserve requirement If a government sets a maximum price for a good or service, what does it create? A A Price ceiling B Price floor C Inflated price D Illegal price What is the result of a price ceiling which is a price set below the equilibrium price? A A Shortage B Surplus C Equilibrium D Equidistant 15 A hurricane hit Florida and destroyed half of the orange crop. What would most likely happen to the orange market? C A Demand for oranges will rise B The price of oranges will fall C The price of oranges will increase D Supply of oranges will increase How many businesses make up an oligopoly? A A Few B None C One D Most Which of the following describes a market in which one firm controls the supply and pricing of a good or service? D A Monopolist competition B Oligopoly C Perfectly competitive D Monopoly Which factor will decrease the demand for a product? B A Increased popularity of a product B A decrease in the number of buyers C A decrease in the price of a complementary good D An increase in the price of a substitute good 16 Study the graph and then answer the following question. Price D2 D1 Quantity In the graph above, if the demand curve moves from D1 to D2, what has happened? A A decrease in demand B An increase in demand C A decrease in quantity demanded D An increase in quantity demanded Denver Bronco tickets are sold out every year in spite of price increases. Therefore, Denver Bronco’s tickets are which of the following? C A Elastic B Equilibrium C Inelastic D Trade off 17 B Which financial instrument is the most “Liquid?” C A Checks B Bonds C Cash D Savings accounts Which of the following terms refers to the interest banks pay to borrow from other banks? A A Discount rate B Value added C Consumer Price Index D Penalty charges Which of the following is a competitive market that has only a few firms controlling the production of a product? B A Fierce competition B Oligopoly C Pure competition D Monopoly 18 5. DESCRIBE THE ECONOMIC ROLES OF THE US GOVERNMENT. When you use cash to buy a taco, how is your money functioning? D A As a store of value B As a unit of accounting C As a short-term loan D As a medium of exchange Which of the following is an economic goal of United States government policy? D A To own the factors of production B To limit international competition C To create a classless society D To promote full employment Study the table below and then answer the following question. Income $ 0 - $ 10,000 $ 10,001 - $ 30,000 $ 30,001 - $ 60,000 $ 60,001 and above STATE TAX TABLE Percentage Tax Rate 0 10 20 30 What of the following is described in the above tax table? A A A progressive income tax B A flat tax on income C A regressive income tax D A value added tax on income 19 Which of the following is the best measure of a nation’s standard of living over time? D A Rate of savings B Rate of unemployment C Rate of inflation D Real GDP per capita Which of the following would result in a decrease in consumer spending? A A Increasing income taxes B Decreasing the reserve requirement C Increasing government spending D Decreasing the interest rate What would the Federal Reserve Bank (FED) do to fight inflation? B A Tell the U.S. Mint to make more money B Slow the growth of the money supply C Encourage people to make more money D Keep the supply of money the same How would you be using money if you were saving for a new car? A Store of value B Medium of exchange C Measure of value D Short-term loan 20 A Which of the following would be an example of using money as a measure of value? D A Saving $100 a month for college B Buying stock on the stock market C Purchasing a hot dog for lunch D Pricing clothes for a yard sale What tool does the Federal Reserve Board (FED) use to control the money supply during an inflationary period? C A Federal taxes B Government spending C Discount rate D Foreign trade In the United States, which of the following is the responsibility of the Federal Reserve Board (FED)? C A Writing tax laws B Setting guidelines for investors C Controlling the supply of money D Making trade agreements What organization controls monetary policy in the United States? A Federal Reserve Board (FED) B Federal Trade Commission (FTC) C Securities and Exchange Commission (SEC) D Department of Transportation (DOT) 21 A 23 Which of these best reflects how the government attempts to manage the economy through fiscal policy? C A Controlling interest rates B Controlling the money supply C Taxing and spending D Buying and selling securities Which of these consumer activities is most influenced by the Federal Reserve Board (FED)? A A Getting a home mortgage B Purchasing an airplane ticket C Buying a prescription drug D Reading nutritional labels on foods What happens when a country’s money supply increases faster than the goods and services it produces? A A Inflation B Unemployment C Equilibrium D Stability Which of these does the Gross Domestic Product (GDP) represent? A The amount of reserve funds that banks are required to hold B The rate of interest charged on reserve funds lent to banks C The total value of finished goods and services produced in a year D The change in the average price of consumer goods and services 22 C Why does a free market economy need some government intervention? A To provide for things that the marketplace does not address B To ensure that the government has the freedom to tax as needed C To make sure consumers get an equal share of the resources D To prevent businesses from becoming too profitable Which type of tax does the federal government impose on incomes? A Proportional B Regressive C Progressive D Absolute A C Which of the following government actions is likely to stimulate the economy? D A Increase income taxes and increase government spending B Decrease income taxes and decrease government spending C Decrease government spending and increase incomes taxes D Increase government spending and decrease income taxes Which of the following government actions is designed to decrease inflation? C A Hire more government employees B Decrease federal income tax C Reduce the money supply D Increase government spending 23 Which of the following situations would result in a government budget deficit? A The Federal Reserve borrows more than it lends. B The government spends more than it collects in taxes. C The Federal Reserve lends more than it borrows. D The government spends the same as it collects in taxes. Which of the following is a characteristic of a public good? A It conveys benefits only to the purchaser B Non-exclusion and shared consumption C It is for the use of government officials only D Ability to pay is essential for the use of the good B Which of the following factors contributes the most to economic growth? B A Large amounts of natural resources B Greater economic freedom C Low investment in human capital D High rates of inflation The term “laissez faire” refers to which of the following concepts? A Command economies B Limited government controls C Government regulation D French monarchies 24 B B Your country is in a period of slow economic growth, rising unemployment, and businesses are not producing goods. Which of the following situations describes your country? 5D A Inflation B Anxiety C Democracy D Recession Your country is in a period of “galloping” inflation. What would you do to the discount rate to eliminate this problem? 5A A Raise it B Leave it alone C Lower it D Transfer it 25 Indicator 6: DESCRIBE THE IMPACT OF TRADE AND GLOBAL INTERDEPENDENCE ON THE US ECONOMY. Use the chart and your own knowledge to answer this question. Which of these best explains Japan’s need for imports? D A An unskilled workforce in Japan B A global scarcity of natural resources C A surplus of electronics in other countries D a shortage of natural resources in Japan Read the excerpt below, then answer the question which follows. “If a foreign country can supply us with a [product] cheaper than we ourselves can make it, better buy it [from] them…” -Adam Smith, The Wealth of Nations, 1776 Based on the excerpt, which of these government actions would Adam Smith support? B A Raising taxes on imported goods B Entering into free trade agreements C Increasing wages paid to workers D Passing strict regulations on businesses 26 Which of these is an economic benefit of tariffs on goods imported into the United States? C A Prices of goods made in the United States will decrease. B United States businesses will attract more imports from other nations. C United States businesses will have less competition from foreign companies. D Competition among producers in the United States will remain the same. Which of these best explains why the United States might place tariffs on imports? C A To cause the price of goods made in the United States to decrease B To promote trade between the United States and other countries C To encourage consumers in the United States to buy American products D To increase the variety of products that are available in the United States Which of these is a goal of the North American Free Trade Agreement (NAFTA) member nations? C A Create a common currency B Forgive common debts C Eliminate most tariffs D Provide relief for refugees When a nation imports more than it exports, economists say it has which of the following? C A A trade surplus B A balance of trade C A trade deficit D A national debt 27 Study the cartoon and then answer the following question. Which economic concept caused the situation illustrated in the cartoon? A A Global trade B Embargoes on foreign products C International aid D Global trade restrictions What is the effect of trade barriers on the economy? A Higher quality of goods B Price of goods will increase C Higher supply of goods D Increased variety of goods 28 B Which of the following is an example of free trade? B A Japan is limited by the US government to selling 10 million cars in the US. B A Mexican farmer sells a truckload of watermelons to a grocery store in Texas. C An American importer brings back Italian shoes and has to pay a 50% tariff. D United States businessmen are not allowed to sell Cuban cigars in urban stores. If Great Britain has a comparative advantage over France in the production of cars, which of the following is true? B A Britain and France should not trade. B Britain should export cars to France. C France should export cars to Britain. D Neither Britain or France will gain from trade. 29 Which of the following statements about tariffs is true? D A They decrease the cost of most imported goods. B They benefit all nations engaged in global trade. C They decrease employment in protected industries. D They benefit some nations at the expense of others. How does the process of specialization affect an economy? A It eliminates unemployment in an economy. B It makes an economy more efficient. C It creates shortages within an economy. D It makes an economy easier to control. B Which of these is usually a result of free trade between economies? A More tariffs on goods B Higher tariffs on goods C More goods in the market D Fewer goods in the market What is the effect of import restrictions on prices? A They cause prices of items to rise. B They have no lasting effect on prices. C They cause prices of items to drop. D They cause prices to steeply rise then fall. 30 A C What happens when the United States trades wheat to Saudi Arabia in exchange for crude oil? A A The United States and Saudi Arabia both gain. B The United States gains and Saudi Arabia loses. C The United States and Saudi Arabia both lose. D The United States loses and Saudi Arabia gains. Which of the following is an example of voluntary trade? D A A person is mugged and their money is stolen B A person is kidnapped and returned when a ransom is paid C Citizens are required to pay taxes to support public education D A music teacher is paid to give private lesson to a violin student 31