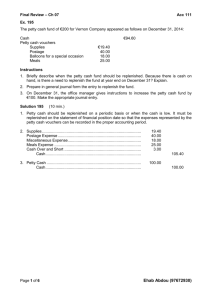

EXERCISE QUESTION

advertisement

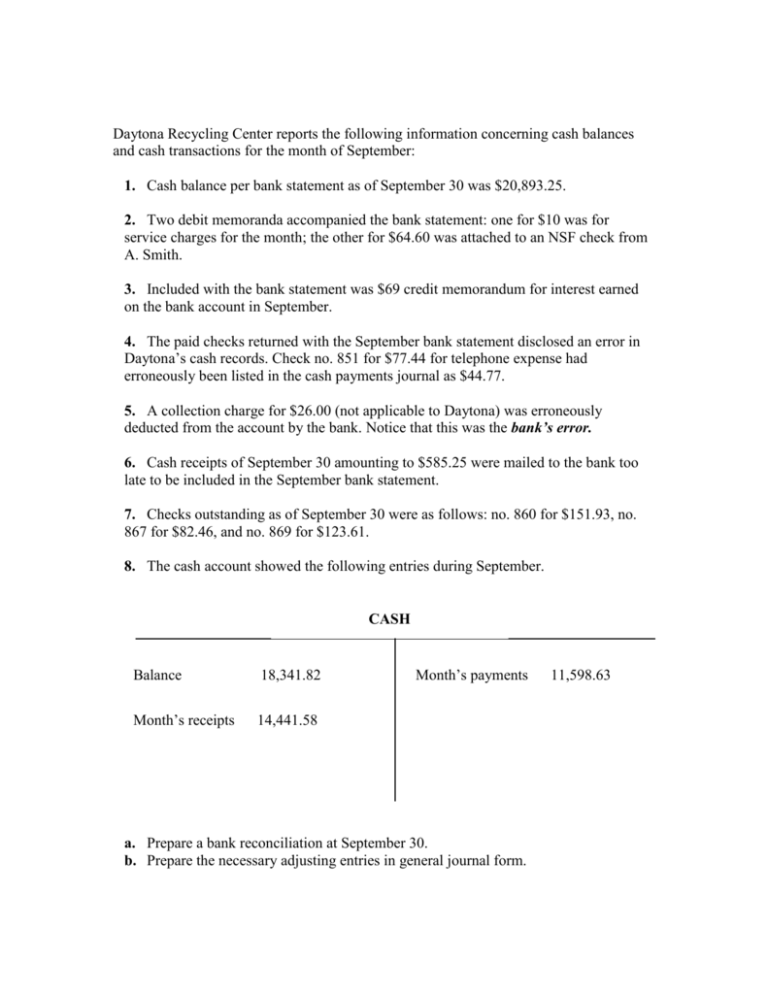

Daytona Recycling Center reports the following information concerning cash balances and cash transactions for the month of September: 1. Cash balance per bank statement as of September 30 was $20,893.25. 2. Two debit memoranda accompanied the bank statement: one for $10 was for service charges for the month; the other for $64.60 was attached to an NSF check from A. Smith. 3. Included with the bank statement was $69 credit memorandum for interest earned on the bank account in September. 4. The paid checks returned with the September bank statement disclosed an error in Daytona’s cash records. Check no. 851 for $77.44 for telephone expense had erroneously been listed in the cash payments journal as $44.77. 5. A collection charge for $26.00 (not applicable to Daytona) was erroneously deducted from the account by the bank. Notice that this was the bank’s error. 6. Cash receipts of September 30 amounting to $585.25 were mailed to the bank too late to be included in the September bank statement. 7. Checks outstanding as of September 30 were as follows: no. 860 for $151.93, no. 867 for $82.46, and no. 869 for $123.61. 8. The cash account showed the following entries during September. CASH Balance 18,341.82 Month’s receipts 14,441.58 Month’s payments a. Prepare a bank reconciliation at September 30. b. Prepare the necessary adjusting entries in general journal form. 11,598.63 a. DAYTONA RECYLING CENTER BANK RECONCILIATION September 30 Balance per bank statement, September 30 Add: Deposit in transit Error Correction Subtotal Less: Outstanding checks: no. 860 no. 867 no. 869 Total outstanding checks Adjusted cash balance per bank statement Balance per accounting records Add: Interest Earned Subtotal Less: NSF check returned Bank service charges Error Correction $ $ $ 20,893.25 $ 611 21,504.25 $ (358) 21,146.25 585 26 151.93 82.46 123.61 $ $ $ 64.60 10 32.67 211,84.77 69 21,253.77 (107.27) Adjusted balance per accounting records $ 21,146.25 b. General Journal July 31 Cash at Bank Interest Revenue Accounts Receivable Cash at Bank Service Charge Expense Cash at Bank Telephone Expense Cash at Bank 69 69 64.60 64.60 10 10 32.67 32.67