Place Text Here - Law Society of Scotland

advertisement

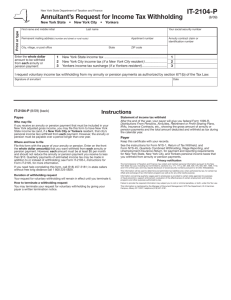

Consultation Response Department for Work and Pension Consultation: Creating a secondary annuity market The Law Society of Scotland’s response June 2015 © The Law Society of Scotland 2015 Introduction The Law Society of Scotland aims to lead and support a successful and respected Scottish legal profession. Not only do we act in the interests of our solicitor members but we also have a clear responsibility to work in the public interest. That is why we actively engage and seek to assist in the legislative and public policy decision making processes. To help us do this, we use our various Society committees which are made up of solicitors and nonsolicitors to ensure we benefit from knowledge and expertise from both within and out with the solicitor profession. The Pensions Law Sub-committee of the Law Society of Scotland (the committee), welcomes the opportunity to consider and respond to the Department for Work and Pension consultation Creating a secondary annuity market. The committee has the following comments to put forward: Comments Paragraph 2.19 to 2.22. Ceasing payments and death of the annuitant. Given that the annuity provider may be less likely to receive a timeous notification of death, then we would suggest that the provider needs protection against scheme sanction charges for unauthorised payments of annuity. We note that the current protection lasts 6 months after the death and this, in our view, would be inadequate. We would suggest that there is a strong argument that there should be an exemption if the failure is related to an assigned policy. Paragraph 2.23. Annuity provider costs. In relation to consent to assignation, we note that the paper acknowledges that annuity providers might have concerns about agreeing to assignations without express consent from named secondary beneficiaries. Insurers may also be troubled about agreeing to an assignment when this is contrary to a prohibition that was included in the policy wording in accordance with the statutory requirements at the time and at the express request of the trustees who proposed for the policy. © The Law Society of Scotland 2015 We would suggest that the UK Government Page | 1 considers including an overriding ‘permissive’ provision that allows an annuity provider to consent to an assignation (along the lines of the flexibility ‘permissive’ provision). Given that it is intended to prohibit the assignation of pensions (that are not secured by an annuity) and annuities held by the trustees, trustees may be uneasy about agreeing to policy terms that allow an annuitant to do so outside of the scheme. This could be covered by altering the legislation to expressly allow trustees to agree to these policy terms. Paragraph 2.27. In relation to joint annuities, the consent of secondary annuitants may also be an issue for cases where the reversionary annuity goes to the ‘spouse at date of death’ which is a requirement for contracted-out benefits such as GMP. Annuities can also continue to young children and disabled children. Paragraph 3. Legislative changes We agree with the consultation, that the main impediment to assignation is in the tax rules and some DWP secondary legislation. There are however other DWP pensions law provisions that need to be considered including section 159 of the Pension Schemes Act 1993 (prevents assignation of guaranteed minimum pensions), section 91 of the Pensions Act 1995 (prevents assignation of pension rights under a scheme (and, by implication requires the trustees to follow that through into the terms of immediate annuities in the pensioner’s name)) and section 19/81 of the PSA93 (covering buy-outs). Paragraph 3.3. Concerning the status of the purchase price received by the annuitant, the purchase price would be paid to the individual after deduction of tax. To the extent to which the payment is paid into the registered pension scheme, the tax would not apply but the payment into the registered scheme is not a contribution or a transfer payment. From the scheme’s perspective, it is akin to a drawdown to drawdown TV except that it comes from the individual (via the buyer). © The Law Society of Scotland 2015 Page | 2 Where the payment goes into a registered pension scheme, the tax legislation would work (subject to the above point) but there is a potential issue if the monies went straight into a flexible annuity as it would not be a registered pension scheme in its own right. The potential issue is whether or not the insurer can apply the premium to its pension business fund under sections 57 & 58 of the Finance Act 2012. Consumer Protection, Chapter 4. Chapter 4 relates to consumer protection and we note that the proposal is made to introduce the requirement for compulsory advice. We would suggest that the model for compulsory advice is a new one and the benefits of this have still remain to be considered and it is a model untested in the context of DB transfers. We would suggest that further evidence and research should be collated and considered to establish if this model does indeed provide any consumer protection. © The Law Society of Scotland 2015 Page | 3 For further information and alternative formats, please contact: Brian Simpson Law Reform DD: 0131 476 8184 E: briansimpson@lawscot.org.uk The Law Society of Scotland Atria One, 144 Morrison Street Edinburgh EH3 8EX www.lawscot.org.uk © The Law Society of Scotland 2015 Page | 4