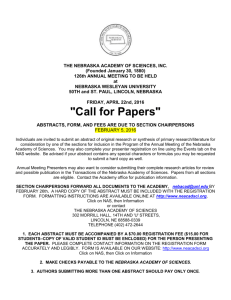

Ethics First - Nebraska Chapter

DECEMBER

CURRENT ISSUES FOR HEALTHCARE FINANCIAL MANAGERS

Aaron Beam presents

Ethics First

“

Wrong is wrong

even if

everyone is doing it.

Right is right

even if

"Ethics First" is the primary message Aaron Beam conveys to his audiences. His experience with HealthSouth and the research he’s done about ethics in American business, qualifies him to deliver this compelling story and message on the value of ethical behavior, and the process of achieving it.

Aaron Beam’s story is “the untold story of HealthSouth” one of America’s most successful health care companies and subsequently the perpetrator of a $2.8 B accounting fraud, one of the largest in American history.

Mr. Beam was the first CFO at Healthsouth Corp., and as a co-founder witnessed firsthand the series of accounting, stock manipulation and leadership failures that led

Healthsouth to the $2B securities fraud scandal and ultimate prosecutions of Richard

Scrushy. He relates to students and professionals the heights of success, followed by the unethical and illegal mistakes that led to his professional downfall. Serving three months in federal prison for his role in approving fraudulent quarterly numbers in 1996 and losing his CPA credentials, led Mr. Beam to his current speaking career; trying to make a positive difference by educating others about the pitfalls of unethical business practices.

Through his Ethics First message he identifies early warning signs, influences and the bad choices he and others made at Healthsouth, allowing the audience to apply what they learn to their business practices and the organization's culture and environment.

no one is doing it”

(Continued)

IN THIS ISSUE

2014

President’s

Message ........................ 2

Region 8

Connection .................... 4

Financial

Statements .................... 6

Sponsor

Spotlight ...................... 11

New Member

Spotlight ...................... 12

Photo Gallery ............... 16

DECEMBER | 2014 Nebraska Healthbeat

President’s

Message

By Troy Bruntz

Tis the season to be enrolling potential patients into the insurance exchange (oh, and to be jolly I suppose ). The insurance exchanges are beginning a second year with increasing premiums and the ACA’s penalties are increasing as well. Throw in the fact that by Easter the Supreme Court may toss out the subsidies in the Federal Exchange and we could be in for a fun spring. Regardless of our thoughts on the ACA or on the lack of

Medicaid Expansion in Nebraska, as healthcare leaders our communities will continue to look to us for advice and education about the subject. Therefore, HFMA will continue to provide education both live and via webinar at the National and Chapter levels regarding Healthcare Reform.

In addition to the Supreme Court’s decision this coming spring, we will also have a major change in the leadership in Washington.

With the results of the November election, the Republicans will control both the House and Senate. It will be important for us as leaders to stay alert and provide input when we can to our representatives. In January at our Winter Meeting in Kearney,

Joe Harnisch, our Vice President and Programming Chair, has both a Washington and a Nebraska Legislative update planned.

In my last article I explained that membership would be our toughest goal to achieve this year. With two consecutive years of large growth in membership we anticipated a tough time maintaining our membership numbers this year. Thanks to the membership committee and the board, I am happy to announce that as of the end of November we only need one more member to join to meet our goal. With five months to go, that shouldn’t be a problem.

The Chapter survey results will be reported to us soon. We are looking forward to seeing how we did in your eyes this past year and more importantly what you would like us to focus on in the future. After I receive the results, I will review them with everyone prior to the start of our following meeting. Thanks everyone for your attendance at our events live and via webinar so far this year. It is a pleasure serving you this year.

Troy Bruntz, CPA, FHMA

President, Nebraska HFMA

(Ethics First Continued)

Moreover, Beam reveals the nature and specifics of the fraud and the twisted personality of the driving force behind HealthSouth – Richard Scrushy. Scrushy was a hard-charging, unscrupulous visionary whose caustic, selfish motives and manipulation of Wall Street; despite

HealthSouth’s meteoric success, led to his fall from grace and expulsion from the company he created.

Aaron Beam, Jr. learned a lesson the hard way. His is a cautionary tale with a moral for all: "You have to stand up for what you believe in - or you may be the guy that goes to prison and pays the price."

Please plan to hear Aaron Beam’s message at the

Nebraska HFMA conference on Friday, January 30, 2015 in Kearney Nebraska. This program will be submitted to the Nebraska Board of Public Accountancy for Ethics CPE credit for your CPA permit renewal.

2

DECEMBER | 2014 Nebraska Healthbeat 3

DECEMBER | 2014 Nebraska Healthbeat

Region 8

Connection

By Tracy Packingham

Happy New Year!!! As I write this, the football season is winding down and the Super Bowl is right around the corner. It reminds me of what a great team we have within HFMA.

“

TEAM

”

T ogether E veryone A chieves M ore

I believe that TOGETHER we can truly achieve anything.

Being part of the HFMA Line Up has been a phenomenal journey that I have had the opportunity to be a part of.

As I talk with other members, officers and colleagues, I realize that I am not alone in this reflection. The chapter leaders and members of Region 8 make a fabulous team.

Please reach out and become part of your chapter.

Regardless of whether you are a sports fan, be a fan and love the Association of which we are a member. Become a part of a “team” of dedicated healthcare Professionals.

“Lead the Change”, with the constant change we all have talents and contributions. Not one of us can do it ALL.

Get involved and make the most out of your membership.

Thank you for the continued support of all of our officers, directors, volunteers and members. Our chapters are truly exceptional. Region 8 ROCKS!!!

Tracy Packingham

Regional Executive

HFMA Region 8

@nehfma

4

DECEMBER | 2014 Nebraska Healthbeat 5

DECEMBER | 2014 Nebraska Healthbeat

Financial Statements

September 30, 2014 and 2013

Submitted by Rebekah Mussman, Treasurer

ASSETS

Current assets:

General checking

Accounts receivable

Prepaid expenses

Total current assets

Investments (certificates of deposit)

Total assets

LIABILITIES AND NET ASSETS

Current liabilities,

Accounts payable

Net assets,

Unrestricted

Total liabilities and net assets $

Days cash on hand

Actual Annual Expenses for Prior Year End $

$

$

$

September 30, September 30,

2014 2013

19,190

2,561

766

22,517

53,880

76,397

-

76,397

76,397

(FY 2014 exp)

135,850

5,325

4,000

2,472

11,797

79,269

91,067

4,087

86,980

91,067

(FY 2013 exp)

144,341

Days cash on hand (Using ave of 2 PY expenses)

2015

190

2014

227

REVENUE

Education

NHA mid-year conference

Winter conference

Spring annual meeting

Education Finance 101

Nebraska/Iowa meeting

NHA annual meeting

Revenue Code Boot Camp

Dinner Meetings

Other income

Dues rebate - National HFMA

Interest income

General sponsorship

Meeting sponsorship

Free/reduced registration fees

Total revenue

(FY 2012 exp) EXPENSES

127,600 Education

NHA mid-year conference

Winter conference

Spring annual meeting

Education Finance 101

Nebraska/Iowa meeting

Studer excellence in leadership

NHA annual meeting

Region 8 Webinar

Revenue Code Boot Camp

Education Audio Teleconference

Dinner Meeting

Meetings

Annual national institute

Fall presidents meeting

Leadership training

Strategic planning meeting

Other expenses

Newsletter

Certification

Golf outing

Social events

Directory

Member recognition

Member survey

HFMA Awards

Registration

Website

Office supplies / copying

Regional executive expenses

Membership committee expenses

Generations committee expenses

Sponsorship committee expenses

Bank service charge

Credit Card Merchant Fee

Adminstrative Expenses

Insurance

Total expenses

INCREASE/(DECREASE) IN NET ASSETS

FYTD 2015

Actual

FY 2015

Budget

Variance

Favorable

(Unfavorable)

-

FYTD

2014

$ - 11,280

- 10,050

- 16,640

195 -

- 17,000

- 31,325

- 10,920

560 1,000

755 98,215

(11,280)

(10,050)

(16,640)

195

(17,000)

(31,325)

(10,920)

(440)

(97,020)

160

-

-

1,092

-

-

-

1,252

-

41

-

1,000

-

1,041

1,796

8,000

175

37,000

3,000

(14,920)

33,255

131,470

(8,000)

(134)

(37,000)

(2,000)

14,920

(32,214)

(129,234)

-

70

5,500

-

-

5,570

6,822

-

-

-

-

-

2,000

-

-

-

-

865

2,865

11,000

9,000

21,000

-

17,000

2,000

12,000

2,000

12,000

1,000

1,000

88,000

11,000

9,000

21,000

-

17,000

-

12,000

2,000

12,000

1,000

135

85,135

-

-

-

1,283

-

2,000

-

-

9,214

12,497

3,706

1,096

-

-

4,802

5,680

2,000

11,000

1,000

19,680

1,974

904

11,000

1,000

14,878

9,219

1,354

-

-

10,573

$

100

395

-

-

500

-

-

-

-

-

-

-

-

-

-

21

-

-

-

1,016

8,682

(6,887)

500

500

100

1,500

84

550

1,400

650

28,784

136,464

(4,994)

600

8,200

2,000

4,000

3,000

2,500

200

300

1,600

600

500

500

500

100

1,500

63

550

1,400

650

27,768

127,782

(1,453)

500

7,805

2,000

4,000

2,500

2,500

200

300

1,600

600

500

100

-

-

500

-

-

81

699

541

178

-

-

-

28

-

-

2,128

25,199

(18,377)

6

DECEMBER | 2014 Nebraska Healthbeat 7

DECEMBER | 2014 Nebraska Healthbeat

Board Minutes

May 22, 2014

Submitted by Rebekah Mussman

Secretary, Nebraska HFMA

Board Members and Officers Present: Mandy Kumm

(Past President), Troy Bruntz (President), Dan Schonlau

(President-elect), Joe Harnisch (Vice-President), Rebekah

Mussman (Secretary), Andy Kloeckner (Treasurer), Louise

Hoffman (Director), Sean Wolfe (Director), David Burd

(Ex-officio Director). Absent: Erik Carlson (Director), Rick

Rogers (Director), Renee Fink (Director). Committee and

Other Members Present: Whitney West (Membership),

Shelly Soupir (Newsletter), Cindy Cherry (Strategic

Planning), Bo Hansen (Website / Technology), Jill McClure

(Sponsorship), Dan Peters (Sponsorship), Bryce Betke

(Strategic Planning), Mike Clymer.

I. Call to order

The meeting was called to order at 11:50am CT at the

Younes Conference Center, Kearney, NE.

II. Approval of Agenda

Vice President made a motion to accept the agenda as proposed. Motion was seconded by President Elect.

Motion passed.

III. Approval of Consent Agenda

Past President made a motion to accept the consent agenda. Motion was seconded by Vice President. Motion passed.

IV. Treasurer’s Report

Secretary presented the financial statements as of April

30, 2014, with a comparison to prior year results.

Liabilities and assets show a decrease of approximately

$45,533 from prior year, with days cash on hand at 255.

Revenue and expenses were reviewed, compared to prior year as well as to budget. Revenue and expense has been reconciled between Iowa, Minnesota, and South Dakota

HFMA for the Joint Meeting. Revenue and expense has been reconciled with Iowa HFMA for the Cost Report

Bootcamp. The Vice President made a motion to approve the report as presented. President Elect seconded the motion. Motion passed.

V. CBSC/DCMS Reports

Vice President reviewed the Chapter Balanced Score Card and the DCMS reports. Our Chapter has completed all of the goals set on the CBSC and in turn has received 100% score this year, similar to years past. Education ended up at 26.7 education hours per member, resulting in the

Platinum Award for Education. Membership ended up at

329 members, resulting in the Gold Award for

Membership. Certification ended up at 19.5%, resulting in our Chapter having the highest percentage of certified members compared to all other Chapters. Overall membership satisfaction was 94%, the highest percentage compared to all other Chapters. Days Cash on

Hand and Provider Composition of the Board was within the acceptable ranges, and all on-time reporting requirements were met. Overall, our Chapter had an excellent year. Past President reported that all Yergers submitted for our Chapter (4 single, 2 joint) won.

VI. Member Committee Reports

Programming – Goal for 2014-2015 is to achieve the

Platinum Award, which is estimated to be around 27 hours per member. Two new initiatives in 14-15 include a timely 340b “mega-rule” webinar that is tentatively scheduled for August 5th as well as a Dinner Meeting in

Omaha, tentatively scheduled for September. Future events include the Revenue Code Boot Camp - scheduled for November 19-21 in Omaha, the Joint Meeting – tentatively scheduled for late February, and the Winter

Meeting in Kearney. Possible administrative help from the Nebraska Hospital Association was discussed. Troy plans on setting up a call in the near future with NHA as well as others to discuss the available options. Discussion also ensued on participating in the keynote speakers with

NHA at the NHA Annual Meeting in October. The

Programming Committee will be discussing this topic in a future call.

Membership – Concern about achieving the CBSC membership goal was discussed. Membership plans to attack the non-renewer list early and if need be use membership promotions throughout the year in order to reach the goal. One of membership’s goals for 14-15 is to focus on communicating the value of HFMA to employers.

Certification – Goal for 14-15 is to achieve 20% certified percentage. There are currently 16 potential candidates to take the test.

(Continued)

8

DECEMBER | 2014 Nebraska Healthbeat

(Board Minutes Continued)

Sponsorship – Jill reported on the cost / benefit analysis that was recently conducted. She will be sending out these results for review in the near future. Goals for 14-15 include changing some processes related to sponsorship recognition during the Award Ceremony at the Annual

Meeting, as well as coordinating with Newsletter to be able to showcase Sponsorship highlights. Jill passed out a draft brochure of the On Demand Education request for information she plans to send out to Sponsors. Sponsors will be given the opportunity to present “on demand” education to members at provider locations if members are interested. Jill plans to send out the request for information to sponsors within the next couple of weeks.

Newsletter – Next issue will be going out in the near future.

Awards / Social – A gathering is coordinated for the Mid-

Year Meeting at the Chicken Coop.

Generations – Goal is to increase the millennial committee members by 1 to fill the need of the website and technology committee.

Website / Technology – The Committee will be meeting in the next couple of weeks to formulate their plans for the upcoming year

VII. Strategic Planning Report

Cindy reported that the Strategic Plan is ready for review and approval.

VIII. Executive Committee Report

No business

IX. New Business a.

Electronic Directory vs. Paper.

There was discussion regarding migrating the Paper

Directory to an electronic version. David explained that the estimated cost savings would be around $1400.00, considering the volumes are similar to the previous year. After discussion it was decided to have the 2014-2015 Directory in an electronic format instead of the traditional paper format. b.

Certification Reimbursement Limits.

There was discussion regarding the Certification

Committee’s recommendation to pay a portion of the retake fee for the five individuals who participated in the certification course and sat for the test by April 30, 2014 and did not pass the exam. The amount of reimbursement would depend on whether or not the individual passed after the second or third time. Secretary made a motion to accept the Certification Committee’s recommendation as stated. Vice President seconded the motion. Motion passed. c.

2015 Operating Budget.

Rebekah presented the proposed 2015 Operating Budget. The budget contains the above certification reimbursement decision as well as reallocation of the cost savings of an electronic directory to administrative help for programming.

Certification expenses from 2013-2014 were forwarded to 2014-2015 in order to reach the

20% certification goal. The proposed budget results in a $4,994 loss, however the loss is resulting from the certification expenses being forwarded from 2013-2014. President Elect made a motion to accept the budget as presented.

Sean Wolfe seconded the motion. Motion passed. d.

2015-2017 Strategic Plan.

Cindy discussed the

Strategic Plan and asked for recommendations or changes. A request was made to update the

Sponsorship Committee Chairs to Jill McClure and Dan Peters on Page 1 of the Plan. Vice

President made a motion to accept the Strategic

Plan as presented with the changes noted.

Louise Hoffman seconded the motion. Motion passed. e.

2014-2015 CBSC.

Troy discussed the 2014-2015

CBSC. Payers can now be considered providers in regards to Board Composition. f.

2014-2015 Operational Goals.

The Eleven

Operational Goals were discussed. President elect made a motion to accept the operational goals as stated. Past President seconded the motion. Motion passed. g.

2014-2015 Due Dates.

The DCMS Due Dates were discussed. h.

Membership Awards.

Jill and Dan requested that the group submit ideas to them regarding membership awards that could be presented by

Sponsors to Members throughout the year or during the Awards Ceremony at the Annual

Meeting in March.

Meeting was adjourned at 12:54 pm

Respectfully submitted,

Rebekah Mussman

Secretary – NE HFMA

9

DECEMBER | 2014 Nebraska Healthbeat

Board Minutes

July 25, 2014

Submitted by Rebekah Mussman

Secretary, Nebraska HFMA

Board Members and Officers Present (Via Conference

Call): Mandy Kumm (Past President), Troy Bruntz

(President), Dan Schonlau (President-elect), Rebekah

Mussman (Secretary), Andy Kloeckner (Treasurer), Louise

Hoffman (Director), Sean Wolfe (Director), Rick Rogers

(Director), Erik Carlson (Director). Absent: Joe Harnisch

(Vice-President), David Burd (Ex-officio Director), Renee

Fink (Director).

I. Call to Order

The meeting was called to order at 1:00 pm CT.

II. Financial Review

The financial review was completed by KPMG and reviewed by the board. Andy Kloeckner discussed the process of the review and no further discussion was necessary. Dan made a motion to approve the review as submitted and Rebekah seconded the motion. The motion passed.

III. 990 Information for National 990 Filing

Andy Kloeckner reviewed the 990 Information Return with the board. Andy explained that the information was reviewed with National staff and determined accurate.

Dan made a motion to approve the information for submission to National HFMA and Rick seconded the motion. The motion passed.

Troy discussed the forms to be submitted to national and explained who was responsible for signing each form and the fact they would be emailed to National later this day to comply with the August 1st deadline.

IV. Membership Plans for This Year

Troy spent a moment discussing membership. Nonrenewer lists are out and we have about 65 non-renewers.

Troy mentioned that the Membership Committee will be discussing their plans for this year and follow up communication with the board will be coming.

Meeting was adjourned at 1:30 pm

Respectfully submitted,

Rebekah Mussman

Secretary – NE HFMA

10

DECEMBER | 2014 Nebraska Healthbeat

Sponsor

Founded in 1999, Magnet Solutions (MS) is a sister company to the well-established Accelerated

Receivables Solutions (ARS). With ARS specializing in bad debt recovery, our specialty with Magnet Solutions is in healthcare receivables outsourcing. We offer custom-made solutions, designed specifically to meet the needs of your organization. Our Patient Account

Representatives become an extension of your in-house accounts receivable department, acting on behalf of your medical facility or practice with the same integrity and professionalism you would expect from your own staff. We bring talent, expertise, and a proven track record for success to the accounts receivable marketplace. To put it simply, we collect more dollars on more accounts than your organization has likely seen in many years.

Our Staff

Customer service is paramount to the success of MS.

Our representatives are trained to treat all patients/ guarantors with the utmost respect and to provide them with a dignified experience while working to satisfy their bill. Our representatives are sensitive to the fact that some patients will require time to satisfy an outstanding balance; however, our representatives will always attempt to minimize that time required, and will work with a cooperative patient to achieve a mutually acceptable resolution.

Our representatives have achieved or are currently pursuing certification as Certified Patient Account

Technicians (CPAT) and or Certified Clinic Account

Technician (CCAT) through the American Association of Healthcare Administrative Management (AAHAM).

Spotlight

The CPAT certification gives our team a greater understanding of the entire patient accounting process which helps them in their communication with guarantors and debtors.

Services

Early Out Self-Pay Recovery

Presumptive Charity Scoring

Cash Acceleration Program (CAP)

Bad Debt Recovery (Provided Through ARS)

Wells Fargo offers Healthcare Solutions to help optimize your revenue cycle. Our Nebraska-based treasury management professionals can share best practices and proven solutions to improve patient collections and unlock cash from your claims outstanding and payable processes.

Our dedicated product management, sales, implementation, and customer service teams each have a thorough understanding of the healthcare industry.

Because Wells Fargo participates in the industry’s development, our team members are up to date and on top of changes. We provide subject matter expertise to the following industry groups:

HIMSS (Healthcare Information Management

Systems Society) Medical Banking & Financial

Systems Steering Committee

NACHA’s (National Automated Clearing House

Association) Healthcare Payments Task Force

The Clearing House (TCH) Healthcare Task Force

Wells Fargo & Company is a diversified financial services company providing banking, insurance, investments, mortgage, and consumer and commercial finance through more than

9,000 stores and 12,000 ATMs and the Internet across North

America and internationally. https://www.wellsfargo.com/com/industry/healthcare

11

DECEMBER | 2014 Nebraska Healthbeat

New Member

Spotlight

Cheryl Brown

Johnson County Hospital

AP/Controller

When did you join HFMA?

Oct 2014.

Bridget Leigh Miller

Box Butte General

Hospital

Controller

When did you join HFMA?

How did you learn about HFMA?

Co-workers.

Were there any particular factors

July 2014.

How did you learn about HFMA?

My peers at the hospital, specifically the CFO recommended I join. which influenced your decision to join our chapter?

No.

How long have you been in your current work position?

I have been in AP for 4 going on 5 years; and I have been in the controller position since

December 2013.

Were there any particular factors which influenced your decision to join our chapter?

I’m new to the healthcare industry and need as many sources of information as possible.

How long have you been in your current work position?

What are some of your previous positions or experiences?

Office manager at Colonial Acres

Nursing Home for 7 years; and

Bookkeeper for Mellage Truck &

Tractor for 5 years.

4 months.

What are some of your previous positions or experiences?

Public accounting and medic in the

US Army.

Where did you attend college and/or graduate school?

Where did you attend college and/or graduate school?

Peru State College.

What are your interests/hobbies outside of work?

Family, fishing, camping and crocheting.

Master’s Degree in Accounting and Financial Management from

Keller Graduate School of

Management.

What are your interests/hobbies

What do you hope to get out of your HFMA membership (e.g., outside of work?

Scrapbooking, reading, and education, networking)?

Education and networking. tutoring mathematics.

What do you hope to get out of your HFMA membership (e.g., education, networking)?

Education, staying up on current events.

Tanya Sharp

Litzenberg Memorial

County Hospital

CFO

When did you join HFMA?

Oct 2014.

How did you learn about HFMA?

Other healthcare professionals.

Were there any particular factors which influenced your decision to join our chapter?

Visiting with the other healthcare professionals regarding the value of this organization and chapter.

How long have you been in your current work position?

My current position at Litzenberg

– 1.5 months.

What are some of your previous positions or experiences?

CEO/Nursing Home Administrator for 7 years; CFO for 7 years.

Where did you attend college and/or graduate school?

Minnesota State University-

Moorhead.

What are your interests/hobbies outside of work?

I have 3 young children-enjoying spending time with family, sport events, etc. and quilting.

What do you hope to get out of your HFMA membership (e.g., education, networking)?

Education, resources and networking.

12

Lynn Steinhauser

Faith Regional Health

Services

Patient Financial Services

Supervisor

When did you join HFMA?

Oct 2014.

How did you learn about HFMA?

New Director of PFS.

Were there any particular factors which influenced your decision to join our chapter?

Opportunities to continue learning health care financial management.

How long have you been in your current work position?

2 years.

What are some of your previous positions or experiences?

Paralegal, Office Manager, and

Director of Customer Relations.

Where did you attend college and/or graduate school?

Northeast Community College,

University of Wisconsin-

Platteville.

What are your interests/hobbies outside of work?

Traveling with my family.

What do you hope to get out of your HFMA membership (e.g., education, networking)?

Education.

DECEMBER | 2014 Nebraska Healthbeat 13

DECEMBER | 2014 Nebraska Healthbeat 14

DECEMBER | 2014 Nebraska Healthbeat 15

DECEMBER | 2014 16 Nebraska Healthbeat

Photo

NHA/HFMA Fall Meeting

October 22-24, 2014

Lincoln, Nebraska

(L-R) Dave Burd, Dean Hyers and Chad VanCleave.

Speaker Dean Hyers gave an excellent presentation on Presenting to Groups and Dynamic Speaking

Todd Nelson, MBA Director Healthcare Finance

Policy Operational Initiatives, speaks to a packed room on "Price Transparency in Challenging

Times. A Concensus- Based Approach"

Photos by Sean Wolfe & Shelly Girtz-Soupir

(L-R) Joe Harnisch, Paul Muraca, and Troy Bruntz.

Speaker Paul Muraca from the American Hospital

Association gave the group an update on the political landscape in Washington, DC.

(L-R) Louis Hoffman, Todd Nelson and Renee Fink

DECEMBER | 2014

Joe Harnisch speaking to the group in the Haymarket

Nebraska Healthbeat

A group of attendees enjoy a dinner

The group included (Left side front to back)

Jim Ulrich, Troy Bruntz, Marty Fattig, Sean Wolfe,

Chuck Seviour, Kelly Utley (Right side front to back) Steve Lewis, Stacy Taylor, Claire Smutz,

Renee Fink, Tami Sorensen

Attendees

17

DECEMBER | 2014 Nebraska Healthbeat

Fall Presidents Meeting

September 21-23, 2014

Chicago, Illinois

HFMA Chapter Leaders from around the country meet annually to discuss planning, elect regional leaders, and conduct other business.

They also enjoyed a Cubs baseball game while in town!

18

DECEMBER | 2014 Nebraska Healthbeat

Members of the

Region 8 Leadership Delegation in Chicago

19

DECEMBER | 2014 Nebraska Healthbeat

Upcoming Education Events

Conferences

January 29-30, 2015

Winter Meeting

Kearney, Nebraska

February 17-18, 2015

Joint Meeting

Omaha, Nebraska

March 25-27, 2015

Annual Meeting

Omaha, Nebraska

Webinars

Free HFMA Webinars to HFMA Members

Live webinars are free for HFMA members and $99 for non-members, unless otherwise noted.

Become a member today.

January 15, 2015

Effective Ways to Identify and Attribute Healthcare

Products for Sustainable Savings

January 20, 2015

Overview of Physician Quality Reporting Programs,

PQRS and Value-Based Payment Modifier Highlights

January 21, 2015

Uncovering Your True Cost to Collect to Calculate Data

Driven Revenue Cycle Performance

January 22, 2015

Building a Successful Healthcare Management Model in a

Provider Environment

January 27, 2015

Successful Strategic Cost Management in Medical Group

Practices

January 29, 2015

Getting It Right the First Time to Prevent Claims Denials

March 19, 2015

Pre-Eligibility Screening of Your Supply Chain Data

Nebraska HFMA

Chapter Officers

Officers

Troy Bruntz, President

Dan Schonlau, President-Elect

Joe Harnisch, Vice President

Rebekah Mussman, Secretary

Andrew Kloeckner, Treasurer

Board

David Burd

Erik Carlson

Renee Fink

Louise Hoffman

Mandy Kumm

Rick Rogers

Sean Wolfe

Healthbeat Editors

Sean Wolfe

Shelly Girtz-Soupir

20

DECEMBER | 2014 Nebraska Healthbeat

Nebraska Healthbeat Sponsors

Diamond

Blue Cross Blue Shield of Nebraska

1919 Aksarben Drive

Omaha, NE 68180

(402) 398-3884 bcbsne.com

lee.handke@bcbsne.com

Credit Management Services, Inc.

105 North Wheeler Street

Grand Island, NE 68801

(800) 658-4447 credit-mgmt.com

bcopple@credit-mgmt.com

mjohnson@credit-mgmt.com

ProSource/Array Services

200 14th Avenue East

Sartell, MN 56377

(800) 692-7374 arraysg.com

shelly.soupir@arraysg.com

ashley.holmgren@arraysg.com

Gold

ARS/Magnet Solutions

2223 Broadway; PO Box 1826

Scottsbluff, NE 69363

(308) 632-7135 or (800) 658-3227 magnetsolutions.biz

Richard.Rogers@ar-solutions.biz

Baird Holm LLP

1500 Woodmen Tower

Omaha, NE 68102

(402) 344-0500 bairdholm.com

vahlers@bairdholm.com

akloeckner@bairdholm.com

mwilliams@bairdholm.com

First National Bank

1620 Dodge Street

Omaha, NE 68197

(402) 602-3315 firstnational.com

btitus@fnni.com

Lutz & Company

13616 California Street, Suite 300

Omaha, NE 68154

(402) 496-8800 lutzcpa.com

pbaumert@lutzcpa.com

Seim Johnson, LLP

18081 Burt Street, Suite 200

Omaha, NE 68022

(402) 330-2660 seimjohnson.com

rhoffman@seimjohnson.com

gheckenlively@seimjohnson.com

The SSI Group, Inc.

4721 Morrison Drive

Mobile, AL 36691

(251) 345-0000 thessigroup.com

bill.landreneau@ssigroup.com

marketing@ssigroup.com

UMB Bank

16929 Burke Street

Omaha, NE 68130 umb.com

joel.falk@umb.com

Wells Fargo Bank

13625 California Street, Suite 200

Omaha, NE 68154-5233

(402) 384-5687 wellsfargo.com

linda.s.schoening@wellsfargo.com

Silver

Dohman, Akerlund & Eddy, LLC

1117 12th Street; PO Box 470

Aurora, NE 68818

(402) 694-6404 daecpa.com

kmoural@daecpa.com

Early Out Services/General Service Bureau, Inc.

5807 Nort h 102nd Street

Omaha, NE 68134

(515) 223-0343 gsbcollect.com

buhlenhopp@gsbcollect.com

RelayHealth

1145 Sanctuary Parkway, Suite 200

Alpharetta, GA 30009

(866) 735-2963 relayhealth.com

Joseph.Andrade@relayhealth.com

sstull@acclaroinc.com

Wakefield & Associates, Inc.

10800 E Bethany Drive, Suite 450

Aurora, CO 80014-2697

(800) 864-3870 wakeassoc.com

Troy.Medina@wakeassoc.com

Bronze

Aureus Group

13609 California Street, Suite 100

Omaha, NE 68154

(402) 891-6900 aureusgroup.com

narcher@aureusgroup.com

tlauver@ca-industries.com

Avadyne Health

7017 John Deere Parkway

Moline, IL 61265

(866) 812-2149 avadynehealth.com

pbrindley@avadynehealth.com

Avantas

11128 John Galt Blvd., Suite 400

Omaha, NE 68137

(402) 717-7705 avantas.com

sallison@avantas.com

Cardon Outreach

4637 N. Drury

Kansas City, MO 64117

(913) 235-9292 cardonoutreach.com

AFrisbie@cardonoutreach.com

Hauge Associates

2320 West 49th Street

Sioux Falls, SD 57105

(605) 336-9490 haugeassociates.com

charliec@haugeassociates.com

MSCB Inc.

1410 Industrial Park Road

Paris, TN 38242

(731) 642-8454 mscbonline.com

jimdriscoll@mscb-inc.com

Merchants Credit Adjusters, Inc.

17055 Frances Street, Suite 100

Omaha, NE 68130

(402) 391-3933 mcaomaha.com

davet@mcaomaha.com

MattE@mcaomaha.com

ProAssurance Companies

2600 Professionals Drive

Okemos, MI 48864

(517) 347-6282 proassurance.com

rgiddings@proassurance.com

SilverStone Group, Inc.

11516 Miracle Hills Drive

Omaha, NE 68154

(800) 288-5501 silverstonegroup.com

jmarshall@SSGI.com

The Olson Group

16820 Frances Street, Suite 101

Omaha, NE 68130

(402) 289-1046 theolsongroup.net

tolson@theolsongroup.net

kcox@theolsongroup.net

Xtend Healthcare

117 East Louisa Street #483

Seattle, WA 98102

206-747-1811 xtendhealthcare.net

KGeorge@xtendhealthcare.net

ABiggs@xtendhealthcare.net

Provider

Community Hospital

1301 E H Street

McCook, NE 69001

(308) 344-2650 chmccook.org

TBruntz@chmccook.org

Regional West Medical Center

PO Box 1437

Scottsbluff, NE

(308) 630-2700 rwmc.net

David.Griffiths@rwmc.net

Sidney Regional Medical Center

645 Osage Street

Sidney, NE 69162

(308) 254-5825 memorialhealthcenter.org

tsorensen@sidneyrmc.com

kutley@sidneyrmc.com

21