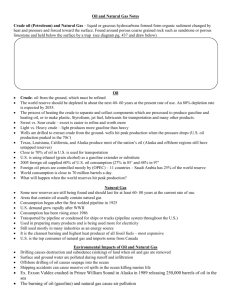

An Anatomy of the Crude Oil Pricing System

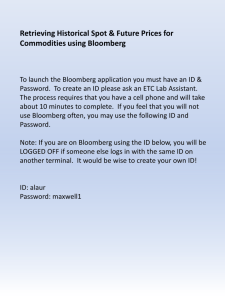

advertisement