MARKET OVERVIEW - Wine and Spirit Trade Association

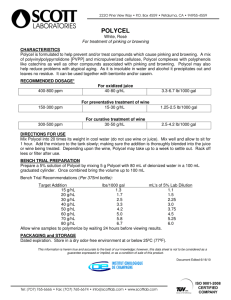

advertisement

THE WINE AND SPIRIT TRADE ASSOCIATION MARKET OVERVIEW UK Wine and Spirits 2014 with data supplied by the IWSR CONTENTS THE UK ALCOHOL INDUSTRY Value Production in the UK Premises Employment GLOBAL CONSUMPTION - IWSR data 6 Wine consumption per country Wine consumption per head Spirits consumption per country Spirits consumption per head CONSUMPTION - UK and Europe 8 Litres per head Drinkers by age Consumer trends European alcohol consumption SALES - IWSR data 2013 4 UK UK UK UK UK UK UK UK UK wine sales 2009 - 2013 wine sales by category spirits sales 2009 - 2013 spirits sales by category wine sales by country of origin wine sales by colour wine exports 2010 - 2013 spirits sales: relative market share spirits exports 2010 - 2012 TAXATION 14 UK alcohol taxation European alcohol taxation SOCIAL RESPONSIBILITY 10 Success statistics Industry initiatives Unit and labelling guidance 16 The Wine and Spirit Market Overview WHO WE ARE 2014 The WSTA represents over 340 companies producing, importing, exporting, transporting and selling wines and spirits in the United Kingdom. THE WINE AND SPIRIT TRADE ASSOCIATION We campaign for a vibrant and sustainable wine and spirit industry, helping to build a future in which alcohol is produced, sold and enjoyed responsibly. IWSR The IWSR quantifies the global market for alcohol by volume and value, and provides insight into short-term and long-term trends. Globally, we track overall consumption and trends at brand, quality and category level for wines, spirits and RTDs, with the aim of providing data that is as accurate and detailed as possible. Our unique methodology allows us to get closer to what is actually consumed and understand better how markets work. The IWSR researchers conduct face-to-face interviews with 1,500 companies around the world, tapping into local expertise, with further input from 350 companies. THE UK ALCOHOL INDUSTRY VALUE £39 billion = Value of the UK alcohol industry Source: CGA Strategy, Nielsen, HMRC, September 2014 Value of the UK grocery market £170 = billion Source: ICG Research, 2013 PRODUCTION IN THE UK 204 working distilleries 448 commercial vineyards 131 english wineries Scotland Northern Ireland 134 6 This equates to: England 61 Source: HMRC Registrations, August 2014 4 Page 4 33,384 hectolitres of wine in 2013 3 Wales produced 4.5 million bottles Source: English Wine Producers, 2013 The Wine and Spirit Market Overview 2014 PREMISES 204,400 licensed premises and 544,600 personal license holders in the UK in 2013 Source: Home Office ,2013 26 MILLION people regularly drink wine in pubs, bars, and restaurants Source: Wine Intelligence, May 2011 Wine = & Spirits 42% of the value of alcohol products sold in pubs, bars and restaurants Source: CGA Strategy, September 2013 EMPLOYMENT Wine and spirits directly and indirectly supports 518,000 UK jobs bottling distilleries vineyards 69% logistics retailers of these jobs are directly dependent on the industry’s activity Source: Alcohol Duty Escalator Economic Impact Assessment, EY, October 2013 5 Page 5 GLOBAL CONSUMPTION - IWSR DATA WINE* CONSUMPTION PER COUNTRY (000s of 9L cases) 1 2 3 4 5 6 7 8 9 10 China USA France Italy Germany UK Argentina Japan Russia Spain % change 734,175 345,500 310,598 294,999 282,889 142,489 116,935 106,146 103,936 99,443 +5 +1 -1 -2 -1 -1 +1 +3 -1 -2 *figures include still light wine, sparkling wine, light aperitifs, fortified wines and other wines Source: The IWSR, September 2014 (2013 Sales figures) CONSUMPTION PER HEAD (litres per person) 112 3 4 6 7 8 9 10 -22 Italy France Slovenia Portugal Switzerland Montenegro Austria Germany Denmark Malta UK 43.2 43.2 39 37.9 37 35.1 34.3 31.4 28.9 27.8 -----20.2 Source: The IWSR, September 2013 6 Page 6 2014 The Wine and Spirit Market Overview SPIRITS CONSUMPTION PER COUNTRY 1 2 3 4 5 6 7 8 9 10 -14 (000s of 9L cases) China 1,178,835 India 310,617 Russia 260,701 USA Italy 204,403 S. Korea France133,098 JapanSlovenia 123,768 BrazilPortugal 106,727 Thailand 72,840 Switzerland Philippines 61,668 Montenegro Germany Austria 47,950 --------Germany 31,013 UK Denmark % change +1 +1 0 +3 43.2 -4 43.2 -2 39 -2 37.9 0 37 -7 35.1 -1 34.3 31.4 +1 28.9 27.8 Source:Malta The IWSR, September 2014 (2013 Sales figures) -----20.2 UK CONSUMPTION PER HEAD (litres per person) 1 2 3 4 5 6 7 8 9 10 -41 South Korea Russia Northern Emirates Estonia Belarus Bulgaria Lithuania Guyana Thailand Ukraine UK 24.5 16.5 14.4 14.2 11.8 11.1 9.8 9.8 9.7 9.3 -----4.4 Source: The IWSR, September 2013 7 Page 7 CONSUMPTION UK ALCOHOL CONSUMPTION LITRES PER HEAD (+15) 11.6 11.3 11.4 11.1 LPA per head (15+) 11 10.8 10.1 2003 2004 2005 19% 2006 2007 2008 2009 10.1 2010 9.9 2011 9.6 2012 9.4 2013 decline in total alcohol consumption since a peak in 2004 Source: BBPA analysis of HMRC customs clearances, 2014 DRINKERS BY AGE 70 60 Percentage 50 40 30 20 10 0 16-24 25-44 45-64 65+ All drank alcohol in the last week drank on 5 or more days in the last week Source: ONS Opinions and Lifestyle Survey, 2012 EUROPEAN ALCOHOL CONSUMPTION litres per capita litres per capita 1 Luxembourg* 15.3 6 Ireland 11.6 11 Hungary 2 France 12.6 7 Czech Republic 11.5 12 Belgium 3 Austria 12.2 8 Russian Fed. 11.5 13 Slovenia 4 Estonia 12 9 Portugal 11.4 14 Denmark 5 Germany 8 11.7 10 Spain 11.4 15 Poland Page 8 2014 The Wine and Spirit Market Overview CONSUMER TRENDS In the last 4 weeks, what have you drunk... m in e ru sp ic ed 18% 5% 7% 13% 10% 6% 6% 5% 5% 34% 26% 39% 20% 13% 13% 23% 19% 12% 12% 7% 7% 6% 5% in tif i ed ru ed ic th er ’ 7% 5% 9% 6% 4% 4% 2% 1% 36% 30% 16% 9% 9% 7% 7% 8% 3% 5% 6% 5% 6% 2% w fo r 10% sp ru 12% ‘o sp m w m w g in in w kl ro ar w se gi 15% 17% n re d hi sk w y in e e e in w a vo dk te 6% hi ci de r al 13% e la ge r e in e ‘o fo se At a bar or pub? th 18% rt ru 14% 18% m gi n er ’ ey vo a w 34% dk al e hi sk sp ar ifi ed w w ro 29% ci de r la ge r w kl in g in e in e w in e w hi te re d w in e At home? Most popular wine varietals 1. Pinot Grigio 4. Cabernet Sauvignon 2. Merlot 5. Syrah/Shiraz 3. Sauvignon Blanc Most popular spirits 1. Vodka 4. Liqueurs/flavoured spirits 2. Gin 3. Whisk(e)y 5. Rum Source: YouGov polling for WSTA, August/September 2014 litres per capita litres per capita litres per capita 10.8 16 UK 10 21 Greece 8.2 10.8 17 Switzerland 10 22 Sweden 7.4 10.6 18 Slovak Rep. 9.9 23 Iceland 7.3 10.6 19 Finland 9.8 24 Italy 6.9 10.4 20 Netherlands 9.4 25 Norway Source: OECD Health at a Glance, 2013 96.6 Page 9 UK SALES - IWSR DATA WINE 154,117 -1.2% 2013 2012 2011 -2.6% -2.9% -1.7% 2010 2009 +1.9% UK WINE SALES 2009 - 2013 151,474 147,129 144,290 142,489 (000s of 9L cases) Source: The IWSR, September 2014 (2013 Sales figures) UK WINE SALES BY CATEGORY 2013 Light Wine Sparkling Wine Year on Year -2% 5 years -10% Year on Year +8% 5 years +21% Other Wines Fortified Wine Year on Year +2% 5 years +11% Year on Year -4% 5 years -13% Light Aperitifs Year on Year -7% 5 years -22% 10 Page 10 Source: The IWSR, September 2014 (2013 Sales figures) The Wine and Spirit Market Overview 2014 SPIRITS -0.7% +0.7% 30,933 30,784 31,013 2013 -0.9% +3.4% +1.9% UK SPIRITS SALES 2009 - 2013 30,160 31,189 (000s of 9L cases) Source: The IWSR, September 2014 (2013 Sales figures) UK SPIRITS SALES BY CATEGORY 2013 Vodka Whisky Year on Year +2% 5 years +7% Year on Year -1% 5 years -4% Flavoured Spirits Rum Year on Year +1% 5 years +3% Year on Year +1% 5 years +12% Gin Brandy Year on Year +3% 5 years +6% Year on Year -3% 5 years -7% * Tequila Cane Year on Year +9% 5 years +36% Year on Year -27% 5 years +6% 11 Source: The IWSR, September 2014 (2013 Sales figures) Page 11 UK SALES - IWSR DATA WINE UK WINE SALES BY COUNTRY OF ORIGIN 2013 Volume % change (000s of 9L cases) (year on year) (last 5 years) 1 Australia 24,286 +1 -14 2 France 17,352 -4 -13 3 Italy 17,200 -8 +1 4 USA 14,825 -2 -13 5 Spain 13,466 -3 +28 6 South Africa 11,091 +14 -17 7 Chile 10,790 -1 -13 8 -12 +18 9 New Zealand 4,551 Germany 3,416 -12 -48 10 Argentina +3 +3 2,376 Source: The IWSR, September 2014 (2013 Sales figures) UK WINE SALES BY COLOUR 2013 % change (year on year) (last 5 years) 45% white 55,563,000 9L cases -2% -10% 43% red 53,355,000 9L cases -2% -10% 12% rosé 14,370,000 9L cases -3% -12% Source: The IWSR, September 2014 (2013 Sales figures) UK WINE EXPORTS 2010 - 2013* (000s) cases 10,526 2013 2012 2011 2010 8,884 9,638 9,734 *all wine products including still, sparkling, fortified, light aperitifs and other wines Source: The IWSR, September 2014 (2013 Sales figures) 12 Page 12 The Wine and Spirit Market Overview 2014 SPIRITS UK SPIRITS SALES: RELATIVE MARKET SHARE 6% 30.1% 9% Vodka Whisky Flavoured Spirits 9% Gin / Genever Rum Brandy Tequila (0.7%) Cane (0.07%) 19.8% National Spirits (0.05%) 25.2% Source: The IWSR, September 2014 (2013 Sales figures) 93% of the value and volume of gin sold in the UK is domestically produced 2013 2012 2011 UK SPIRITS EXPORTS 2010 - 2013 2010 (000s) cases 122,727 2013 118,669 2012 121,719 2011 2010 103,610 Source: The IWSR, September 2014 (2013 Sales figures) 13 Page 13 TAXATION IN THE UK £17 billion = Tax paid by the alcohol industry (Excise duty and VAT) £329 Equivalent tax per UK adult Source: WSTA analysis based on ONS, HMRC, Nielsen And CGA data, September2013 Wine contributed £3.7 billion to the exchequer in 2013/2014 29% of all duties 35% of all duties Spirits contributed £3 billion to the exchequer in 2013/2014 Source: WSTA analysis based on HMRC Alcohol Duty bulletin, July 2014 THROUGHOUT EUROPE The UK wine and spirit industry is now WINE 3rd highest for Wine £ per 75cl bottle Finland £2.03 Sweden and l Ire 5 £2.5 United Kingdom Denmark over £1.50 £0.50 to £1.50 £0.01 to £0.50 £0.00 No data £1.61 £0.89 £2.05 Pol and £0. 22 France £0.02 14 Page 14 Source: Spirits Europe, May 2014 2014 Since 2008... The Wine and Spirit Market Overview Wine taxation has increased by Spirits taxation has increased by 54% 44% 56% tax 76% tax 78% tax 79% tax wine £5.26 vodka £12.45 whisky £10.06 gin £10.03 (average price 75cl) (average price 70cl) (average price 70cl) (average price 70cl) Source: WSTA analysis, March 2013 one of the most heavily taxed in Europe SPIRITS 4th £ per 70cl bottle @ 37.5% abv over £10 £5.00 to £9.99 £2.50 to £4.99 up to £2.49 No data d lan Ire 4 £8.9 Finland highest for Spirits £9.57 Sweden £12.32 United Kingdom £7.10 Bel giu m £4.4 5 Poland £2.83 France £3.61 Greece £5.36 Source: Spirits Europe, May 2014 15 Page 15 SOCIAL RESPONSIBILITY SUCCESS STATISTICS The number of people reporting binge drinking (over 8 units for men and 6 units for women) in the previous week continues to fall. Binge drinking on at least one day of the week: from 2005 to 2012 MEN All 4% MEN WOMEN WOMEN 11% 10% 4% 16 - 24 16 - 24 All Source: ONS Drinking habits amongst adults, 2012 More young people are abstaining from alcohol, and those that have tried alcohol appear to be drinking less 61% 55% of 11-15 year olds had never drunk alcohol in 2013. This is up from 39% in 2003. 9% 12% of 11-15 year olds drank alcohol in the last week. Down from 25% in 2003. Source: Smoking, drinking and drug use among young people in England 2013, ONS, HSCIC 28% In 2010, just of young people agreed it is acceptable for someone their age to drink alcohol once a week (down from 46% in 2003) Source: Smoking, drinking and drug use among young people in England 2012, ONS, HSCIC 16 Page 16 The Wine and Spirit Market Overview 2014 INDUSTRY INITIATIVES Charity established by the industry to change the nation’s drinking behaviour for the better. Social responsibility body for alcohol producers which ensures alcohol is marketed responsibly. RASG tackles issues with underage sales and underage drinking. The group formed Challenge 25, a retailing strategy that encourages anyone over 18 but looks under 25 to carry acceptable ID. It is now commonplace in supermarkets, independent retailers and the on-trade. RASG Retail of Alcohol Standards Group The Benevolent aims to make a difference to the daily lives of those who work or have worked in the drinks industry and now need help. Responsibility Deal pledge: ‘...80% of products on shelf by December 2013 will have labels with unit content, NHS guidelines and a warning about drinking when pregnant. Working with: COMMUNITY ALCOHOL PARTNERSHIPS Community Alcohol Partnerships (CAPs) aim to reduce alcohol harm in local communities with a primary focus on tackling underage drinking. This is achieved via a partnership approach with a focus on education, enforcement and public perception. www.communityalcoholpartnerships.co.uk Since 2007, 83 CAPs have been set up across the UK. Each CAP is unique and is a success story in its own right. Many have won awards for innovative partnership working and/or the positive impact they have had on local communities. DERRY GATESHEAD 54% drop in referrals to the Youth Diversion Officer between 2010 and 2012 50% decrease in anti-social behaviour in February 2013 compared to the same period in 2012. ISLINGTON BRECON 40% decrease in reports of alcohol-related youth anti-social behaviour between April 2012 and March 2013 Source: CAP Interim Reports, 2011-2013 Youth alcohol related accidents requiring the attention of the London Ambulance Service halved were in April to December 2011 compared to the same period in 2010 17 Page 17 GUIDANCE UNITS 90% of respondents have heard of units (up from 79% in 1997) and 63% know what a unit of each type of drink was (up from 47% in 1997) 2 1 1.5 9 Glass of wine (175ml) Single measure of Spirits Alcopop or can of lager Bottle of wine 2 Pint of regular beer/lager/cider Source: ONS Statistics on Alcohol: England, 2013, May 2013 VOLUNTARY LABELLING As part of the UK Government’s Public Health Responsibility Deal, many companies within the UK alcohol industry have pledged to implement a health labelling scheme to better inform consumers about responsible drinking. Elements to include on a label (Government’s preferred format) Responsibility message (optional) Government safe drinking guidelines Drink Responsibly (x) UK Units UK Chief Medical Officers recommend adults do not regularly exceed Men 3-4 units a day Women 2-3 units a day www.drinkaware.co.uk Information in a boxed format Number of UK units in the container Pregnancy logo or wording (‘Avoid alcohol (x - insert the correct number of units for if pregnant or trying to your drink) conceive’) Drinkaware logo or 18 website (optional) Page 18 The Wine and Spirit Market Overview 2014 SELECTED DATA KINDLY SUPPLIED BY: www.theIWSR.com 39 Moreland Street London EC1V 8BB +44 (0)20 7689 6841 info@theiwsr.co.uk twitter: @theiwsr DATA COMPILED AND DESIGNED BY: THE WINE AND SPIRIT TRADE ASSOCIATION www.wsta.co.uk 39-45 Bermondsey Street London SE1 3XF +44 (0)20 7089 3877 info@wsta.co.uk twitter: @wstauk If you have any comments, queries or suggestions please contact Antonia Fordyce antonia@wsta.co.uk 0207 089 3880 19 Page 19 The Wine and Spirit Trade Association International Wine and Spirit Centre 39-45 Bermondsey Street LONDON SE1 3XF www.wsta.co.uk info@wsta.co.uk @wstauk Registered Number: 410660 England Limited by Guarantee VAT Number: GB 243 8260 60