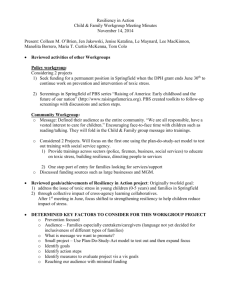

A Dynamic View of Liquidity

advertisement