PROBLEM SET 4 - Shepherd Webpages

advertisement

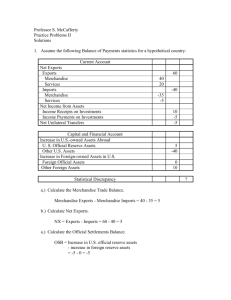

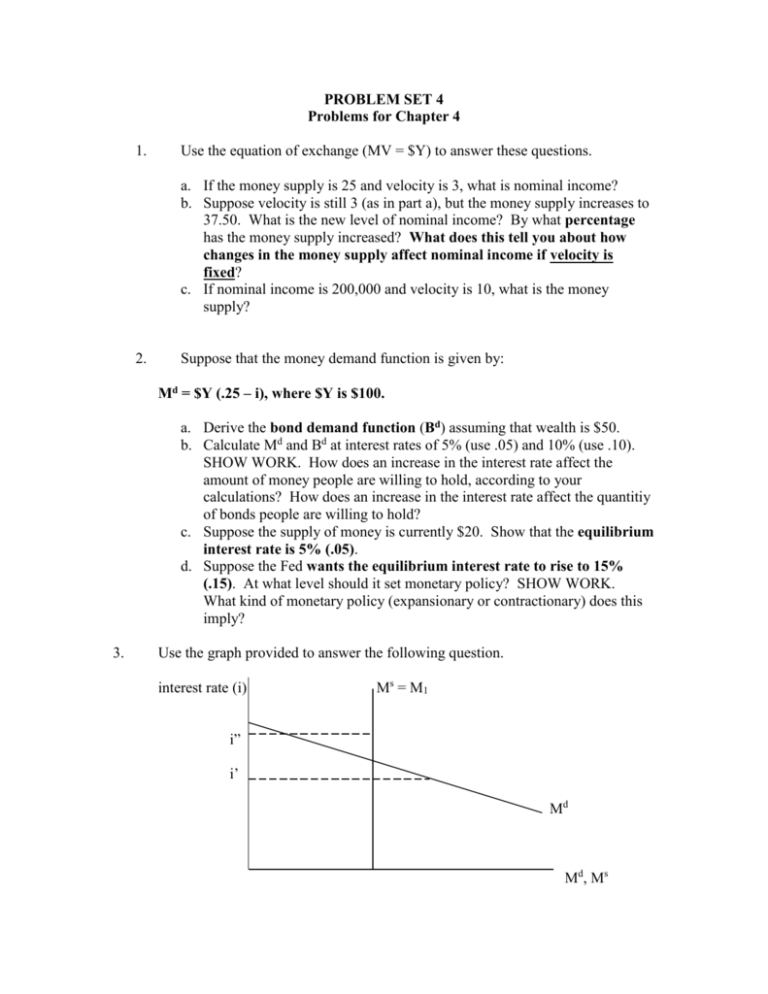

PROBLEM SET 4 Problems for Chapter 4 1. Use the equation of exchange (MV = $Y) to answer these questions. a. If the money supply is 25 and velocity is 3, what is nominal income? b. Suppose velocity is still 3 (as in part a), but the money supply increases to 37.50. What is the new level of nominal income? By what percentage has the money supply increased? What does this tell you about how changes in the money supply affect nominal income if velocity is fixed? c. If nominal income is 200,000 and velocity is 10, what is the money supply? 2. Suppose that the money demand function is given by: Md = $Y (.25 – i), where $Y is $100. a. Derive the bond demand function (Bd) assuming that wealth is $50. b. Calculate Md and Bd at interest rates of 5% (use .05) and 10% (use .10). SHOW WORK. How does an increase in the interest rate affect the amount of money people are willing to hold, according to your calculations? How does an increase in the interest rate affect the quantitiy of bonds people are willing to hold? c. Suppose the supply of money is currently $20. Show that the equilibrium interest rate is 5% (.05). d. Suppose the Fed wants the equilibrium interest rate to rise to 15% (.15). At what level should it set monetary policy? SHOW WORK. What kind of monetary policy (expansionary or contractionary) does this imply? 3. Use the graph provided to answer the following question. interest rate (i) Ms = M 1 i” i’ Md M d , Ms 2 a. b. c. d. 3. Given the money demand and money supply, explain what type of situation exists when the interest rate equals i”. At this interest rate, how much money do individuals want to hold? At this interest rate how much money actually exists? Based on your analysis in part a, what must happen to the interest rate for financial market equilibrium to occur? What happens to money demand and money supply as the interest rate (i) changes? Given the money demand and money supply, explain what type of situation exists when the interest rate equals i’. At this interest rate, how much money do individuals want to hold? At this interest rate how much money actually exists? Based on your analysis in part c, what must happen to the interest rate for financial market equilibrium to occur? What happens to money demand and money supply as the interest rate (i) changes? Suppose that the demand for money is given by the following equation: Md = $Y (.25 – .8i) Assume that nominal income ($Y) is $5,000 billion. a. b. c. Determine the equilibrium level of the interest rate if the money supply is $900 billion. Suppose the central bank increases the money supply to $950 billion. Determine the new equilibrium interest rate. Suppose we have the original money supply (in part a) and that the level of nominal income increases to $6,250 billion. Determine the equilibrium interest rate. TEXTBOOK, Ch. 4, pp. 82 -83: #1 (a – g), 2, 4. NOTE: Use the decimal version to express interest rates for calculations (i.e. express 5% as .05). 3 SELECTED ANSWERS 1. a. $Y = 75. b. $Y = 112.50. The money supply increased by 50% and nominal income also increased by 50%. If velocity is fixed, changes in the money supply change nominal income in the same proportion. c. M = 20,000. 2. a. Bd = $Wealth - Md Bd = $Wealth - $Y (.25 – i) Bd = $50 – 100 (.25 – i) b. i Md Bd .05 $20 30 .10 $15 35 An increase in the interest rate from 5% to 10% decreases Md and increases Bd. c. Md = M s 100(.25 – i) = 20 Solve for i: I = .05 (5%) d. Md = M s 100(.25 – .15) = Ms Solve for Ms: Ms = 10. This would require reducing the money supply from $20 to $10, which is contractionary monetary policy. 4. a. See the graph below. At i”, individuals demand M” while the money supply (the amount that actually exists) equals M; there is excess supply of money. Ms = M 1 interest rate (i) i” i’ Md M” b. c. M M’ M d , Ms i must fall to restore equilibrium. As i falls, the supply of money does not change; however, the quantity of money demanded increases. At i’, money demand exceeds money supply. Individuals want to hold M’ while only M exists. 4 d. 4. a. b. c. i must increase to restore equilibrium. As i increases, the money supply does not change while the quantity of money demanded falls. .025 (2.5%) .0125 (1.25%) .07 (7%) ANSWERS TO TEXTBOOK PROBLEMS 1. a. b. c. d. e. f. g. 2. False. False. False. True. False. False. True. a. i = .05: money demand = $18,000. i = .10: money demand = $15,000. b. c. d. e. 4. a. b. Money demand decreases when the interest rate increases. The demand for money falls by 50%. The demand for money falls by 50%. A 1% increase (decrease) in income leads to a 1% increase (decrease) in money demand. The effect is independent of the interest rate. i = .05 (5%). To increase i to .15 (15%), decrease Ms to $10.