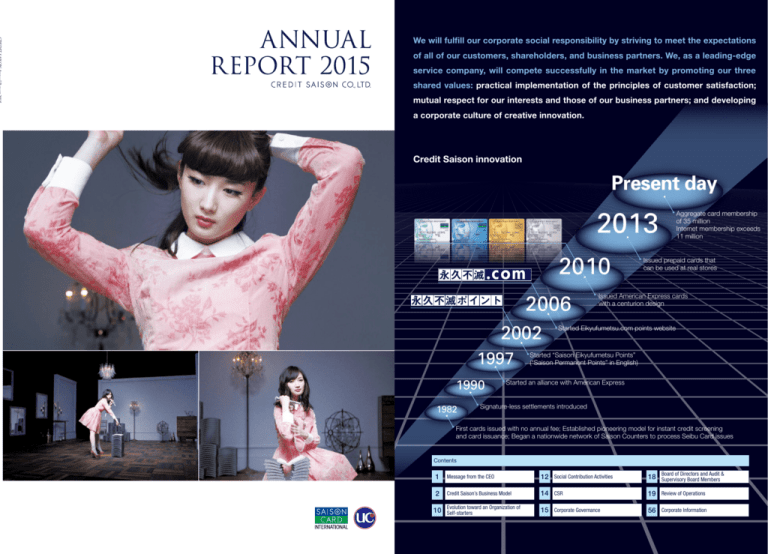

19 Credit

advertisement