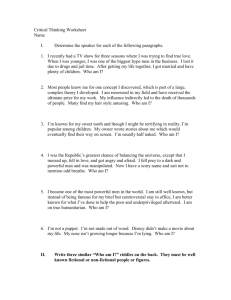

Page 33/ Bus 6

advertisement

ARAB TIMES, SATURDAY, NOVEMBER 7, 2015 BUSINESS 33 Slovakia to seal JLR deal by year-end: minister Indian-owned Jaguar Land Rover (JLR) will ink an agreement with Slovakia by year end to build a car manufacturing plant there, Slovakia’s economy minister said Thursday. “By the end of this year an agreement will be signed, which creates a formal base for Land Rover to come to Slovakia,” Economy Minister Vazil Hudak the told reporters in Bratislava. “Discussions are ongoing, we now have the first draft of the investment agreement which should be concluded between the Slovak government and Jaguar Land Rover.” On Wednesday, Hudak had another round of negotiations with Alexander Wortberg, chief operating officer for the JLR factory Oil prices weaken; gold at 3-month low NEW YORK, Nov 6, (Agencies): The dollar jumped more than 1 percent to a 7-month high and shortterm benchmark US bond yields rose to their highest in five years on Friday, after stronger-than-expected jobs data left investors expecting the first rise in US interest rates in almost a decade next month. FRANKFURT: Deutsche Telekom on Thursday confirmed its full-year profit targets after rising mobile subscriber numbers in the United States and the expansion of its fibre-optic network in Germany buoyed business in the third quarter. “Deutsche Telekom’s performance in the third quarter of 2015 was dominated by double-digit growth rates in the most important financial indicators,” the company said in a statement. Net profit increased by 59.9 percent to 809 million euros ($879 million) in the period from July to September. (AFP) ❑ ❑ ❑ FRANKFURT: German reinsurance giant Munich Re said Thursday it is sticking to its full-year profit target even though the recent turbulence on financial markets hit earnings in the third quarter. “For the current financial year, Munich Re is still aiming for a profit of at least 3.0 billion euros” ($3.3 billion), the company said in a statement. In 2014, net profit amounted to 3.2 billion euros. In the period from July to September, bottom-line profit fell by 28.7 percent to 525 million euros. Underlying or operating profit was down 36.2 percent at 579 million euros on 3.6-percent increase in gross premium income to 12.481 billion euros. (AFP) ❑ ❑ ❑ Wall Street dipped modestly, rebounding from earlier losses, a sign that investors have grown comfortable with the idea that the Fed will raise rates before the end of the year. The health of the US labor market is a key factor in the Federal Reserve’s thinking. A total of 271,000 non-farm jobs were added in the US economy last month, easily topping expectations of 180,000. That was the largest rise since December 2014, with wages also increasing at a robust clip. The unemployment rate fell to 5 percent while payrolls data for August and September were revised to show 12,000 more jobs created than previously reported. That boosted federal-funds futures contracts that bet on the Fed’s next moves. Expectations for a December increase were up to about 73 percent in the wake of the report, from 58 percent one day ago. The two-year Treasury yield rose to its highest in five years, boosting the gap between US and German yields to its widest since late 2006. The two-year yield rose to 91 basis points, while the 10-year sold off, boosting its yield to 2.34 percent. A broad worldwide index of equities was lower, losing 0.6 percent. The dollar rose more than 1 percent against most major currencies such as the euro, the yen and the British pound. Sterling fell to a six-month low against the dollar and also slipped against the euro, a day after it was sent tumbling after the Bank of England kicked a UK rate hike down the road. It fell to $1.5073, down 0.9 percent on day. The stronger dollar added downward pressure to crude oil, which was already dragged down by oversupply concerns, and to OPEC currencies. US crude fell 1.8 percent to $44.39 a barrel, after falling more than 2 percent in the previous session. Brent dropped 1.1 percent to $47.43 a barrel. Spot gold was down to $1,086 an ounce, a three-month low, and on track for a 4.5 percent loss for the week. SAN FRANCISCO: Take another discount on the stock price: Groupon fell hard on Wednesday as the company’s new chief executive laid out his strategy in the face of a weakening sales. In midday trade, the daily deals group Groupon traded down 27 percent at $2.93 — after already tumbling some 75 percent over the past two years Groupon on Tuesday named Rich Williams as its new CEO, replacing cofounder Eric Lefkofsky as the company reported a loss of $27.6 million in the past quarter and offered a weak outlook for the next three months. Williams said Groupon “will renew our investment in customer acquisition to introduce more new customers to our marketplace and accelerate growth.” (AFP) ❑ ❑ ❑ ZURICH: Zurich Insurance on Thursday said third-quarter profits fell 79 percent, after the company was hit with $275 million (254 million euros) in losses following the industrial disaster in Tianjin, China. Switzerland’s largest insurance provider posted after-tax profits of $207 million, down from $966 million over the same period last year, a plunge also linked to poor performance in its general insurance unit. The firm’s performance was below projections from analysts polled by the AWP agency, who had expected profits of $241 million. Chief executive Martin Senn said in a statement that a “comprehensive review” of the business aimed at restoring profitability would lead to changes in the management structure and job cuts. (AFP) ❑ ❑ ❑ PARIS: The French industrial group Alstom said Wednesday it planned to stage a 3.2-billion-euro ($3.47-billion) share buyout following the sale of its energy assets to General Electric. Under the offer, 91.5 million shares, amounting to 29.5 percent of capital, will be repurchased at 35 euros apiece and then cancelled under a strategy to refocus the company, it said in a statement. The offer price is a 17.6-percent premium over Tuesday’s market close, and 21.8-percent higher than the weighted average for the previous month, it said. Bouygues, which currently owns around 29.2 percent of Alstom’s capital, will add a number of shares to the proposal so that its current stake is maintained at a similar level, Alstom said. (AFP) ❑ ❑ ❑ FRANKFURT: Adidas, the German maker of sportswear and equipment, raised its full-year sales and profit targets on Thursday as strong demand for its Adidas and Reebok brands powered a strong third-quarter performance. “In the third quarter of 2015, the Adidas group delivered a stellar financial performance,” boasted chief executive Herbert Hainer. In the period from July to September, net profit rose by 10.4 percent to 311 million euros ($338 million). Underlying or operating profit was up 26.5 percent at 505 million euros on a 17.7-percent increase in sales to 4.758 billion euros. (AFP) ❑ ❑ ❑ COPENHAGEN: Danish wind turbine maker Vestas Wind Systems on Thursday raised its annual revenue and profit forecast for the second time this year as quarterly profit more than doubled. “I am very pleased that year-on-year for orders, Vestas is growing in all regions,” chief executive Anders Runevad said in a statement. “With greater clarity on deliveries for the remainder of the year and a very solid financial position, we are raising our guidance.” (AFP) LONDON: Morrisons, Britain’s fourth biggest supermarkets operator, reported another fall in quarterly underlying sales on Thursday, hit by its own price cuts ore tap on and off to regulate the global, market-based price,” Andrew Harding, head of Rio’s iron ore division, said in a speech in the West Australian city of Perth. “We are vigorously competing against global suppliers for market share. If we stop doing that the Pilbara (mining region) producers will lose and Australia will lose. It’s that simple. (AFP) Wall Street sags after strong US jobs data; dollar bounces and a move to wean itself off money-off vouchers. The company, which trails market leader Tesco, Wal-Mart’s Asda and Sainsbury’s in annual sales, has not reported positive underlying sales since the fourth quarter of its 2011-12 year. Former Tesco executive David Potts joined as chief executive in March, tasked with reviving Morrisons’ fortunes. But he warned in September it would be a “long journey”. Shares in Morrisons fell up to 3.7 percent after it said sales at stores open more than a year, excluding fuel, fell 2.6 percent in the 13 weeks to Nov 1, its fiscal third quarter. (RTRS) ❑ ❑ ❑ steel producer, ArcelorMittal, has suspended its 2015 dividend as a slump in market prices caused by cheap exports from countries like China pushed the company to a net loss. The Luxembourg-based company said Friday that its sales dropped 22 percent to 15.6 billion euros in the third quarter from a year earlier. It fell to a net loss of 711 million euros from a profit of 22 million euros the year before after booking 500 million euros in charges to reduce the value of its inventory of steel. The company blamed record exports from China and nations belonging to the former Soviet Union for pushing down market prices significantly. “The already challenging operating conditions have further deteriorated during recent months, largely due to additional declines in steel prices caused by exceptionally low Chinese export prices,” said Lakshmi Mittal, the chairman and CEO. (AP) ❑ ❑ ❑ worsened by slowing growth in China, the world’s largest commodities consumer. The supply-demand imbalance has seen the ore price sink by more than two-thirds since peaking near $200 a tonne in 2011, and placed the bottom lines of higher-cost smaller miners under pressure. “There has been a view that Australia can simply turn the iron Rio Tinto’s iron ore chief on Thursday hit back at critics of the mining giant’s decision to continue expanding its iron ore output even as prices plunge, saying Australia did not have the power to control the market. Leading exporters such as Rio and Anglo-Australian giant BHP Billiton have kept lifting production levels, adding to a supply glut planned by its owner Tata Motors, India’s largest car maker. “We reviewed the process of talks and both of us expressed satisfaction with the progress of negotiations,” Hudak said. Slovak Finance Minister Peter Kazimir said earlier that “we’ll be able to announce the date of the signature later this month.” (AFP) bottomline LUXEMBOURG: The world’s largest Rio Tinto defends boosting iron ore output US US stock indexes were little changed in choppy morning trading on Friday after a stronger-than-anticipated jobs report hardened the chance that the Federal Reserve would finally raise interest rates in December. Eight of the 10 major S&P sectors were lower, with the interest-rate sensitive utilities sector’s 3.42 percent decline easily the worst. The financials sector was up 1.25 percent, led by bank stocks. Job growth in October was the best since December 2014, while the unemployment rate fell to 5 percent, the lowest since April 2008. The jobless rate is now at a level many Fed officials view as consistent with full employment. Traders raised the odds of a hike in December to 70 percent from the 58 percent just before the jobs data was released, according to the CME Group’s FedWatch program. The dollar rose to a 6-1/2 month high after the data. Higher rates increase borrowing costs for companies, while a strong dollar hurts their income from overseas markets. At 10:44 am ET (1544 GMT), the Dow Jones industrial average was up 2.34 points, or 0.01 percent, at 17,865.77. The S&P 500 was down 5.03 points, or 0.24 percent, at 2,094.9 and the Nasdaq Composite index was up 5.21 points, or 0.1 percent, at 5,132.95. Among financial stocks, JPMorgan rose 3 percent and gave the biggest boost to the S&P 500, followed by Bank of America, up 3.8 percent and Citigroup, up 3.2 percent. Goldman rose 3.3 percent and was the biggest influence on the Dow, followed by Disney, which was up 2.6 percent after reporting a higher-than-expected profit. Exxon was down 1.5 percent to $83.59, the biggest drag on the S&P, after the New York attorney general launched an investigation into whether the company misled the public and shareholders about the risks of climate change. Energy stocks fell 1 percent as crude oil prices slipped. Chevron shed 2 percent and weighed the most on the Dow. TripAdvisor slumped 10 percent to $74.82, while Kraft Heinz was down 4 percent at $72.49 after both reported quarterly results below estimates. Kraft was the biggest drag on Nasdaq. Declining issues outnumbered advancing ones on the NYSE by 2,222 to 758. On the Nasdaq, 1,452 issues fell and 1,126 advanced. Cement maker CRH rose 4.7 percent after UBS upgraded the construction sector to “overweight” and named the Irish company as its preferred pick. Construction and materials, banks and autos were the top sectoral gainers and were all up more than 1.5 percent. Richemont fell 7.6 percent after warning of a challenging second half after first-half net profits grew less than expected, as strong demand for high-end jewellery could not make up for weaker luxury watch sales in Hong Kong. According to data from Thomson Reuters StarMine, 52 percent of companies on the European STOXX 600 index have beaten or met market forecasts with their third-quarter results so far, while earnings guidance has been cut for the fourth quarter. UK Britain’s top share index retreated on Friday, weighed down by mining stocks that fell as the dollar surged following better-than-expected US jobs data. US non-farm payrolls expanded by 271,000 in October, the largest rise since December 2014 and making a December Federal Reserve rate hike more likely. The blue chip FTSE 100 was down 0.2 percent at 6,353.83 points at the close, lagging European indexes. Mining stocks were the top fallers, with Glencore falling 4.7 percent and Anglo American and Antofagasta down 1.7 percent and 0.3 percent respectively. Another negative for the sector was Thursday’s dam burst in Brazil at an iron ore mine owned by Vale and BHP Billiton, devastating a nearby town with mudslides and reportedly leaving scores dead or missing. BHP Billiton shares fell 5.7 percent, trimming nearly 5 points off the FTSE 100. Burberry was hit by weak earnings from Switzerland, where Richemont fell 5.7 percent after poorly received results that knocked back the luxury sector. Burberry fell 0.7 percent. Among top risers, HSBC added 8.3 points to the index, rising 2.1 percent after the dollar rally. Earnings reports boosted shares in British Airways owner IAG , which rose 3.7 percent after lifting its long-term guidance, while Inmarsat rose 3.2 percent after its results. Intercontinental Hotels Group was the top gainer, up 6.2 percent after saying that it was exploring strategic options including a potential sale or merger. Building company CRH was up 3.6 percent after UBS upgraded the construction sector to “overweight”, naming CRH as a preferred pick. Europe European stock markets edge higher on Friday after stronger than expected US jobs data boosted the dollar, lifting export-oriented stocks like autos, although Cartier brand-owner Richemont plunged after warning of tough times ahead. The pan-European FTSEurofirst 300 index was up 0.15 percent and the euro zone’s blue-chip Euro STOXX 50 index gained 0.24 percent, while Germany’s export-heavy DAX outperfomed to gain 0.75 percent. Shares in Swiss agriculture company Syngenta rose more than 4 percent after media reports of a possible deal with DuPont, while disgruntled shareholders called for a strategic review of company should abandon efforts to sell parts of its business and instead conduct a strategic review. Asia Tokyo’s benchmark Nikkei index closed at its highest level in more than two months Friday, while traders in Asia were closely watching a US jobs report that could indicate a Fed move on interest rates. The Nikkei 225 shrugged off a weak lead from US markets to end 0.78 percent higher following a week of gains, led by Japan Post’s market debut. Japan Post is now worth $36 billion more than its government price tag following the biggest initial public offering globally this year, with its insurance unit especially in demand among investors. The government hopes the Japan Post sell-off will draw more investment to Japanese firms and provide a lift for Prime Minister Shinzo Abe’s faltering bid to kick-start the world’s number-three economy. Hong Kong stocks closed up 1.00 percent on the week, though slightly down for the day, tracking a lower finish on Wall Street Thursday on the eve of the US payrolls report. The benchmark Shanghai Composite Index gained 6.13 percent over the week. Chinese firms have rallied in Shanghai and Hong Kong in recent days on hopes for economic reforms after the ruling Communist Party issued guidelines for its 2016-2020 development plan on Tuesday. The proposals included calling for liberalisation in China’s capital markets and foreign exchange regime. Standard Chartered shares slumped 3.70 percent in Hong Kong after a Fitch downgrade, with the ratings agency citing “unfavourable profitability and asset quality trends as well as its underperformance relative to peers” as the reason for the move. Elsewhere, Singapore Airlines (SIA) announced a full takeover bid for its struggling budget carrier subsidiary Tigerair on Friday, vowing to redevelop it as an integral part of the group’s portfolio. Oil The oil market fell Friday, reversing earlier gains as the dollar surged on bright US jobs data that boosted hopes of a rate hike before year-end. In late afternoon deals in London, Brent North Sea crude for December shed 51 cents to stand at $47.47 per barrel. US benchmark West Texas Intermediate for delivery in December slid 26 cents to $45.46 per barrel compared with Thursday’s close. “Oil was slow to react to the strong jobs number given the positive implications for oil demand in a growing US economy,” said CMC Markets analyst Jasper Lawler. Gold Gold fell to a three-month low on Friday and was set to post its biggest weekly drop since 2013 after US data showed job growth surged in October, making it likely the Federal Reserve will hike interest rates in December. Nonfarm payrolls increased 271,000 last month, the largest rise since December 2014, while the unemployment rate fell to 5.0 percent, the lowest level since April 2008, from 5.1 percent the prior month, the Labor Department said on Friday. Spot gold, stronger initially, fell as much as 1.5 percent to percent to $1,087 an ounce, its lowest since Aug. 7. It was down 1.4 percent at $1,087.70 by 1358 GMT. exchange rates – November 05 US dollar BEC Muzaini Dollarco Commercial Bank Gulf Bank NBK Burgan Bank ABK Oman KBE Sterling pound Transfer .301750 .304100 .304100 .303800 .283900 .286000 .281550 .283650 .281450 .283550 .285950 .283550 .302700 .304800 — — .303450 Buy Sell Sell Sell Buy Sell Buy Sell Buy Sell Buy Sell Buy Sell Buy Sell Sell Cash .300000 .304500 .302900 .304000 .285000 .288000 .279050 .285650 .276450 .285050 .276200 .285000 .300200 .306300 — — — Buy Sell Sell Sell Buy Sell Buy Sell Buy Sell Buy Sell Buy Sell Buy Sell Sell Cash .040746 .045746 — — — — — — — — — — — — — — — Buy Sell Sell Sell Buy Sell Buy Sell Sell Transfer Cash Draft — — — — — — — — — .695000 .578645 .578645 — — — — — — — — — — — — — — — Draft .301750 .304100 .304100 .303800 .283900 .286000 .281550 .283650 .281450 .283550 .285950 .283550 .302700 .304800 — — .303450 Cash .460842 .469842 — .470000 .445000 .453902 .468169 .471390 .476290 .485630 .480590 .468050 .460960 .472770 — — — Danish krone BEC Muzaini Dollarco Commercial Bank Gulf Bank NBK Burgan Bank ABK Oman KBE Draft .040746 .045746 — — .049827 .050196 .050751 .051668 .051020 .051540 .046462 .046997 .044480 .045650 — — — Muzaini Dollarco Gulf Bank ABK KBE travellers cheques BEC Commercial Bank Gulf Bank Al-Ahli Bank Transfer .459841 .469341 .469070 .469525 .446160 .445920 .457969 .464891 .477790 .482630 .442550 .447120 .465100 .470070 — — .472326 Indian rupee Transfer .040746 .045746 — — .049827 .050196 .050751 .051668 .051020 .051540 .046462 .046997 .044480 .045650 — — — Cash .004394 .004784 — .004900 .004000 .006900 — — — — — — — — — — — Cyprus pound BEC Draft .459841 .469341 .469070 .469525 .435318 .438538 .457969 .464891 .477790 .482630 .444600 .436000 .465100 .470070 — — .472326 Draft .004572 .004648 .004642 .004638 — .005278 — .004513 — — .005094 .005093 .004565 .004673 — — .004653 Transfer .004572 .004648 .004642 .004638 — .005278 — .004513 — — .005094 .005093 .004565 .004673 — — .004653 Yemeni riyal Cash .001372 .001452 — — — — — — — US dollar .3041000 .2858000 .2848500 .3048000 Draft .001359 .001459 .001417 — — — — — .001550 Transfer .001359 .001459 001417 — — — — — .001550 Sterling .4693416 .4371900 .4548350 .4700700 Euro Cash .324887 .332887 — .339000 .369000 .378000 .382772 .395251 .379500 .388120 .339010 .347320 .328420 .337540 — — — Draft .324886 .332386 .331770 .335840 .371497 .374245 .386202 .392484 .381000 .385120 .380190 .340510 .331370 .335610 — — .340769 Japanese yen Transfer .324886 .332386 .331770 .335840 .374245 .386202 .392484 .388850 .381000 .385120 .367130 .383120 .331370 .335610 — — .340769 Pakistani rupee Cash .002768 .003048 — .003150 — — — — — — — — — — — — — Draft .002844 .002876 .002881 .002878 — .002917 — .002673 — — — — — .003010 — — .002881 Euro .3323868 .3780000 .3850860 .3356100 Draft .008116 .008716 .008557 .952000 — — – — — Draft .002417 .002597 .002503 .003510 .002864 .002885 .002722 .002765 .002762 .002795 .003588 .003636 .002487 .002515 — — — Transfer .002417 .002597 .002503 .003510 .002864 .002885 .002722 .002765 .002762 .002795 .003588 .003636 .002487 .002515 — — — Sri Lanka rupee Transfer .002844 .002876 .002881 .002878 — .002917 — .002673 — — .003233 — — .003010 — — .002881 Thai baht Cash .008216 .008766 — .010250 — — — — — Cash .002417 .002597 — .003000 — — — — — — — — — — — — — Cash .001866 .002446 — .002500 — — — — — — — — — — — — — Draft .002118 .002160 .002161 .002160 — .002286 — .002192 — — .002546 — — .002224 — — .002161 Transfer .002118 .002160 .002161 .002160 — .002286 — .002192 — — .002546 — — .002224 — — .002161 South African rand Transfer .008116 .008716 .008557 .952000 — — — – — Cash Transfer Draft .001601 — — .002451 — — — — — — — — — — — — .027843 .027843 — — — — — — — — — local gold BEC Muzaini Exchange Swiss franc Cash .299385 .309585 — .303000 .302000 .317000 — — .308480 .318890 .279180 .289100 — — — — — Draft .300385 .307385 .307480 .300840 .315715 .304597 .315568 .321998 .312480 .316390 .315180 .283180 .303960 .308240 — — — Transfer .300385 .307385 .307480 .300840 .315715 .304597 .306850 .315568 .312480 .316390 .315030 .283180 .303960 .308240 — — — Bangladesh taka Cash .003498 .004098 — .004000 — .003678 — .003704 — — — — — — — — — Draft .003846 .003889 .003891 .003887 — — — — — — .004017 — — — — — .003892 Transfer .003846 .003889 .003891 .003887 — .003678 — .003704 — — .004017 — — — — — .003892 Korean won Cash .000257 .000272 — — — — — — — Draft — — — — — — — — — Gold 999 kg — 10,939.000 Transfer — — — — — — — — — Canadian dollar Cash .225477 .233977 — .238000 .278000 .292000 — — — — .277897 .282890 — — — — — Draft .223477 .233477 .231780 .234250 .279512 .281579 .264664 .269564 .259110 .262130 .275770 .279970 .229640 .232390 — — — Transfer .223477 .233477 .231780 .234250 .279512 .281579 .264664 .269564 .259110 .262130 .286988 .256960 .229640 .232390 — — — Philippine peso Cash .006410 .006690 — .006750 — — — — — — — — — — — — Draft .006029 .006496 .006493 .006483 — .007006 — .006597 — — .006449 — — .006935 — — .006451 Transfer .006029 .006496 .006493 .006483 — .007006 — .006597 — — .006449 — .006935 — — .006451 Syrian pound Cash .001287 .001507 — .200000 — — — — — Gold 999 10 tola — 1,313.740 Draft .001279 .001499 .216400 .260500 — — — — — Transfer .001279 .001499 .216400 .260500 — — — — — Gold ounce — 349.680 Swedish krona Cash .031174 .036174 — — — — — — — — — — — — — — — Draft .031173 .036173 — — .044440 .043546 .042590 .043364 .042270 .042710 .041155 .043700 .035010 .035800 — — — Transfer .031173 .036173 — — .044440 .044769 .042590 .043364 .042270 .042710 .041155 .043700 .035010 .035800 — — — Saudi riyal Cash .080457 .081157 — .082000 .072000 .077000 — .076315 .073980 .076670 .073684 .075774 .079500 .082010 — — — Australian dollar Cash .210022 .221522 — — — — — — — — — — — — — — — Draft .208021 .221021 — — .298109 .300314 .261600 .266783 .264560 .267810 .284712 .264500 .217170 .220150 — — — Transfer .208021 .221021 — — .298109 .300314 .261600 .266783 .264560 .267810 .284712 .264500 .217170 .220150 — — — Draft — — — — — — — — — Gold gm 22k — 10.040 Transfer — — — — — — — — — Transfer .080506 .081146 .081137s .081740 .075727 .076287 .074986 .075781 .074980 .075670 075640 .072340 .080210 .081530 — — .081393 Hong Kong dollar Cash .037076 .039826 — — — — — — — — — — — — — — — Iranian Riyal Cash .000084 .000085 — — — — — — — Draft .080506 .081146 .081137 .081740 .075727 .076227 .074986 .075781 .074980 .075670 .075640 .072340 .080210 .081530 — — .081393 Draft .036576 .039676 .039168 — .036574 .036844 .036334 .036924 — — — — .038940 .039320 — — — Transfer .036576 .039676 .039168 — .036574 .036844 .036334 .036924 — — — — .038940 .039320 — — — Lebanese pound Draft Cash Transfer .000151 .000186 .000186 .000251 .000206 .000206 .202400 .202400 — — — — — — — — — — — — — — — — — — — Gold gm 21k — 9.580 Gold gm 18k — 8.210 UAE dirham Cash .081814 .082963 — .084000 .077070 .077844 .075828 .077939 .076140 .077170 .075223 .077374 .082095 .082920 — — — Draft .081314 .082764 .082689 .083010 .077325 .077897 .076576 .077394 .076570 .077250 .077237 .074510 .081950 .083210 — — .082736 Transfer .081314 .082764 .082689 .083010 .076810 .077897 .076576 .077394 .076570 .077250 .077140 .077237 .081950 .083210 — — .082736 Singapore dollar Cash .213926 .219926 — — — — — — — — — — — — — — — Transfer .212925 .218925 .218220 — .229377 .231074 .225352 .229193 .224760 .226990 .222630 .216673 .216140 .218700 — — — Draft .212925 .218925 .218220 — .229377 .231074 .225352 .229193 .224760 .226990 .216673 .218433 .216140 .218700 — — — Malaysian ringgit Cash .067765 .073765 — .890000 — — — — — 100 gm 999 — — Draft .065767 .072767 .072102 .071750 — — — — — Transfer .065767 .072767 .072102 .071750 — — — — — 10 gm 999 — 116.645 Bahraini dinar Cash .799422 .807422 — .810000 .758415 .737294 .741794 .762290 .744400 .751880 — — — — — — — Draft .798921 .807421 .806560 .806320 .753350 .758923 .749073 .756975 .746060 .752820 .740873 .750398 .799140 .811090 — .751000 .806028 Transfer .798921 .807421 .806560 .806320 .753350 .758923 .749073 .756975 .746060 .752820 .740873 .750398 .799140 .811090 — .751300 .806028 Jordanian dinar Cash .424138 .431638 — .426000 — — — — — — — — — — — — — Draft .422359 .429859 .427870 .428080 — .404526 — .403470 — — .394853 .398939 .425240 .431550 — — — Transfer .422359 .429859 .427870 .428080 — .404526 — .403470 — — .394853 .398939 .425240 .431550 — — — Indonesian rupiah Cash .000018 .000024 — — — — — — — Draft .000017 .000022 — — — .000025 — — .002438 Transfer .000017 .000022 — — — .000025 — — 002438 Omani riyal Cash .783450 .789130 — — .736094 .743492 .726318 .746616 .729750 .737090 .735741 — — — — — — Draft .777949 .788949 .788850 — .737690 .743147 .733445 .741410 .730560 .737070 .734440 .722120 .783420 .794240 — — — Transfer .777949 .788949 .788850 — .737690 .743147 .733445 .741410 .730560 .737070 .734440 .719020 .783420 .794240 — — — Egyptian pound Cash .037323 .040153 .038950 .041000 .037000 .044000 — — — — — — — — — — — Draft .037153 .037922 .037848 .037724 — — — .041547 — — .047830 .049026 — .039250 — .039488 .378530 Transfer .037153 .037922 .037848 .037724 — — — .041547 — — .047830 .049026 — .039250 — .039488 .378530 New Zealand dollar Cash .198212 .207712 — — — — — — — Draft .196211 .207211 — — .231317 .236230 .203170 .206870 — Transfer .196211 .207211 — — .231317 .236230 .203170 .206870 — All rates in KD per unit of foreign currency