Exchange rate economics

advertisement

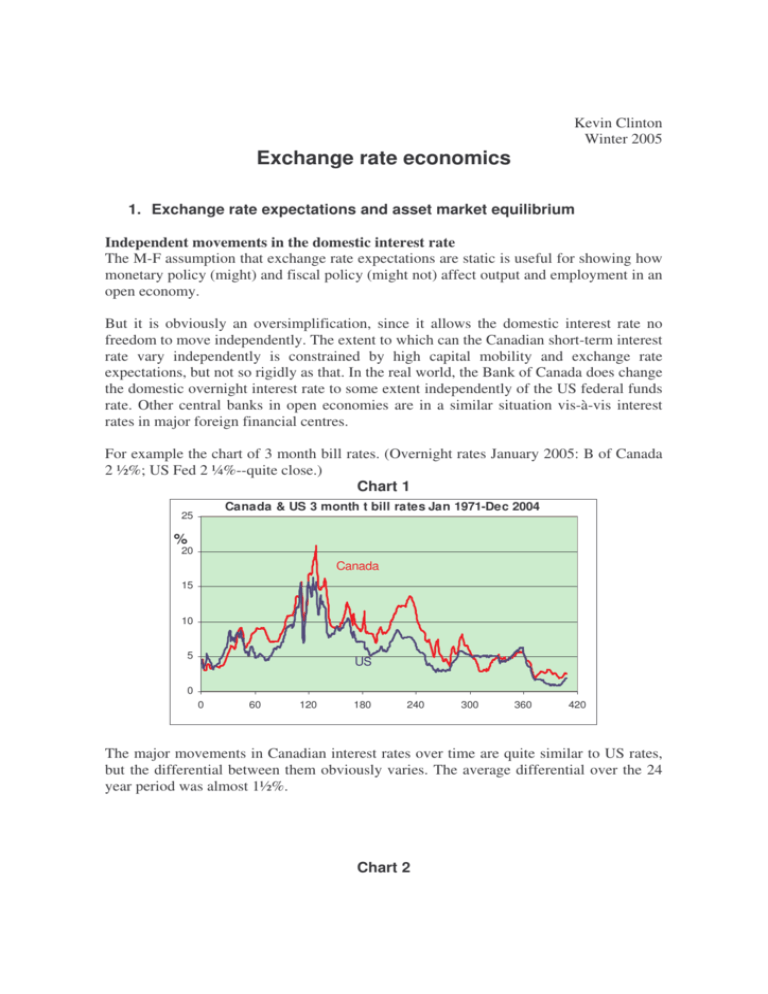

Kevin Clinton Winter 2005 Exchange rate economics 1. Exchange rate expectations and asset market equilibrium Independent movements in the domestic interest rate The M-F assumption that exchange rate expectations are static is useful for showing how monetary policy (might) and fiscal policy (might not) affect output and employment in an open economy. But it is obviously an oversimplification, since it allows the domestic interest rate no freedom to move independently. The extent to which can the Canadian short-term interest rate vary independently is constrained by high capital mobility and exchange rate expectations, but not so rigidly as that. In the real world, the Bank of Canada does change the domestic overnight interest rate to some extent independently of the US federal funds rate. Other central banks in open economies are in a similar situation vis-à-vis interest rates in major foreign financial centres. For example the chart of 3 month bill rates. (Overnight rates January 2005: B of Canada 2 ½%; US Fed 2 ¼%--quite close.) Chart 1 Canada & US 3 month t bill rates Jan 1971-Dec 2004 25 % 20 Canada 15 10 5 US 0 0 60 120 180 240 300 360 420 The major movements in Canadian interest rates over time are quite similar to US rates, but the differential between them obviously varies. The average differential over the 24 year period was almost 1½%. Chart 2 Canada - US 3 month t bill differential Jan 1971-Dec 2004 6.00 % 4.50 3.00 1.50 0.00 0 60 120 180 240 300 360 420 -1.50 -3.00 A realistic model allows some interest rate independence in the short-run, but not in the long run. For this, we have to modify the static expectations in the M-F model. Dornbusch assumed rational expectations for the exchange rate. That is, the expected value of the exchange rate is the long-run equilibrium value. Uncovered interest parity With perfect capital mobility, the domestic interest rate is equal to the foreign rate minus the expected increase in the exchange value of the currency: rt = r*t - Et∆et , where Et∆εt is the expected percentage appreciation of the domestic currency.1 This may be written as rt = r*t + Et(et+1) - et. (1) where Et(et+1) is the expected value, in period t, of e in t+1. Equation (1) is known as uncovered interest parity (UIP). The expected rate of return is the same, adjusted for expected changes in the exchange rate, regardless of currency. UIP holds in the special case of the M-F model, with Et∆et = 0. In effect, et (non-italic) is the logarithm of the exchange rate, e (italic), and ∆et is the percentage change in e. 1 2 Rapid asset price adjustment The short-run interest rate is set by the central bank, and the exchange rate adjusts instantly—see chart 5. Financial asset markets clear continuously. (The output price level, in contrast, is sticky—does not instantly jump from one LR equilibrium position to the next, but moves in steps over a period of time.) Chart 3 Exchange rate: US$ per C$ Jan 1971-Dec 2004 1 0.9 0.8 0.7 0.6 0 60 120 180 240 300 360 420 We can draw an asset market equilibrium line, AA, in (e, r) space from which there are no deviations, even in the short run. The asset market equilibrium line slopes down, showing the intuitive feature that an increase in the domestic interest rate is associated with a strengthened currency. 3 Figure 1 General equilibrium: asset and output markets r IS: FE equilibrium AA: asset market equilibrium r2 r1 e1 e e2 At an interest rate above r1, say r2, asset market equilibrium requires that the exchange rate appreciate, to e2 in the chart. People expect the exchange rate to return to the longrun equilibrium value e1. That is, they expect e to fall. With UIP, the expected decrease in e just compensates for the higher domestic interest rate. Example A 100 basis point (one percentage point) increase in r for one period causes e to rise one per cent. Investors expect it to fall back to its equilibrium value next period. The expected exchange loss is equal to the domestic-foreign interest rate differential. Evidence According to the theory, the Canada-US interest differential and the C$/US$ exchange rate should be positively correlated. The chart below shows some correlation, particularly since the mid-1980s, but it is quite loose. Chart 4 US $/C$ ra te a nd t bill spre a d Ja n 1971-De c 2004 1.05 e xch a n g e ra te t b ill s p re a d (s ca le d ) 0.95 0.85 0.75 0.65 0.55 0 60 120 180 240 300 360 420 4 The problem with interpreting data is that in the real world many things happen at the same time. There is not a simple experiment in which the central bank shocks the interest rate to see what happens—monetary policy is itself responding to economic events, including sometimes changes in the exchange rate (e.g. 1992, 1995, and 1998). So we have causality going both ways—the identification problem in econometrics. However we can see the effect of the tight money policy of the late 1980s and early 90s in both the interest rate differential (strongly up) and e (up too). Likewise, the easing of monetary policy, after the inflation rate was brought down to the target rate of 2%, later in the 1990s, is evident in the steep (if uneven) decline in the interest rate, and the drop in e to record lows. 2. Monetary policy Figure 2 Monetary contraction—increased interest rate r IS: FE equilibrium AA: asset market equilibrium r2 r1 e1 e2 e Temporary monetary contraction The central bank raises the interest rate, from r0 to r1, for 1 year. For UIP (equation 1) to hold, e must immediately rise to a higher level, e2, such that its expected depreciation afterwards, back to the long-run equilibrium e1, exactly offsets the interest differential: E1(et+2) - e2 = e1 - e2 = r1 - r0. The asset market equilibrium line AA has a negative slope: in increase in the short-term interest differential requires the exchange rate to jump immediately, to the point that investors think that it will now decline at a rate that offset the interest differential. Moreover, since asset prices are fully flexible, the asset market is always in equilibrium, so the path to long-run equilibrium is along AA. 5 Exchange rate flexibility, with non-static expectations, allows monetary policy to affect r as well as e, whereas it affects only e in the M-F model. In the example the increase in both r and e is deflationary: output falls below potential. The monetary contraction reduces output. The price level would eventually fall if the tight policy continued, but in the short run it stays constant (price level stickiness). Figure 3 Temporary monetary contraction: paths of interest and exchange rates r2 r1 0 1 2 year 3 e1 0 1 2 3 year A general implication of all flexible exchange rate models is that there is a positive correlation between the real exchange value of the currency and the real interest differential. In a situation where inflations rates are low and stable, this implies a positive correlation between the exchange rate and the nominal interest differential. 6 Permanent monetary contraction In the long run, a permanent monetary contraction results in no change in output, and a decrease in both the money stock and the price level (long-run classical monetary neutrality). In the short-run, however, because of sticky prices for goods and labour, the price level does not drop immediately, but adjusts over time, and output declines. Figure 4 Permanent monetary contraction: paths of output & price level y1 y2 0 2 4 0 2 4 0 2 4 year 6 p1 p3 year 6 Inflation ∆p 0 6 year In the long run the price level will fall by the same percentage as the money stock. During the adjustment period there is deflation (negative inflation). 7 Figure 5 Permanent monetary contraction: paths of interest & exchange rate r2 r1 rate E 0 2 4 0 2 4 year 6 Ε2 E3 E1 6 year The interest rate rises, causing deflation in the goods market. As the price level falls, the value of the real money stock rises (nominal money supply is constant at the new higher level), which allows the interest rate to decline. In the long run the decrease in the price level restores the real value of money supply to its initial equilibrium level, and the interest rate also returns to initial equilibrium. The initial equilibrium nominal exchange rate is E1. After the increase in the money supply, the long-run equilibrium is E3. Constancy of the real equilibrium exchange rate (purchasing power parity) requires that in the long run the nominal exchange rate E rise by the same percentage that the price level falls. Exchange rate overshooting With the permanent decrease in the money stock (and price level) the exchange rate depreciates more in the short-run than in the long run. This is because of uncovered interest parity, allied to the expectation that the exchange rate will eventually reach equilibrium level e3. Hence the name: Dornbusch exchange-rate overshooting model. Conclusion Monetary policy has substantial effects on output and prices in an open economy with a floating exchange rate. The change in the exchange rate (the external channel) reinforces the policy change in the interest rate (the domestic channel of transmission of monetary policy). 8 3. Other determinants of Canadian exchange rate Commodity prices Chart 4 Commodity prices and US$/C$ rate Indexes of commodity prices C$ The positive correlation between the C$ (thick line), and the indexes of commodity prices reflects Canada’s position as a large exporter of resource-based output. Relative international price levels: Purchasing Power Parity The principle of purchasing power parity (PPP) says that in the long run exchange rate movements reflect movements in relative price levels. In the simplest version, PPP implies that the nominal exchange rate moves exactly to offset differing price level movements: the real exchange rate is constant. Competition and arbitrage of goods across borders ensure some such tendency. Inflation does weaken a currency. However, other things, which vary over time, affect the real equilibrium value of a currency. In fact, movements in the real (price level adjusted) US$/C$ exchange rate e = E * PCAN/PUS shows somewhat more stability over time than the nominal rate E, which is weak evidence of PPP. But it does not show the convergence to a constant value implied by the simple version of PPP. 9 4. Contrast of regimes: flexible versus fixed exchange rate A fixed exchange rate regime implies a very different monetary policy environment from a flexible exchange rate. Fixed exchange rate regime Monetary policy There is no independent monetary policy, since the interest rate is fixed in the rest of the world, and the nominal exchange rate cannot change. Fiscal policy Since neither the interest rate nor the exchange rate can change, expansionary fiscal policy has strong short-run output effects. There is no offset from currency appreciation as in the floating regime, or from interest rate increases as in the closed economy case. However, this also means that there are large implications for foreign indebtedness, which grow over time. Fixed exchange rate regimes often collapse in a crisis when foreign debt burdens become excessive. Adjustment to exogenous real shocks The processes of adjustment following shocks to foreign demand, etc., are much slower under a fixed exchange rate. Reason: the exchange rate can jump immediately to a new equilibrium, whereas price levels adjust relatively slowly over time. For example, following a sharp increase in raw materials prices, the nominal C$ usually appreciates promptly. This helps keep the economy in equilibrium—the increased value of the C$ releases resources for use in the booming industries. Under a fixed regime, the required real appreciation of the C$ has to occur through domestic inflation—which takes time. A downside shock to demand would involve a particularly prolonged and painful adjustment period—a recession—because the overall domestic wage and price level is particularly inflexible in the downward direction. Volatility of exchange rates Some economists worry about the volatility of floating exchange rates. Exchange rates often vary for no apparent reason at all. Sometimes it is difficult to see a correlation with economic fundamentals. There is a lot of froth in financial markets, exchange markets included. However: 1. There is no evidence that weekly or monthly volatility has any significant macroeconomic effects at all. 2. The broad movements in the C$, over years, have been in an equilibrating direction— e.g. the dismal 1990s would have been even more dismal if the C$ had not depreciated 10 20% or more. And with the strong demand for Canadian exports, and high commodity prices, over the past couple of years, the rise in the C$ has held inflation in check. Monetary unions These are fixed exchange rate regions par excellence—there is only one money. Examples: Canada, the euro area. In Canada monetary union issues arise in 3 contexts: • • • Provincial fiscal policy—in a large province fiscal expansion might increase provincial output in the short run (the fixed exchange rate case) but it has a negative impact on other provinces through effects on interest rates—e.g. Ontario 1985-95. “Beggar thy neighbour” policy. Debate about monetary union with US. Lower transactions costs, and more trade, versus adjustment problems. Quebec secession scenarios—the PQ has debated these regimes: the C$; the US$; and a Q$? Re the euro area, note: • just one monetary policy for the whole area—too soon to judge how effective this is, but there are obvious teething problems at least • the Maastrich Stability and Growth Pact puts a 3% limit on government deficit/GDP ratio—an effort to stop the beggar-thy-neighbour fiscal policy, which is a risk in a currency union. Again, not clear yet whether this is effective. 11