Beating investor bias

advertisement

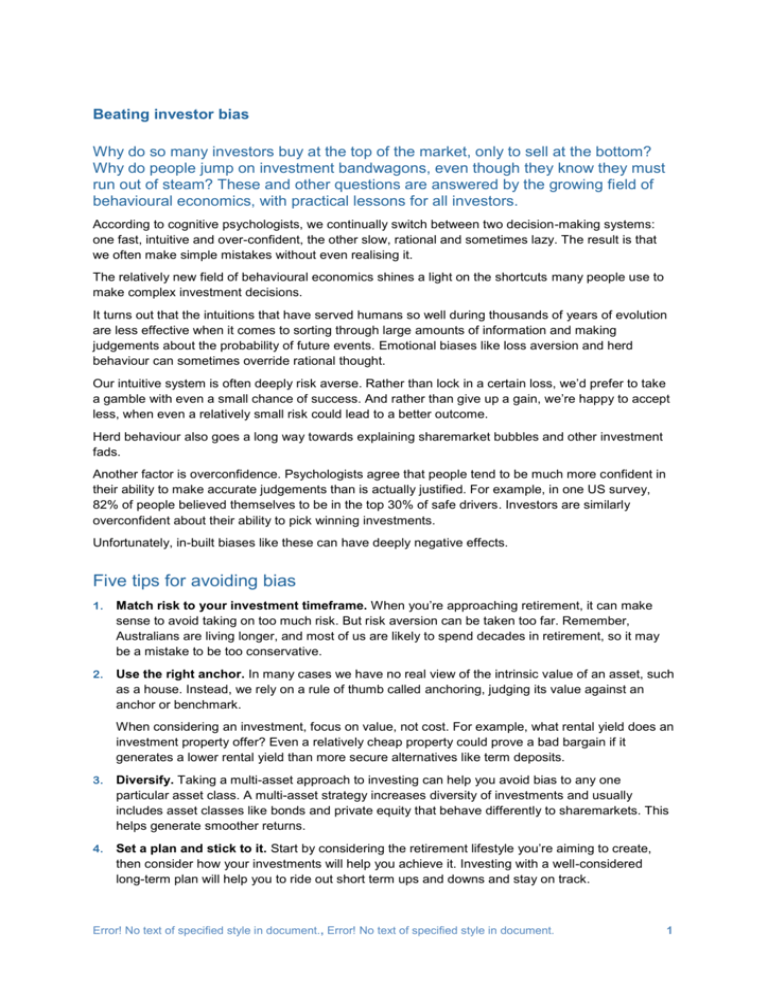

Beating investor bias Why do so many investors buy at the top of the market, only to sell at the bottom? Why do people jump on investment bandwagons, even though they know they must run out of steam? These and other questions are answered by the growing field of behavioural economics, with practical lessons for all investors. According to cognitive psychologists, we continually switch between two decision-making systems: one fast, intuitive and over-confident, the other slow, rational and sometimes lazy. The result is that we often make simple mistakes without even realising it. The relatively new field of behavioural economics shines a light on the shortcuts many people use to make complex investment decisions. It turns out that the intuitions that have served humans so well during thousands of years of evolution are less effective when it comes to sorting through large amounts of information and making judgements about the probability of future events. Emotional biases like loss aversion and herd behaviour can sometimes override rational thought. Our intuitive system is often deeply risk averse. Rather than lock in a certain loss, we’d prefer to take a gamble with even a small chance of success. And rather than give up a gain, we’re happy to accept less, when even a relatively small risk could lead to a better outcome. Herd behaviour also goes a long way towards explaining sharemarket bubbles and other investment fads. Another factor is overconfidence. Psychologists agree that people tend to be much more confident in their ability to make accurate judgements than is actually justified. For example, in one US survey, 82% of people believed themselves to be in the top 30% of safe drivers. Investors are similarly overconfident about their ability to pick winning investments. Unfortunately, in-built biases like these can have deeply negative effects. Five tips for avoiding bias 1. Match risk to your investment timeframe. When you’re approaching retirement, it can make sense to avoid taking on too much risk. But risk aversion can be taken too far. Remember, Australians are living longer, and most of us are likely to spend decades in retirement, so it may be a mistake to be too conservative. 2. Use the right anchor. In many cases we have no real view of the intrinsic value of an asset, such as a house. Instead, we rely on a rule of thumb called anchoring, judging its value against an anchor or benchmark. When considering an investment, focus on value, not cost. For example, what rental yield does an investment property offer? Even a relatively cheap property could prove a bad bargain if it generates a lower rental yield than more secure alternatives like term deposits. 3. Diversify. Taking a multi-asset approach to investing can help you avoid bias to any one particular asset class. A multi-asset strategy increases diversity of investments and usually includes asset classes like bonds and private equity that behave differently to sharemarkets. This helps generate smoother returns. 4. Set a plan and stick to it. Start by considering the retirement lifestyle you’re aiming to create, then consider how your investments will help you achieve it. Investing with a well-considered long-term plan will help you to ride out short term ups and downs and stay on track. Error! No text of specified style in document., Error! No text of specified style in document. 1 5. Get professional advice. A financial planner can draw on research, experience and proven investment strategies to help you make well considered decisions, without emotion getting in the way. Error! No text of specified style in document., Error! No text of specified style in document. 2