bus241syl06fall

advertisement

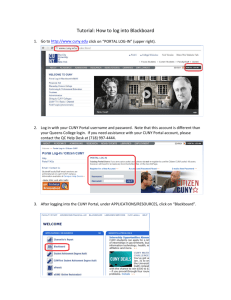

Queens College Department of Economics Corporate Finance, Business 241 Fall 2006 Prof. Nix Course objective: The primary objective of the course is to understand fundamental principles of corporate finance. This will be accomplished through application of specific principles to topics such as the time value of money, the valuation of stocks and bonds, the evaluation of risk/return relationships, and capital budgeting. Office hours: Days: Wednesdays and Fridays Hours: 10:00-10:30 AM and 1:00-1:30 PM, 3:00-3:30PM. Appointment is strongly suggested. Place: Powdermaker, Room 306G Email: joan.nix@qc.cuny.edu Grade: 20% of the grade is based on the midterm, 30% of the grade is based on a final exam, and 20% is based on your performance in the lab. The remaining 30% is distributed as follows: team quizzes will count as 20% and 10% will be based on teamwork during class. You are expected to attend the classes on time. Absence from a class or lateness to class will result in penalty points that will be deducted from your teamwork grade. Opportunities for bonus points will be provided throughout the semester. Bonus points will be added to your team performance grade and/or individual exam grades. Of course, absence from a team performance assessment task implies that you will get zero for that task. Study Groups: Participation in study groups is mandatory. There should be no more than four students to a group. Effective Studying: There are 168 hours in a week. You will spend three hours per week in this class. Most of the work for this course will be done outside of class. The assignments are structured to encourage consistent attention to the material each week. Expect to spend three to four hours on the material each week. Page 1 of 4 General Comments: Various teaching methods will be employed to communicate the course content. Please recognize that the primary method employed is student centered team exercises. If for any reason you feel uncomfortable with this approach, there are alternative sections of this course that rely on the more traditional instructor centered lecture method. Your commitment to serious team work is considered part of the classroom contract you have agreed to by registering for this course. Text: Required: Principles of Finance with Excel, by Simon Benninga. Web Page for Class via Blackboard.com: The webpage for the class is available through blackboard. Access to blackboard has changed, it is now done through the CUNY portal. You must get a portal ID. You may obtain a portal ID, by clicking on “login” in the CUNY portal page, www.cuny.edu. This should be done immediately. After you log in to the portal, there is a link to blackboard. Lecture123-A software package that enables the lecture to record what I say and write on the tablet for your access outside of the class is used. In order to access the material you need both a community: 2006_Fall_Bus_241 and key: bus241fall06. Follow these steps: 1) visit http://www.lecture123.com/qc.cuny click “Student Jump Start.” 2) Install lecture123- follow instructions on the Install Web Page. 3) Create a user account-go to create an account web page, enter key=bus241fall06, and rest of the information. 4) Review getting started web page. Page 2 of 4 Schedule of Classes I. Session 1 Topic: Introduction to Finance Required Readings: Benninga: Chapter 1 ______________________________________________________________________________ II. Sessions 2,3.4, and 5 Topic: Time Value of Money Team Quiz #1: material from chapters 5 and 6 will be covered. Required Readings: Benninga: Chapters 5 and 6. III. Sessions 6,7, and 8 Topic: Capital Budgeting Required Readings: Benninga: Chapter 7 Team quiz #2: Material from chapter 7. ____________________________________________________________________________ IV. Sessions 9 and 10 Topic: Cost of Capital Required Readings: Benninga: Chapter 9 Team Quiz #3 Page 3 of 4 V. Sessions 11-22 Topic: Risk and Return Required Readings: Benninga: Chapters 11-14. MIDTERM: FRIDAY, OCTOBER 20TH. VI. Sessions 23-26 Topic: Valuation of Stocks and Bonds Required Readings: Benninga: Chapters 18-19 Team Quiz #4 Page 4 of 4

![[Podcast Release Date] - Baruch College](http://s3.studylib.net/store/data/008359763_1-82cf867f872dc479cb445ad091ea0f0c-300x300.png)