We use the asset and liability method of accounting for income taxes

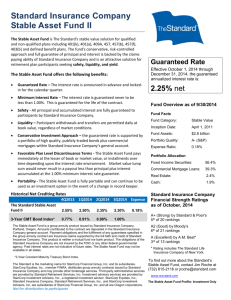

advertisement

2 0 0 6 A N N UA L R E P O RT Income Taxes OPERATING RESULTS We use the asset and liability method of accounting for income taxes as required by SFAS No. 109, “Accounting for Income Taxes.” Under the asset and liability method, we recognize deferred tax assets and liabilities for the future tax consequences attributable to temporary differences between the financial statement carrying amounts and the tax basis of existing assets and liabilities. We recognize the future tax benefits to the extent that realization of such benefits is more likely than not. We amortize deferred investment tax credits over the lives of the related properties. We evaluate operating results based on earnings per share. We have various classifications of sales, defined as follows: We record deferred tax assets for capital losses, operating losses and tax credit carryforwards. However, when we believe we do not or will not have sufficient future capital gain income or taxable income to realize the benefit of the capital loss, operating loss or tax credit carryforwards, we reduce the deferred tax assets by a valuation allowance. We recognize a valuation allowance if we determine, based on available evidence that it is unlikely that we will realize some portion or all of the deferred tax asset. We report the effect of a change in the valuation allowance in the current period tax expense. industrial customers. Other retail: Sales of energy for lighting public streets and highways, net of revenue subject to refund. Tariff-based wholesale: Sales of energy to electric cooperatives, municipalities and other electric utilities, the rates for which are generally based on cost as prescribed by FERC tariffs. This category also includes changes in valuations of contracts that have yet to settle. Market-based wholesale: Sales of energy to wholesale customers, the rates for which are generally based on prevailing market prices as allowed by our FERC approved market-based tariff, or where not permitted, pricing is based on incremental cost plus a permitted margin. This category also includes changes in valuations of contracts that have yet to settle. Asset Retirement Obligations Energy marketing: Includes: (i) transactions based on market We calculate our asset retirement obligations and related costs using the guidance provided by SFAS No. 143, “Accounting for Asset Retirement Obligations” and the Financial Accounting Standards Board’s (FASB) Interpretation No. 47, “Accounting for Conditional Asset Retirement Obligations”(FIN 47). prices with volumes not related to the production of our generating assets or the demand of our retail customers; (ii) financially settled products and physical transactions sourced outside our control area; and (iii) changes in valuations for contracts that have yet to settle that may not be recorded in tariff- or market-based wholesale revenues. We estimate our asset retirement obligations based on the fair value of the asset retirement obligation we incurred at the time the related long-lived asset was either acquired, placed in service or when regulations establishing the obligation become effective. In determining our asset retirement obligations, we make assumptions regarding probable disposal costs. A change in these assumptions could have a significant impact on our asset retirement obligations reflected on our consolidated balance sheets. Contingencies and Litigation We are currently involved in certain legal proceedings and have estimated the probable cost for the resolution of these claims. These estimates are based on an analysis of potential results, assuming a combination of litigation and settlement strategies. It is possible that our future results could be materially affected by changes in our assumptions. See Note 16 of the Notes to Consolidated Financial Statements, “Legal Proceedings,” for more detailed information. 32 Retail: Sales of energy made to residential, commercial and Transmission: Reflects transmission revenues, including those based on a tariff with the SPP. Other: Miscellaneous electric revenues including ancillary service revenues and rent from electric property leased to others. Regulated electric utility sales are significantly impacted by such things as rate regulation, customer conservation efforts, wholesale demand, the economy of our service area and competitive forces. Our wholesale sales are impacted by, among other factors, demand, cost and availability of fuel and purchased power, price volatility, available generation capacity and transmission availability. Changing weather affects the amount of electricity our customers use. Hot summer temperatures and cold winter temperatures prompt more demand, especially among our residential customers. Mild weather serves to reduce customer demand.