Market-related sales decline in core business Automotive

advertisement

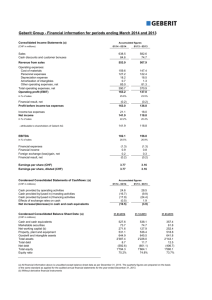

Press release Market-related sales decline in core business Automotive • Currency-neutral Group sales for first nine months of 2015 slightly below comparable prior-year period • Earnings also hurt by production changes and strong Swiss franc • Owing to decline in Japanese car market, sales for fiscal 2015 now expected to be CHF 132 million • EBIT margin of between 0 and 1 percent now expected for year as a whole Zurich, October 22, 2015 – In the first nine months of 2015 Micronas Group posted consolidated net sales of CHF 102.0 million. Owing to the removal of the minimum Swiss franc exchange rate against the euro, this was 14.7 percent lower than the figure for the first nine months of 2014. After adjusting for exchange rates (calculated in euros), sales were 1 percent down on the prior-year period. As already communicated in July, this slight decrease was due to the fall in demand for cars in Japan, a key sales market for Micronas. Domestic car sales in Japan were over 10 percent lower in the first nine months of 2015 than in the same period of the previous year, and exports by Japanese car manufacturers more or less stagnated compared to the first nine months of 2014. Micronas generates about half of its overall sales from customers in Japan. Consequently, currency-neutral sales were also down by 1 percent in the core Automotive business compared with the first nine months of 2014. The Automotive segment achieved sales of CHF 95.1 million in the first nine months of 2015, accounting for 93 percent of total sales. The small Industrial segment, which contributed CHF 7.0 million or 7 percent of total sales in the reporting period, experienced a currency-neutral fall in sales of 3 percent for the first nine months of the year. Most Industrial sales are generated through Micronas Group’s distribution partners. In order to increase sales, Micronas concluded new agreements with Rutronik, Digi-Key and Mouser in the first half of 2015. These partnerships are already starting to deliver their first successes. Industrial sales were 23.0 percent higher in the third quarter of 2015 than in the previous three-month period. Micronas Semiconductor Holding AG, Technopark, Technoparkstrasse 1, CH-8005 Zurich, Switzerland, phone +41 44 445 39 60, fax +41 44 445 39 61 Micronas Group’s operating profit (EBIT) for the first nine months of 2015 was CHF 1.9 million, while the EBIT margin stood at 1.8 percent. The main additional factors weighing down on operating profit continue to be the switch in front-end production from 6 to 8 inches and the changeover to new backend production facilities, combined with various new product launches and qualifications. The Automotive segment posted an EBIT margin of 1.3 percent, and the Industrial segment of 9.2 percent. After financial income and taxes, Micronas Group reported a loss of CHF 7.4 million for the period under review. This is largely explained by the valuation of cash balances held in euros by the holding company. Earnings per share came to CHF -0.25. At the end of September 2015 shareholders’ equity reached CHF 91.4 million, which gives an equity ratio of 34.7 percent. Cash, cash equivalents and short-term financial cash deposits fell CHF 3.7 million in the third quarter to CHF 122.6 million owing to further investments in production areas. Capacity utilization at the Freiburg manufacturing plants remained unchanged at 85 percent in the third quarter of 2015. The share buy-back program announced on February 26, 2015, continues to progress as planned. Between March 10 and September 22, 2015, the Company bought back a total of 1 002 250 shares, which is 3.4 percent of total Micronas share capital. The downward trend of the Japanese automotive market has also prompted Japanese customers to make inventory corrections. As a result, orders planned in as sales for the fourth quarter have been moved to next year. The sales and EBIT forecasts given for financial 2015 have therefore been revised downwards slightly. The Board of Directors and Management now expect sales of CHF 132 million. After adjusting for currency movements, this would mean a fall in sales of 3 percent compared with the prior year. The full-year EBIT margin is likely to be between 0 and 1 percent. Owing to the valuation of cash holdings denominated in foreign currencies, the net result is still likely to be negative. About Micronas Micronas (SIX Swiss Exchange: MASN) the most preferred partner for sensing and control serves all major automotive electronics customers worldwide, many of them in long-term partnerships for lasting success. While the holding company is headquartered in Zurich (Switzerland), operational headquarters are based in Freiburg (Germany). Currently, the Micronas Group employs around 900 persons. Micronas Semiconductor Holding AG, Technopark, Technoparkstrasse 1, CH-8005 Zurich, Switzerland, phone +41 44 445 39 60, fax +41 44 445 39 61 For further information Susy Krucker Investor Relations Phone: +41 44 445 39 60 E-mail: investor@micronas.com Disclaimer This press release contains forward-looking statements, such as projections, forecasts and estimates. Such forward-looking statements are dependent on certain risks and uncertainties which may cause actual results, performance or events to differ materially from those anticipated in this press release. The forward-looking statements contained in this press release are based on Micronas' views and assumptions as of this date and Micronas does not assume any obligation to update or revise this press release. This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction. Micronas Semiconductor Holding AG, Technopark, Technoparkstrasse 1, CH-8005 Zurich, Switzerland, phone +41 44 445 39 60, fax +41 44 445 39 61 Micronas Group – Key data for first nine months 2015 Consolidated profit and loss statement Net sales Margin Operating profit/loss (EBIT) EBITDA Profit/loss for the period Earnings per share in CHF Segment reporting Automotive Net sales Operating profit/loss (EBIT) Industrial Net sales Operating profit (EBIT) Q3/2015 CHF 1 000 31 203 9 121 -29 2 619 -2 212 -0.08 Q3/2015 CHF 1 000 Orders on hand Book-to-bill Orders on hand, beginning of period Net sales Order intake Translation adjustments Orders on hand, end of period Book-to-bill 102 036 28 476 1 880 9 354 -7 385 -0.25 119 625 37 137 4 968 13 404 3 093 0.10 Q2/2015 9 months 2015 CHF 1 000 CHF 1 000 9 months 2014 CHF 1 000 35 171 9 431 607 2 915 -771 -0.03 33 059 557 95 077 1 237 111 254 4 666 2 597 380 2 112 50 6 959 643 8 371 302 25.9.2015 CHF 1 000 26.6.2015 CHF 1 000 31.12.2014 CHF 1 000 84 846 55 416 122 845 263 107 91 361 149 085 22 661 263 107 122 631 82 948 45 626 126 593 255 167 94 140 143 597 17 430 255 167 126 336 95 892 49 658 152 149 297 699 109 762 167 715 20 222 297 699 151 361 Q2/2015 9 months 2015 CHF 1 000 CHF 1 000 9 months 2014 CHF 1 000 Non-current assets Other current assets Cash, cash equivalents and short-term financial investments Total assets Equity Long-term liabilities Current liabilities Total shareholders’ equity and liabilities Cash, cash equivalents and short-term financial cash deposits Cash flow from operating activities Cash flow from investing activities Cash flow from financing activities Change in cash, cash equivalents and shortterm financial cash deposits 9 months 2014 CHF 1 000 28 606 -409 Consolidated balance sheet Consolidated cash flow statement Q2/2015 9 months 2015 CHF 1 000 CHF 1 000 Q3/2015 CHF 1 000 -727 -4 322 -2 166 -2 121 -2 169 -2 469 -5 145 -7 680 -6 612 441 -14 025 -1 375 -3 705 -6 979 -28 730 -16 357 Q2/2015 9 months 2015 CHF 1 000 CHF 1 000 9 months 2014 CHF 1 000 49 006 102 036 95 107 -4 841 37 236 0.93 48 125 119 625 119 485 -766 47 219 1.00 Q3/2015 CHF 1 000 37 402 31 203 29 384 1 653 37 236 0.94 40 855 35 171 31 855 -137 37 402 0.91 Micronas Semiconductor Holding AG, Technopark, Technoparkstrasse 1, CH-8005 Zurich, Switzerland, phone +41 44 445 39 60, fax +41 44 445 39 61