asu financial literacy course outline

advertisement

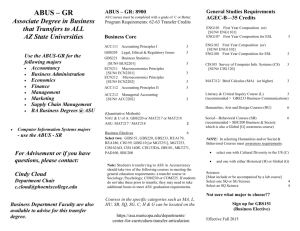

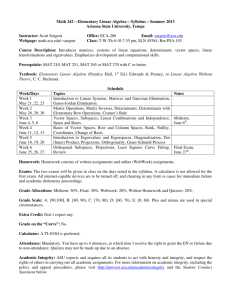

ASU FINANCIAL LITERACY COURSE OUTLINE FIN 191 - Topic: ASU Financial Literacy (class #27023). The financial literacy course is presented in a one-credit, pass/fail, online format. Course description: A practical approach to financial issues faced by ASU students. Emphasis is on financial challenges likely to be encountered while at ASU, as well as challenges to be encountered immediately upon graduation. Content is tailored specifically for the ASU student. The course is divided into fourteen units. Each unit will be narrated by student volunteers and will contain extensive interviews with current ASU students. The core curriculum has been developed entirely by W.P. Carey Finance Department faculty. To date, over 400 students have been involved in the production of the course. Topics include: 1) GOAL SETTING a) Financial goals are usually just a means of obtaining more important core goals in life. b) Can be in writing or informal (in writing better). 2) WHERE YOU SPEND a) Some budget items, such as housing, are critical due to size. b) Some budget items, such as coffee, are critical due to frequency. 3) COMPOUNDING a) Underestimating often causes delays in starting to save. b) Underestimating often causes us to take out more debt. c) Underestimating causes delays in starting to pay off debt. 4) CONSUMER TRAPS a) Budget busting marketing techniques. b) Resist artificially created feelings of urgency to buy; control your impulses. 5) CREDIT CARDS a) Credit versus debit cards. b) Watch annual fees, interest charged on balances and other fees. c) Avoid the minimum payment trap. 6) PAYING FOR SCHOOL a) Difference in “Financial aid” from parents, scholarships, loans. b) Huge student loan balances now could prevent the purchase of a home or car later. c) Working as an alternative. 7) CREDIT SCORES a) The keys to a good credit score are to limit borrowing and to pay bills on time. b) A poor credit score makes borrowing expensive or even impossible. c) Free access to credit file is available online to everyone. 8) SAVING a) Importance of seasonal student savings. b) Start saving as soon as possible for goals in life. c) Allows you to become an investor. 9) INVESTING a) Why invest? Purchasing power risk. b) Why diversify? Market risk. c) Risk versus return: Historical returns and risks for various investment types. 10) INSURANCE a) Types of insurance. b) Cost versus benefit: Don’t be sold insurance you don’t need. c) Importance of shopping around. 11) BUYING A CAR a) Do you need a car on campus? Alternatives. b) Before you buy a car, investigate expenses such as gas mileage, cost or monthly payment, auto insurance and likely repair costs (all vary greatly by model). c) State minimum insurance or additional insurance. 12) HOUSING a) Importance of location. b) Rental alternatives and pitfalls. c) Rent or buy decision. 13) TAXES a) How income taxes work. b) Other types of taxes. 14) BEHAVIORAL ISSUES a) Anchoring, overconfidence, myopic risk aversion. b) Wisdom of elders.