insightpaper

THE FUTURE OF AUSTRALIAN AVIATION

What does it mean for Australian airports?

DECEMBER 2014

MAR BELTRAN

Investment Director,

Airports

IN THIS PAPER WE DISCUSS...

ABOUT THE AUTHOR

Mar Beltran is Investment Director of

AMP Capital’s airport investments.

Previously, Ms Beltran managed AMP

Capital’s first social infrastructure fund,

the AMP Capital Community Infrastructure

Fund, as well as AMP Capital’s retail focused

Core Infrastructure Fund. Prior to the Core

Infrastructure Fund’s inception in October

2007, she served as a portfolio manager of

AMP Life and the Future Directions Fund

infrastructure portfolios, as well as the

manager of AMP Capital’s investment in

Australia Pacific Airports Corporation.

Ms Beltran holds an Executive MBA

from the Australian Graduate School of

Management and has a Senior Aeronautical

and Industrial Engineering Degree from

Madrid Polytechnic University in Spain.

—T

he airline adaptation cycle – what is it?

—W

here various global regions are in the cycle

—T

he considerations for airports based on previous lessons learnt

As legacy airlines around the globe respond to the competitive

market dynamics created by low cost carriers, there is a distinct

cycle of adaptation for the industry. This happens to recapture lost

market share and reposition carriers for financial performance.

Airport operators must continuously assess elements of airport

services and terminal design depending on where legacy and low

cost carriers are in their respective ‘adaptation cycles’.

What can we learn from the airline models adopted around the

world? Is the model adopted by Australian carriers sustainable,

and how will this impact Australia’s largest airports?

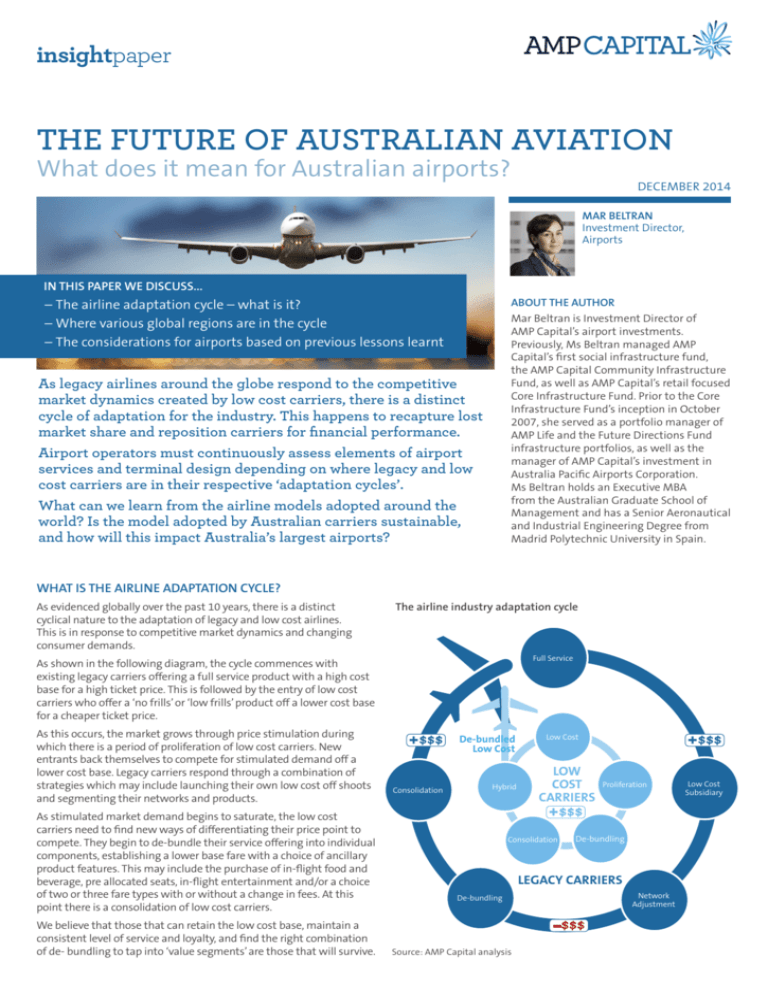

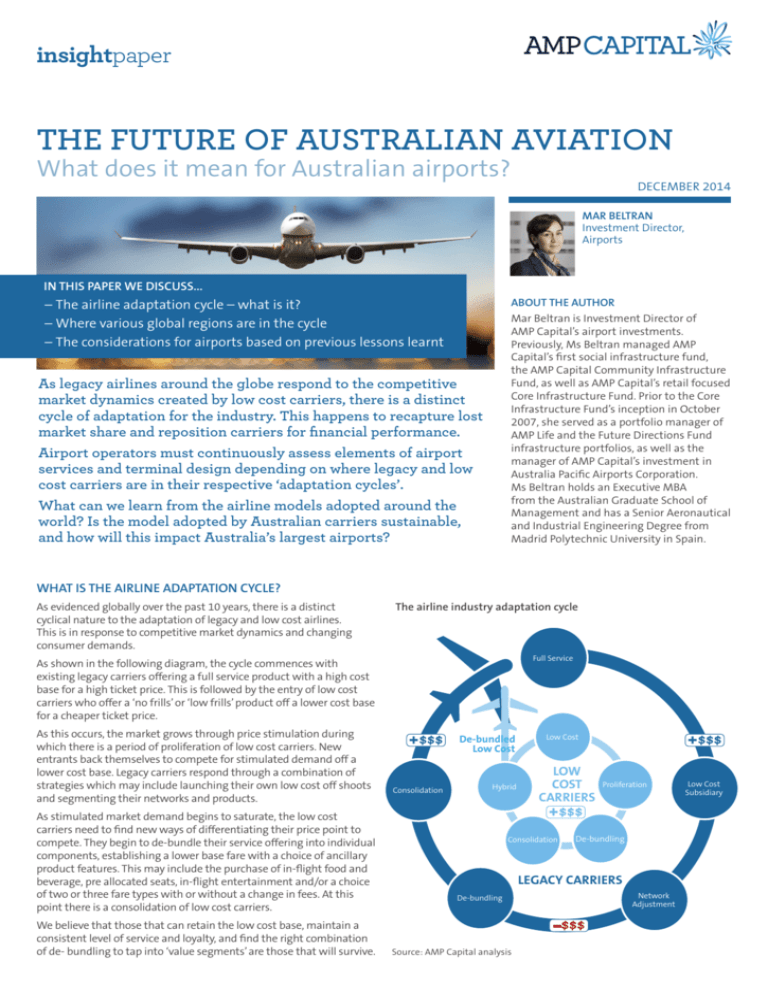

WHAT IS THE AIRLINE ADAPTATION CYCLE?

As evidenced globally over the past 10 years, there is a distinct

cyclical nature to the adaptation of legacy and low cost airlines.

This is in response to competitive market dynamics and changing

consumer demands.

The airline industry adaptation cycle

Full Service

As shown in the following diagram, the cycle commences with

existing legacy carriers offering a full service product with a high cost

base for a high ticket price. This is followed by the entry of low cost

carriers who offer a ‘no frills’ or ‘low frills’ product off a lower cost base

for a cheaper ticket price.

As this occurs, the market grows through price stimulation during

which there is a period of proliferation of low cost carriers. New

entrants back themselves to compete for stimulated demand off a

lower cost base. Legacy carriers respond through a combination of

strategies which may include launching their own low cost off shoots

and segmenting their networks and products.

As stimulated market demand begins to saturate, the low cost

carriers need to find new ways of differentiating their price point to

compete. They begin to de-bundle their service offering into individual

components, establishing a lower base fare with a choice of ancillary

product features. This may include the purchase of in-flight food and

beverage, pre allocated seats, in-flight entertainment and/or a choice

of two or three fare types with or without a change in fees. At this

point there is a consolidation of low cost carriers.

We believe that those that can retain the low cost base, maintain a

consistent level of service and loyalty, and find the right combination

of de- bundling to tap into ‘value segments’ are those that will survive.

De-bundled

Low Cost

Consolidation

Hybrid

Low Cost

LOW

COST

CARRIERS

Consolidation

Proliferation

De-bundling

LEGACY CARRIERS

De-bundling

Source: AMP Capital analysis

Network

Adjustment

Low Cost

Subsidiary

WHERE ARE WE NOW IN THE CYCLE?

Where various regions are in the cycle

The following diagram shows the evolution of these cycles

in each of the global regions. It shows the impact on market

share, adjustments to airlines models and the impacts on

financial performance.

Full Service

North America

North America

UK/Europe

De-bundled

Low Cost

UK/Europe

Hybrid

Consolidation

Low Cost

LOW COST

CARRIERS

Proliferation

Low Cost

Subsidiary

Australia

Asia

Consolidation

De-bundling

Asia

Australia

LEGACY CARRIERS

Network

Adjustment

De-bundling

Source: AMP Capital analysis

Legacy carriers have been repositioning, and

further segmenting their networks, as well

as launching premium economy products

to regain cabin yield. Within a competitive

domestic environment this has not been

enough and in response to getting their

premium value proposition right, have also

commenced their own processes of product

de-bundling.

Within an unprecedented industry

environment that has included deregulation,

wars, SARS, the September 11 terrorist

attacks and economic recession, there has

been incredible pressure on performance.

This has seen the legacy cycle, unable to

adapt quickly enough to its high cost base,

and pass through a period of consolidation.

In the European market, Air France has

merged with KLM, Lufthansa with SWISS,

Brussels Airlines and Austrian Airlines, and

British Airways with Iberia and Vueling.

In North America, American Airlines has

merged with US Airways, United Airlines

with Continental Airlines and Delta Airlines

with Northwest Airlines. These carriers are

now managing their integration programs

and are delivering substantial profits off a

scaled cost base.

The low cost carrier cycle is also coming

full circle, with those that remain slowly

moving across into the consolidated legacy

airline space. They are increasing their

product and service offerings, tempted by

the higher yielding corporate market sectors

to create hybrid models. These models are

providing an increasing level of in-cabin

product and service, with attributes chosen

and packaged together by consumers to

create their own value products. How far

these hybrid models pitch into the legacy

space by offering a medium and long haul

network off a competitive cost base will be

an interesting dynamic to watch.

Low cost carriers are expanding and gaining

market share stimulating demand with

attractive fares and new routes. In 2014

AirAsia was again awarded the world’s best

low cost airline for the sixth consecutive year

in a row.

Europe and North America have passed

through the legacy and low cost carrier

consolidation phase. Within these regions,

the industry has now evolved to the point

where financial performance has improved

following significantly restructured and

scaled back cost bases, and where the gap

between legacy, hybrid and the individual

brands of low cost carriers has become

blurred. Most carriers are now looking to

compete with an enhanced product offer

that remains de-bundled, but which can be

packaged by the consumer, to determine

their own value for money.

Australia is at the point in both legacy and

low cost cycles where product differentiation

through de-bundling is the competitive

edge. Within Australia, it is important to

note the significant underperformance of

the Qantas international flying business, and

the impact this has on the industry. Unlike

the other global regions, regulation through

the Qantas Sales Act is preventing Qantas

from doing what other global legacy carriers

have done – i.e. merge with a partner to

rescale its cost base, leverage operational

synergies and reposition its brand. It

would appear that Qantas may need more

flexibility to adapt its business model and

the biggest constraint is the Qantas

Sale Act 1992. If freed from these regulatory

restrictions it is likely the Australian aviation

industry would move forward in line

with other global regions to deliver

better financial performance and a more

certain future.

Asian low cost carriers are in infancy stage,

but pace of change has accelerated. The

industry has lagged behind that of North

America and Europe - however it is now

beginning to grow rapidly as the region

continues to develop economically. It

continues the process of deregulation and

liberalisation and adapts its infrastructure to

accommodate the low cost carrier model.

The Oceanic region is half way through the

cycle and in ‘unstable’ territory. In this

region the models of adaptation are not

quite as far advanced as the European and

North American markets. Legacy carriers

are fully de-bundling their service offerings

to turn performance around and may be on

the verge of consolidation in the low cost

carrier space.

For a deeper analysis of Australian carriers,

please contact our Infrastructure team via

ampcapital.com

CONSIDERATIONS FOR AIRPORTS

How might various scenarios impact terminal capacity?

All of these potential airline futures raise some interesting

considerations for the airports with whom they interface.

We analysed the potential impact on terminal capacity at

Melbourne Airport for a few potential scenarios. The results of

these scenarios are represented in the chart, which highlight the

change in the number of years available for each terminal before it

reaches capacity. The results show that from a capital management

perspective, there is the potential to reshuffle supply and adjust or

defer a medium-term capital program.

Looking globally, we can see airports have and are adapting their

infrastructure to meet the needs of low cost carriers. Airports are

building dedicated low cost terminals, often separated from the

main international terminals, with a menu of services available for

use at discounted rates.

One of the lessons that airports have learnt is that there is

no guarantee of low cost carrier loyalty. As the cycle of airline

adaptation evolves, low cost operators are changing their models

and slowly moving back into hybrid airlines. This, in turn, raises

questions about the future of dedicated low cost carrier terminals

and whether, in fact, airports are better to avoid exclusive

arrangements and remain more flexible in their terminal designs.

At the other end of the spectrum, legacy airlines are also looking to

enhance their consumer’s airport experience, and extend the debundling and segmentation of the offer into the airport.

Discussion in the industry includes future airport designs that

segment the airport infrastructure vertically, designing a full

premium experience for passengers, a premium economy

experience, and a different experience again for economy

passengers. This design could also facilitate a low cost offering.

The benefits of such a design eliminates the need to build dedicated

and isolated terminals, but allows for scale to be consolidated within

a centralised terminal building that offers a streamlined and tailored

passenger experience for all airlines offering a similar segmentation.

A common user approach such as this cushions the airport against

industry cycles - i.e. against consolidation and the shifting of carriers

between models and service offerings.

Other terminal design options include the model of integrating

home carrier domestic and international terminal services, as

these airlines look for a competitive home advantage. In the case of

Sydney and Brisbane Airports, one could readily see the benefits of

integrating the Qantas domestic and international services as the

terminals from which they currently operate are physically isolated

from each other.

This opportunity is also available for Melbourne Airport when Jetstar

relocates into a dedicated low cost carrier terminal, and frees up

substantial capacity in the current Qantas Terminal 1. However,

given the uncertainty around the future of Qantas, particularly

with its international business, a dedicated terminal might not be

sustainable in the short-term.

There might also be a future where de-bundling of the domestic

product could position Jetstar and Qantas to merge their businesses.

This could allow Jetstar to take over the flying network of Qantas

to leverage its lower cost base but retain integration of premium

services at the lounge and frequent flyer program level. In this

scenario, the purpose built low cost carrier terminal would be less

than ideal for a merged Jetstar and Qantas carrier.

Terminal base case: Terminals are configured where only Qantas

is operating out of Terminal 1 in 2015 and Jetstar and Tiger are

operating fully out of Terminal 4. Terminal 2 continues to service

the current portfolio of international airlines and Virgin Australia is

operating out of Terminal 3.

Terminal 1 base case and international: Qantas domestic and

international services are combined into Terminal 1.

Terminal 1 base case and international merger with Middle

East carrier: Qantas mergers with Emirates - all the associated

international traffic of QF and Emirates shifts into Terminal 1.

Terminal base case – slower domestic growth: Same as terminal

Base Case but with a lower outlook on forecast domestic growth as

a consequence of Qantas and Virgin managing for yield.

Number of years till terminal capacity is reached

Terminals

base case

T1 base case +

international

T1 base case +

international merger

with Middle East carrier

Terminals base

case slower

domestic growth

0

5

10

Impact T4

Impact T3

15

Impact T2

20

25

Impact T1

Source: AMP Capital.

Note: Terminal capacities are a measure of passenger throughput not aircraft

movements, and as such make no comment as to the ability to handle the

corresponding number of required aircraft movements or aircraft sizes. Further,

these terminal capacities do not take into account any pattern associated with

peak hour handling.

Given the future uncertainty of our airlines, and the potential

changes in the operating models across the next 10 years, it may be

more prudent to retain as much flexibility in terminal arrangements

as possible. It will also be important to avoid entering into exclusive

arrangements that may prohibit a reshuffling of supply and impact

a suboptimal capital program.

In addition, airports will need to be constantly

assessing the social and environmental

impacts of terminal reconfigurations and

construction, as these can have a major

impact on the commercial, financial and

reputational components of the business.

There are multiple social issues that will

need to be assessed including impacts from

noise, visual amenity, safety, and passenger

grievances or losses.

We will continue to monitor changes in the

Australian aviation landscape, in particular

any further changes to the Qantas Sales Act,

and look to other global markets for lessons

to be learnt as it manages its investors’

interests in airports.

CONTACT US

If you would like to know more about how AMP Capital can help you, please visit www.ampcapital.com

Important notice While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) makes no representation

or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance.

This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An

investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the

investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided and must not be provided to any other person or entity

without the express written consent of AMP Capital.

© Copyright 2014 AMP Capital Investors Limited. All rights reserved.