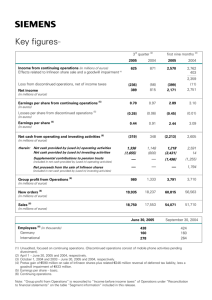

Annual Report 2002

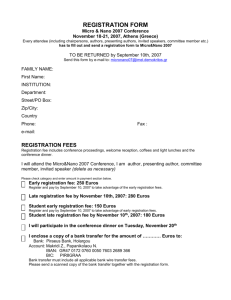

advertisement